David Bailey's Bitcoin treasury KindlyMD acquires $679 million in BTC

Key Takeaways

- KindlyMD acquired 5,744 Bitcoin worth approximately $679 million through its subsidiary Nakamoto Holdings.

- The purchase is part of KindlyMD's strategy to accumulate one million Bitcoin as a corporate reserve asset.

KindlyMD, led by President Donald Trump’s Bitcoin advisor David Bailey, announced Tuesday it had spent approximately $679 million to accumulate around 5,744 Bitcoin.

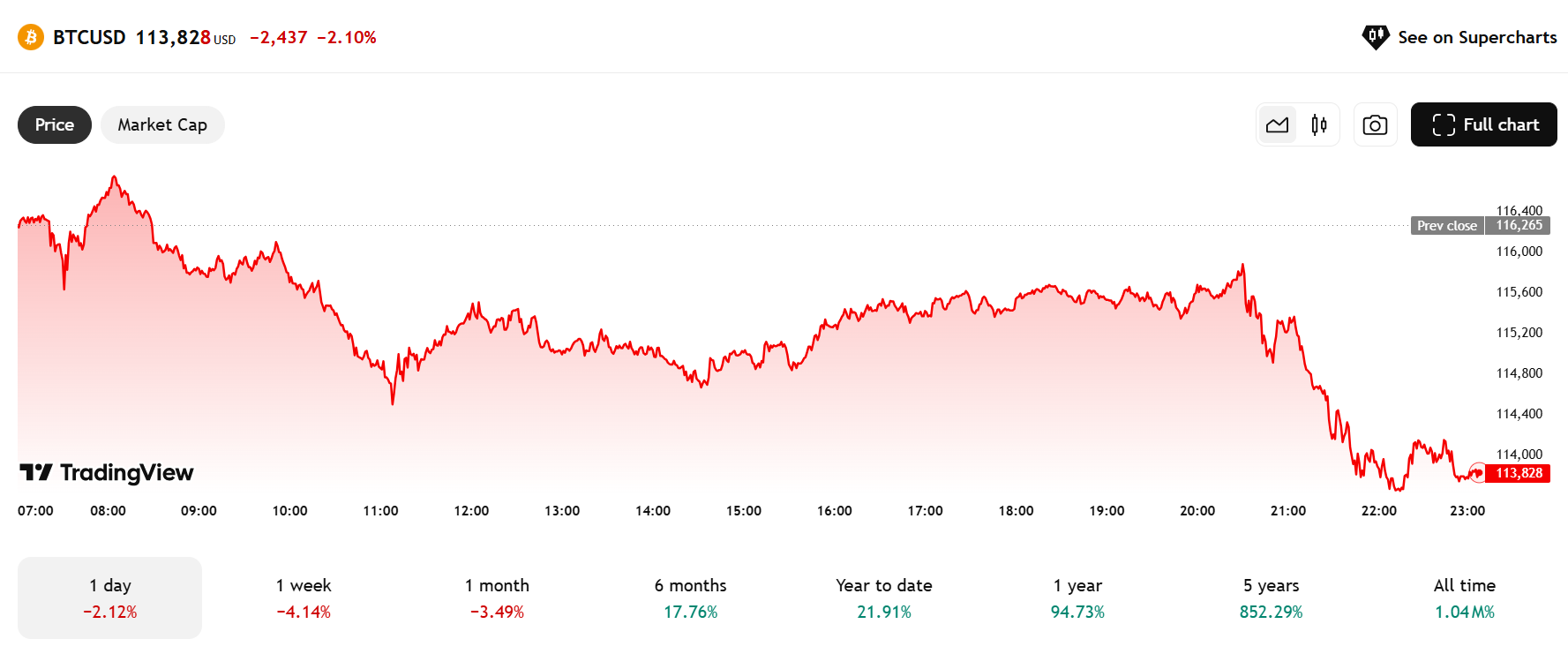

With the latest acquisition, KindlyMD’s Bitcoin stash surpasses 5,764 units, equating to over $655 million at current prices of about $113,840. The company used PIPE proceeds for the purchase as part of its strategy to acquire one million Bitcoin under the Nakamoto Bitcoin Treasury.

Commenting on KindlyMD’s BTC purchase, the first since it completed its merger with Nakamoto Holdings, CEO Bailey reiterated that his team is doubling down on Bitcoin as a cornerstone asset for the future.

“Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance, and we are committed to building the most trusted and transparent vehicle to achieve that future,” he added.

KindlyMD now ranks sixteenth among corporate Bitcoin holders, ahead of firms like Semler Scientific and GameStop.

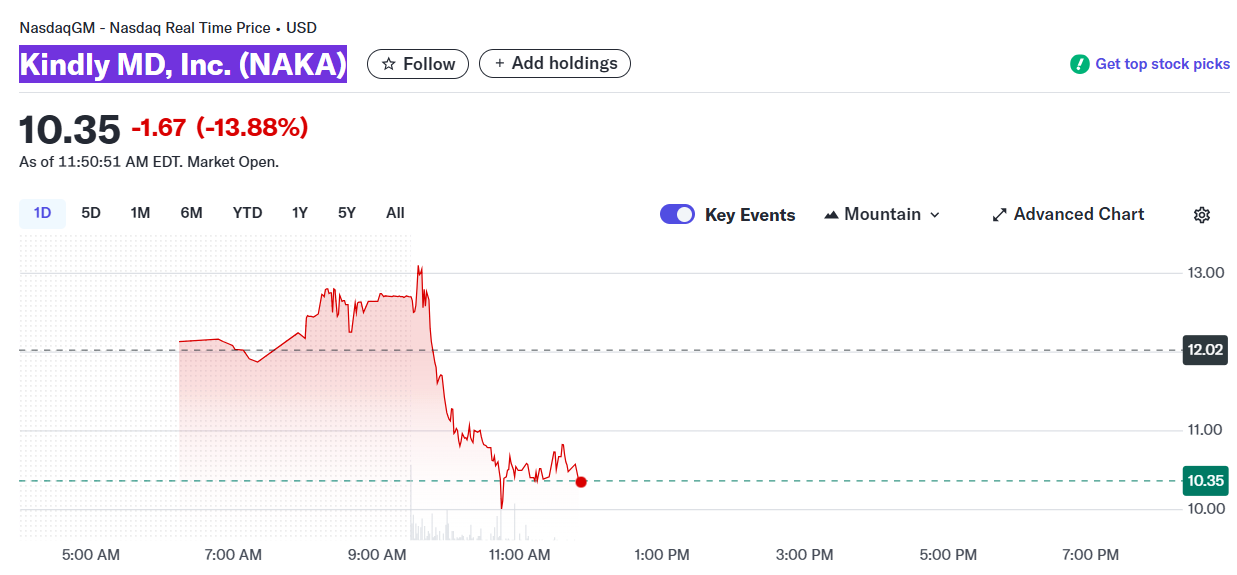

Shares of the company (NAKA) fell 14% at Tuesday’s open as Bitcoin slipped from above $115,800 to $113,846 amid a market-wide pullback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Holds the $84,000 Support Like a Champion: Oversold Rebound Targets $94,000 This Week

Bitcoin has successfully held the $84,000 support level and may rebound to $94,000 this week. If it falls below $80,000, it could further drop to $75,000. Although market sentiment is extremely bearish, a short-term oversold condition may trigger a rebound. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being updated iteratively.

What will happen to the price of DOGE after the listing of Grayscale's GDOG ETF?

Dogecoin's price is being suppressed by resistance at $0.1495, with short-term support at $0.144. Grayscale's DOGE ETF debut failed to boost the price, and continued whale sell-offs are exerting further pressure. Technical analysis indicates a neutral-to-bearish trend, lacking clear reversal signals. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

BitMine spends heavily again to buy 70,000 ETH! Holdings surpass 3% of total circulating supply; Tom Lee: Ethereum's worst-case scenario is a drop to $2,500

BitMine Immersion Technologies increased its holdings by 69,822 ETH, bringing its total holdings to 3.62 million ETH, which accounts for 3% of the circulating supply, with total assets of $11.2 billions. Tom Lee believes that ETH's risk/reward is asymmetric, with limited downside potential. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Trending news

MoreBitget Daily Digest (Nov 25) | Grayscale XRP ETF and Franklin XRP ETF go live; Public companies bought a net $13.4M BTC last week; U.S. September PCE rescheduled to December 5, and Q3 GDP advance report canceled

Bitcoin Holds the $84,000 Support Like a Champion: Oversold Rebound Targets $94,000 This Week