Mantle Gains 35% as Price Targets 16-Month Peak

Mantle (MNT) has surged 35% in the past week, trading within a bullish ascending parallel channel. With strong buying pressure indicated by the Chaikin Money Flow and Super Trend support, MNT could target a rally to $1.51, though risks of a pullback remain.

Mantle (MNT) has defied the broader market’s lackluster performance over the past week, standing out as one of the best-performing tokens.

While many altcoins struggled to hold ground, MNT has climbed an impressive 35% in the past seven days. It trends within an ascending parallel pattern on the daily timeframe, suggesting more upside could be ahead.

MNT Price Action Strengthens

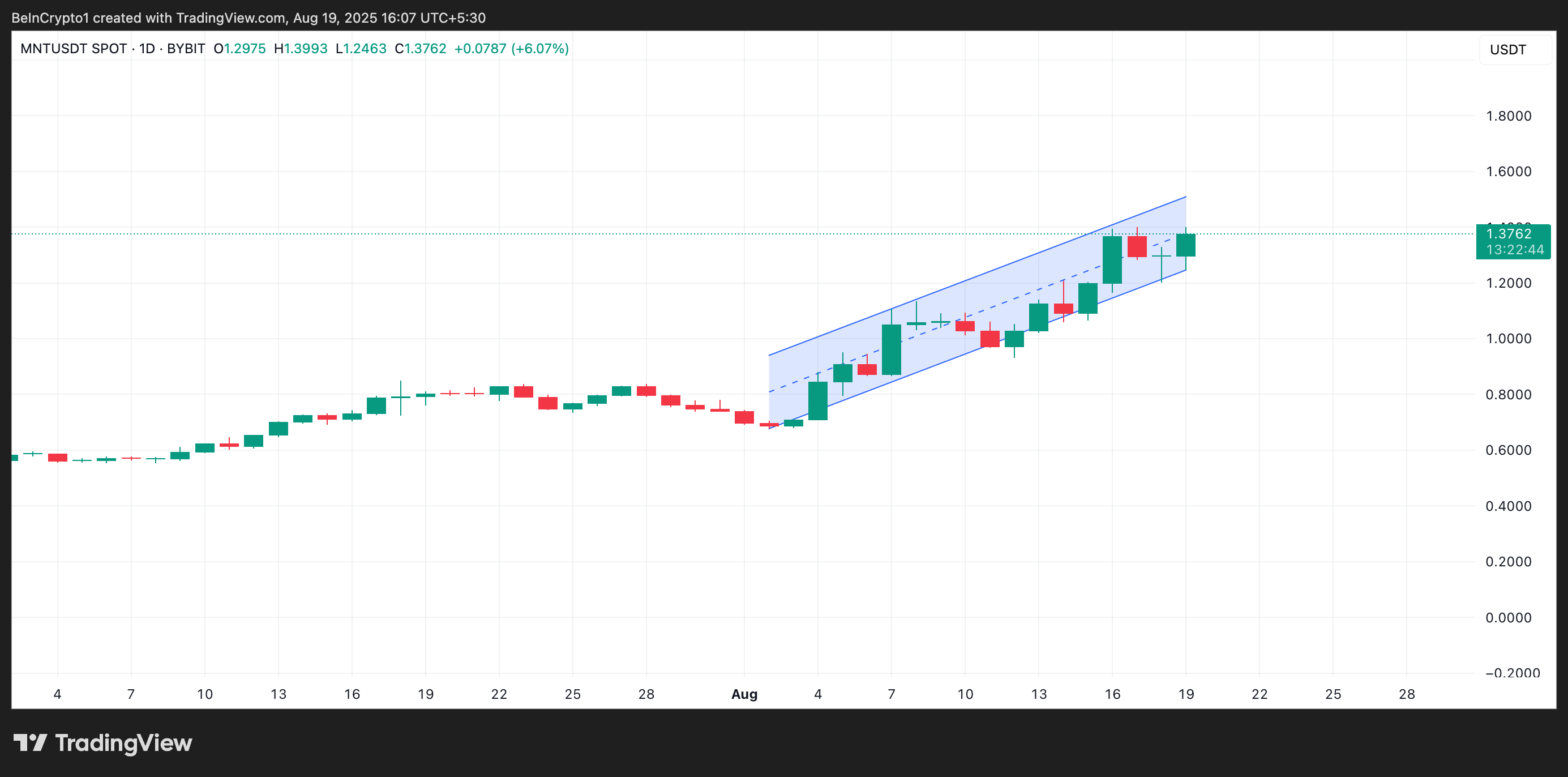

Readings from the MNT/USD daily chart show the token trending within an ascending parallel channel. This is a bullish pattern formed when an asset’s price action consistently makes higher highs and higher lows, moving between two upward-sloping parallel lines.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

