Wyoming unveils FRNT state stablecoin, joining the battle in the $285B arena

Wyoming has introduced the Frontier Stable Token (FRNT), the first stablecoin created and issued by a US government entity, according to an Aug. 19 announcement.

Formerly called the Wyoming Stable Token (WYST), FRNT aims to deliver fast, secure, and transparent digital transactions for individuals, businesses, and institutions worldwide.

According to the statement, each FRNT token will be fully backed by US dollars and short-term treasury securities, held in trust to protect holders’ interests.

The token launch is powered by LayerZero, enabling FRNT to operate across seven blockchain networks, including Arbitrum, Avalanche, Base, Ethereum, Optimism, Polygon, and Solana.

Wyoming Governor Mark Gordon, who also chairs the Commission overseeing the project, said the initiative illustrates the state’s ongoing commitment to innovation and consumer protection.

According to him:

“The mainnet launch of the Frontier Stable Token will empower our citizens and businesses with a modern, efficient, and secure means of transacting in the digital age.”

The press statement revealed that the Wyoming-based digital asset exchange Kraken will list FRNT on the Solana blockchain in the coming days. At the same time, Raincards’ Visa-integrated card platform will enable transactions on Avalanche.

FRNT enters competitive stablecoin market

FRNT enters a sector currently dominated by crypto-native stablecoins like Tether’s USDT, Circle’s USDC, and Ripple’s RLUSD.

The market, currently valued at around $285 billion, is drawing increasing interest from traditional financial institutions like Bank of America, which is exploring similar digital offerings.

These efforts are designed to capture a slice of a market projected to reach trillions in value.

Speaking on these kinds of assets, US Treasury Secretary Scott Bessent said:

“Stablecoins will expand dollar access for billions across the globe and lead to a surge in demand for US Treasuries, which back stablecoins.”

Due to this, financial regulatory authorities in the United States, South Korea, Hong Kong, and Europe are introducing stricter regulations for the emerging sector.

The post Wyoming unveils FRNT state stablecoin, joining the battle in the $285B arena appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VivoPower Plans $300M Ripple Labs Share Vehicle in South Korea

Revealing: Kevin Hassett’s Bold Call for an Interest Rate Cut and What It Means for Crypto

Changpeng Zhao’s Crucial Mission: Talks with 10 Governments on Crypto Regulation

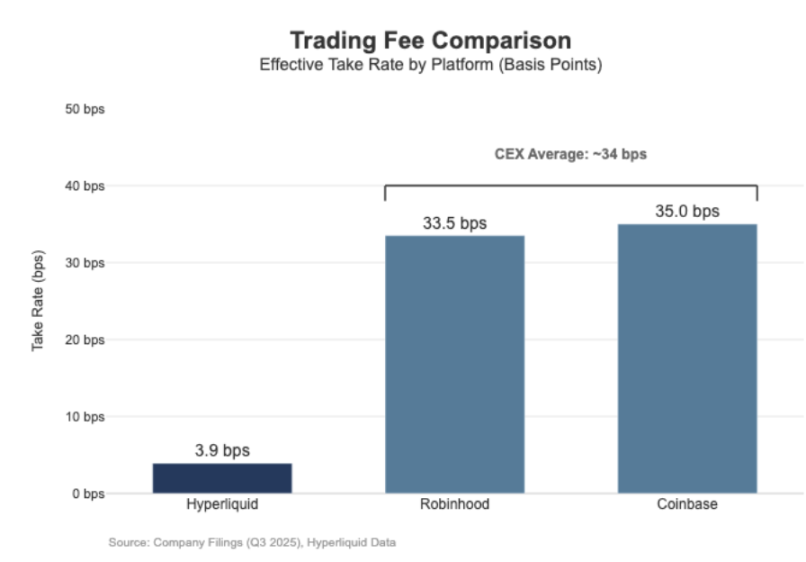

Hyperliquid at a Crossroads: Follow Robinhood or Continue the Nasdaq Economic Paradigm?