Fake Announcement on U.S. Debt Payment Strategy

- No official confirmation of a “Bessent” at U.S. Treasury.

- Official policy remains under Janet Yellen’s leadership.

- Tariff revenue insufficient for meaningful debt reductions.

A purported statement from “Treasury Secretary Bessent” claiming tariff revenues will repay U.S. debt lacks official confirmation, suggesting misinformation surrounding U.S. Treasury leadership updates.

The alleged announcement holds no weight in verified markets or economic policy, remaining unrecognized by official Treasury channels and leading authorities.

Body

The recent claim about using tariff revenue to reduce U.S. debt remains unverified. There is no record of a Treasury Secretary named “Bessent.” Business Think confirms Janet Yellen continues her role with focus on economic growth challenges.

The assertion centers around tariff revenues supposedly tackling U.S. debt. However, Janet Yellen , not “Bessent,” oversees the Treasury, tackling issues like inflation and economic risks related to tariffs.

The potential impact of tariffs is a rise in inflation as highlighted by Yellen, but no notable government policy shift exists on redirecting tariff revenue for debt repayment. “I would expect inflation, on a year-over-year basis of this year, to shoot up to at least 3%, or slightly over, because of the tariffs.” – Janet Yellen, Secretary, U.S. Treasury. Source

Economists state the $2.8 trillion projected tariff revenue over ten years falls short of significantly impacting the $21.8 trillion deficit. The Congressional Budget Office reports no strategic change supports using tariffs directly for debt reduction.

No cryptocurrency exchanges or financial institutions reported any related shifts. Additionally, past precedents in tariff policy did not reflect direct debt management through such revenue claims.

The absence of official documentation keeps the statement within speculative territory. Historical fiscal policy indicates tariffs alone can’t address sovereign debt under existing legislative frameworks. Politico Pro suggests the recent fiscal legislation indicates a $3.4 trillion increase in U.S. debt, dwarfing any potential tariff revenue impact.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

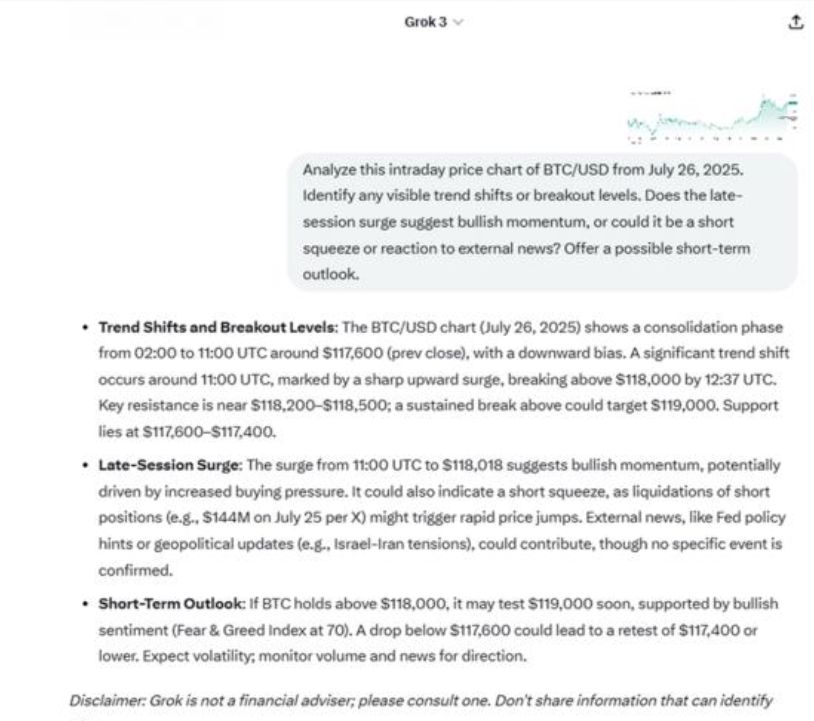

ChatGPT and Grok shift crypto trading to sentiment, now explains “why” behind moves

Share link:In this post: Crypto traders have turned to ChatGPT and Grok for real-time context, sentiment analysis, and narrative framing. In charts, Grok gives a more detailed and information-packed breakdown, pointing out resistance and support levels, liquidation events, and possible outside causes. Experts say that over-reliance on the bots without checking the ideas against standard charts or news causes traders to have false confidence.

Trump’s Fed chair shortlist grows longer than expected

Share link:In this post: President Trump, through Treasury Secretary Scott Bessent, is moving forward with interviews for 11 potential replacements for Fed Chair Jerome Powell, whose term ends in May. The list includes current Fed governors, past officials, and top financial executives. Philip Jefferson, the current vice chair, is also in the running. If selected, he would become the first Black Fed Chair in U.S. history.

Pennsylvania House sees bill to ban public officials from owning Bitcoin and digital assets

Share link:In this post: A new bill (HB1812) introduced in the Pennsylvania House of Representatives could impose jail time on public officials who fail to divest their Bitcoin holdings. Officials who do not comply with the divestment requirement could face civil penalties of up to $50,000, and violations may be classified as felonies. Similar proposals, especially at the federal level, are growing as more officials express discontent with Donald Trump’s relationship with crypto.

Wyoming launches FRNT stablecoin with Visa support across seven blockchains