MNT Ascending Parallel Channel. Source:

TradingView

MNT Ascending Parallel Channel. Source:

TradingView

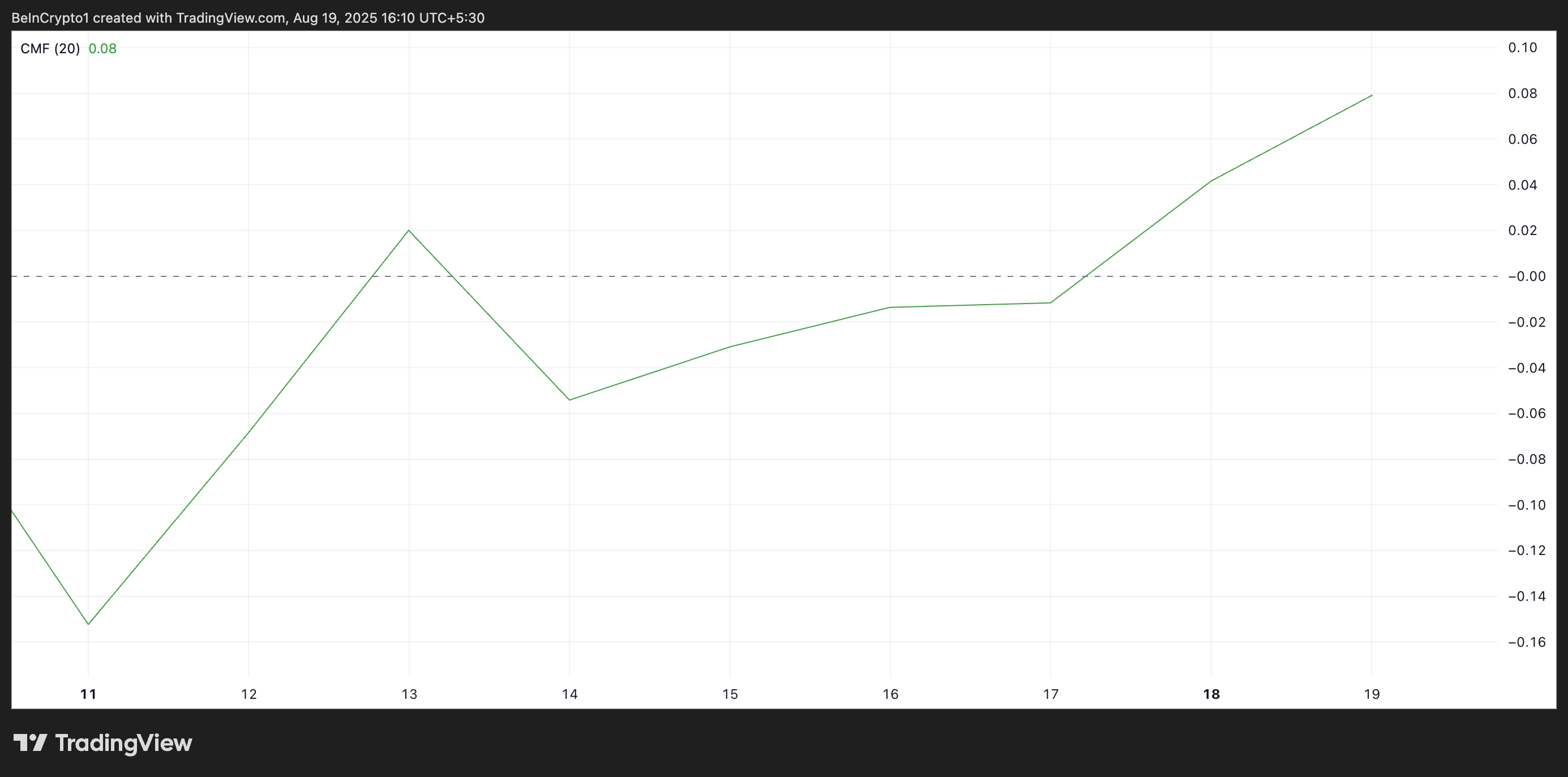

The pattern reflects a market in a steady uptrend, where each dip is met with renewed buying pressure. MNT’s surging Chaikin Money Flow (CMF) supports the uptick in buy-side pressure.

As of this writing, this momentum indicator, which tracks how money flows into and out of an asset, is at 0.08 and trending upward. The positive CMF reading indicates strong buying pressure, showing investors continue to pour capital into MNT.

MNT CMF. Source:

TradingView

MNT CMF. Source:

TradingView

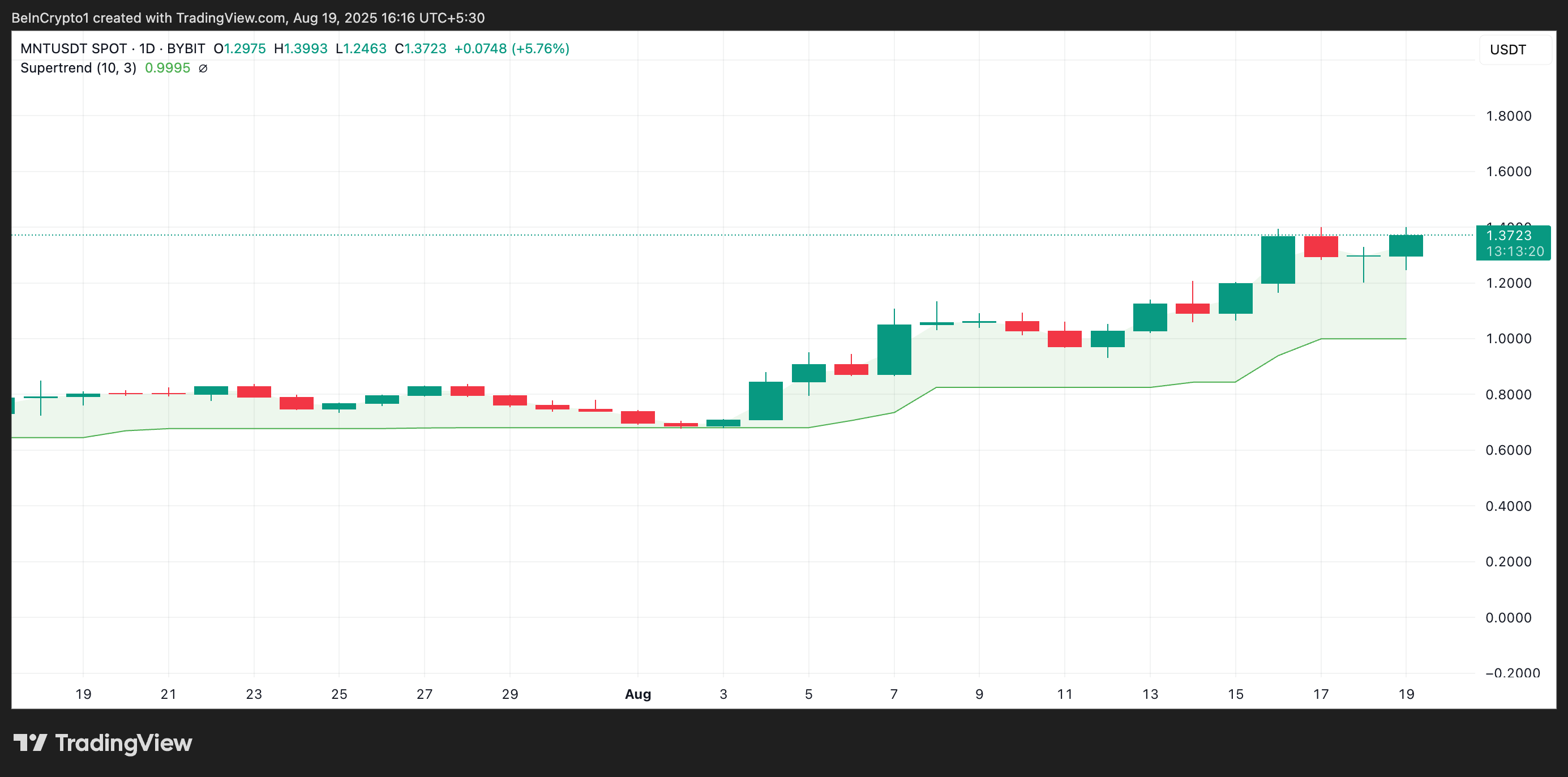

Furthermore, MNT’s Super Trend indicator, which currently forms dynamic support below its price at $0.99, confirms this bullish setup.

MNT Super Trend. Source:

TradingView

MNT Super Trend. Source:

TradingView

This indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades below the Super Trend line, it signals a bearish trend, indicating that the market is in a downtrend and selling pressure is dominant. Conversely, as with MNT, when the price rests above this indicator, upward momentum is strong and buyers are in control.

MNT Traders Brace for Next Big Move

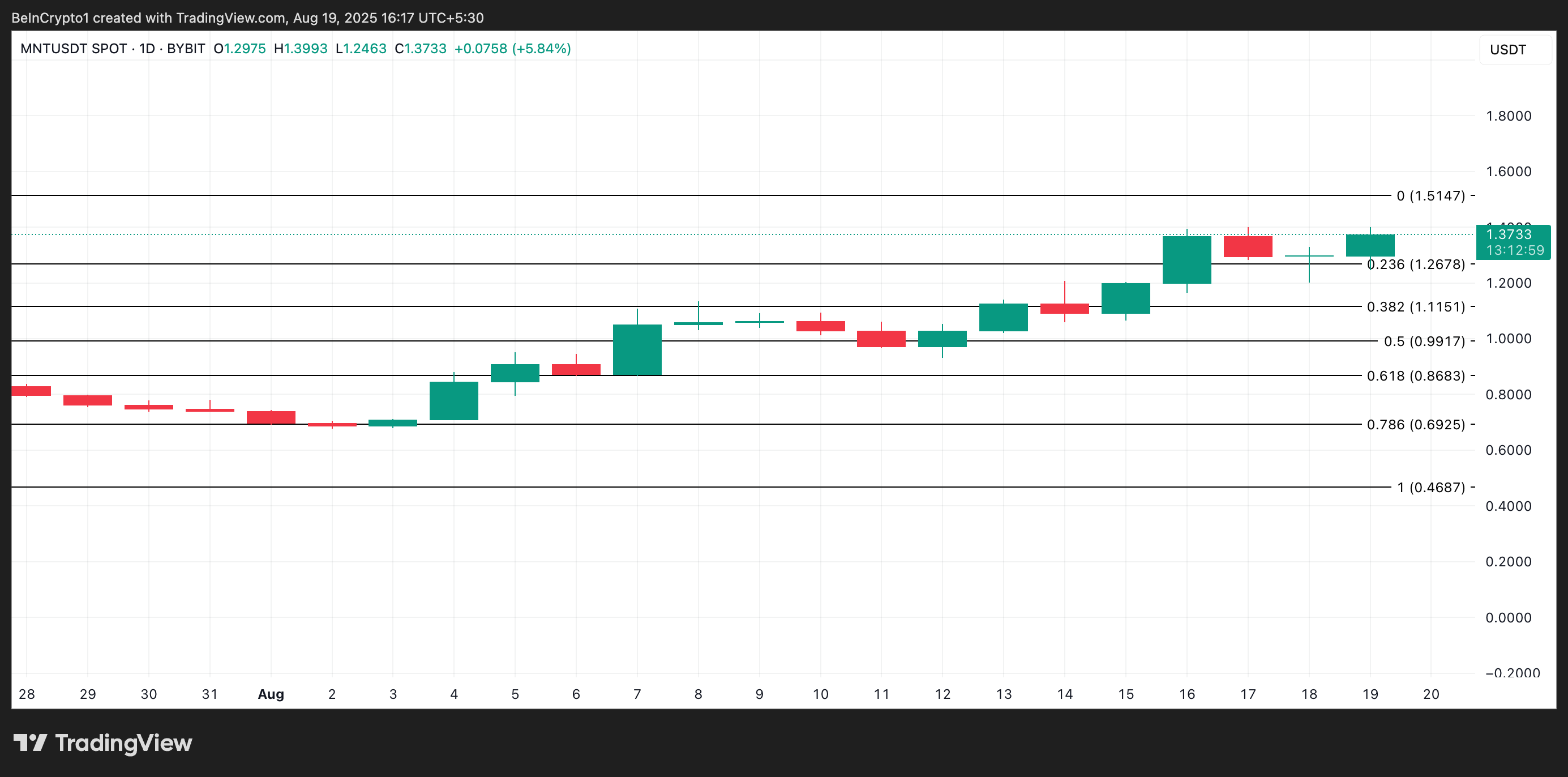

At press time, MNT trades at $1.37, hovering above the support at $1.26. If accumulation persists, MNT could rally to $1.51, a high last reached in April 2024.

MNT Price Analysis. Source:

TradingView

MNT Price Analysis. Source:

TradingView

On the other hand, if buying declines, MNT’s price could break below the support at $1.26 and fall toward $1.11.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How are those who followed CZ's trades doing now?

Whether it’s CZ personally getting involved, the community creating a meme atmosphere, or YZi Labs providing investment backing, so-called "calls" are just a spark, while the community riding on the concept adds fuel to the fire. When the two meet, the market heats up. This also demonstrates that the market itself needs hotspots to maintain attention and liquidity.

The Butterfly Effect of the Balancer Hack: Why Did XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet increases, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

Whale "7 Siblings" scoops up 38,000 ETH in two days! What signal does this send?