Shiba Inu Bears Press Hard: Can Buyers Defend Key Levels?

- Analysts see $0.00001285 rebound as the immediate test to decide SHIB’s near-term direction.

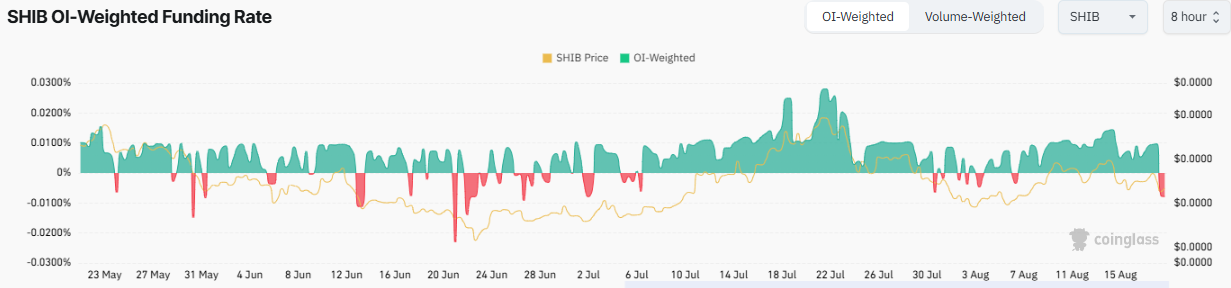

- Derivatives show funding rate flipped to -0.0079%, the first negative reading since early August.

- Governance update adds staking, ERC-20 wallet voting, and quadratic voting to Shiba Inu DAO.

Shiba Inu (SHIB) is once again in the spotlight after slipping below a critical support trendline that had guided its price for weeks. Analysts say the breakdown could mark the start of a deeper correction, with downside levels from earlier in the year now back on the radar. At press time, the token trades at $0.00001273, down 3.07% in the past 24 hours.

Technical analysts point to the $0.00001285 rebound as the immediate test. They note that SHIB may retest the broken trendline, a typical market behavior, before deciding its next direction. A rejection at this level could open the path lower, with the 23.6% Fibonacci retracement at $0.00001226 as the next target.

Source:

TradingView

Source:

TradingView

If momentum continues to fade, the August low of $0.00001161 comes into play. Not all views are bearish. Some analysts suggest a surprise scenario where SHIB regains strength and climbs back above the 50% Fibonacci level at $0.00001299.

This would be against expectations and may mislead the market players who have already factored in more losses. Such a recovery would take the token to the range of $0.000013 — $0.000015 and even more.

Bearish Signals Grow in Shiba Inu’s Derivatives Market

Shiba Inu’s on-chain derivatives data points to mounting bearish sentiment as traders shift heavily into short positions. The funding rate has turned negative, down to -0.0079%, recording the first such reading since early August. Analysts are interpreting this as an indication that short sellers are taking over the market.

Source:

Coinglass

Source:

Coinglass

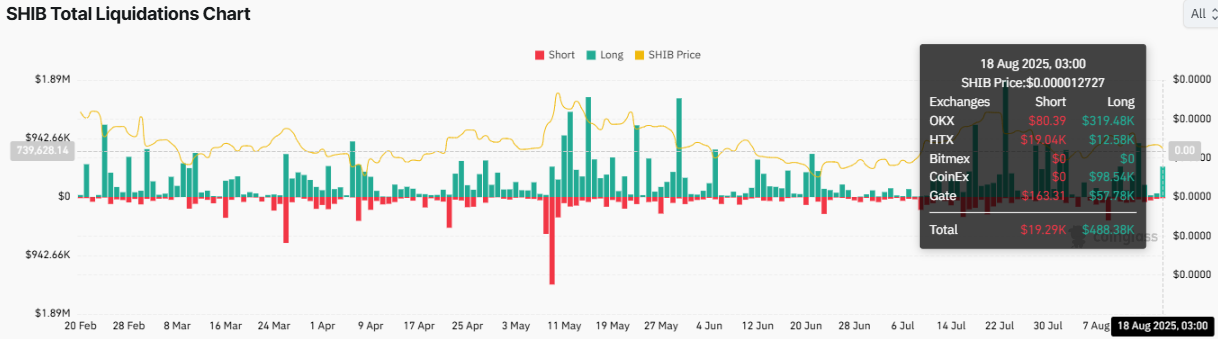

The liquidation data, at the same time, underscores the squeeze on bullish traders. More than $488.38k worth of long positions were liquidated, as opposed to only $19.29k worth of shorts, highlighting the extent to which the market turned against buyers.

The asymmetry in liquidations is indicative of a decreasing level of confidence in leveraged longs as SHIB dipped to key levels. Nonetheless, the arrangement comes with both advantages and drawbacks. In the past, extended negative funding rates have created an environment where a short squeeze can take place, leading to fast upticks.

Source:

Coinglass

Source:

Coinglass

However, SHIB’s open interest tells a different story. Current levels stand at $204 million, still 37% lower than July’s peak. This points to a lack of conviction from buyers to trigger such a reversal.

Related: Shiba Inu’s Data Signals Big Move as Volume and Price Spikes

SHIB Governance Upgrade Introduces Fairer Voting Options

While SHIB’s price struggles to hold ground, its ecosystem continues to progress as the Doggy DAO rolls out new governance features. The update is meant to empower its community with more decision-making ability.

For the first time, proposal creators are able to decide how votes are cast—via staking to gain influence, direct voting with ERC-20 tokens, or quadratic voting, which limits the dominance of whales by making each subsequent vote progressively more expensive.

A fourth approach, identity-based voting, is coming, which will usher in a real one-person-one-vote system. The upgrade opens the door for holders of SHIB, BONE, LEASH, and TREAT to take part in a fairer and more flexible governance model, shaping the future of Shibarium.

The post Shiba Inu Bears Press Hard: Can Buyers Defend Key Levels? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne