Qubic Targets Dogecoin After $2,3 Million Daily Mining Profits

- Qubic plans to transition from Monero to Dogecoin mining

- Dogecoin mining generates around $2,3 million per day

- Project bets on useful proof of work for AI

The artificial intelligence-focused project Qubic has indicated that it may begin mining Dogecoin (DOGE) after completing its current phase on the Monero (XMR) network. On August 17, founder Sergey Ivancheglo revealed that the community voted for DOGE as the next priority, beating out options like Kaspa and Zcash.

The #Quic community has chosen the #Dogeco . pic.twitter.com/EnevIZUAw5

— Come-from-Beyond (@c___f___b) August 17, 2025

The decision comes shortly after Qubic dominated Monero's hash rate, a situation that led exchange Kraken to temporarily suspend XMR deposits due to concerns of a potential 51% attack. Now, the choice of Dogecoin reflects an interest in exploring a well-established blockchain with high liquidity and a history of global adoption.

Created in 2013, Dogecoin began as a memecoin but gained prominence after being boosted by mentions from Elon Musk. It currently ranks among the ten largest digital assets, with a market value of over $33 billion. Despite this, mining the currency is highly competitive, dominated by large operations like BIT Mining.

Data from CoinWarz indicates that the Dogecoin network has a hash rate of 2,93 PH/s, which generates approximately $21 per unit of mining power per day for miners. At network scale, daily rewards are estimated at between $2,3 and $2,8 million, equivalent to over $840 million annually.

Ivancheglo emphasized that preparing to mine DOGE could take months, with Qubic's pool remaining active in Monero until then. The founder also reiterated that the network's goal goes beyond profit:

"A lot of electricity is burned in useless PoW; we need that electricity for AI. These words may be difficult to understand, and I can't reveal more now, but they will eventually make sense."

Qubic's unique selling point lies in its proof-of-work model, which converts energy spent on mining into computing power applied to training artificial intelligence. This concept aims to direct resources toward real-world applications, connecting blockchain, mining, and advances in artificial intelligence with the goal of developing Artificial General Intelligence (AGI).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

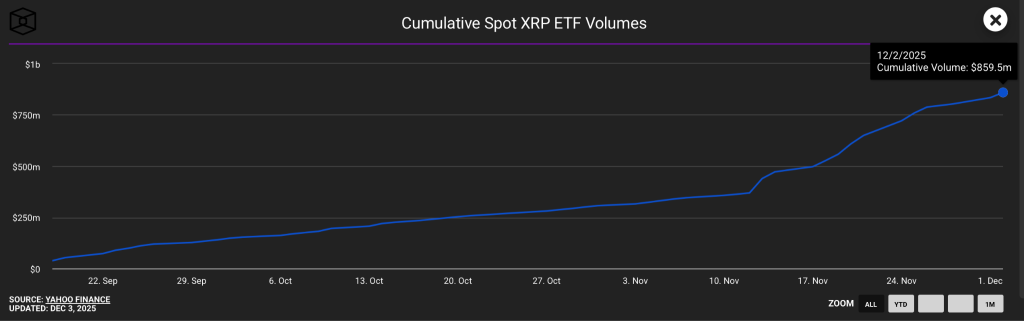

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts