Stablecoins Projected to Hit $1 Trillion in Payments by 2030 With DeFi on Overdrive

Stablecoins are poised to move $1 trillion a year by 2030, disrupting global payments and unlocking trillions in capital, according to a newly released industry report.

Stablecoins Set to Move $1 Trillion Annually by 2030—Legacy Rails Can’t Compete

Crypto liquidity provider Keyrock released a detailed report this week in collaboration with Latin American crypto platform Bitso, projecting that stablecoins are set to dramatically reshape global financial infrastructure. Titled “Stablecoin Payments: The Trillion Dollar Opportunity,” the study presents a comprehensive case for stablecoins becoming dominant payment rails across business and consumer use cases. The report states:

Stablecoins are becoming a $1 trillion payment rail: We estimate that by 2030, annual stablecoin payment volume across key verticals will be above $1 trillion.

While they accounted for less than 3% of the $195 trillion cross-border market in 2024, the report forecasts stablecoins could support 12% of all cross-border flows—about 1 in every 8 dollars moved globally.

The report highlighted significant gains in capital efficiency through decentralized finance (DeFi) infrastructure. It noted: “DeFi Is the New Balance Sheet: DeFi credit protocols are turning into working capital engines. Mansa reported an average monthly capital turnover of 11x, compared to just 1–2x annualized capital turnover for traditional fintechs like Wise.” That level of turnover far exceeds the legacy prefunding model, where firms lock capital in local accounts across jurisdictions.

The report estimates that as much as $27 trillion is currently trapped in global payment rails—a cost that stablecoin rails can eliminate through just-in-time liquidity and programmable settlement.

At the macro level, the report emphasized how stablecoins could transform U.S. monetary operations:

Stablecoins will reshape monetary policy: At $2 trillion supply, stablecoins will hold close to 25% of the Treasury bill market, directly impacting Fed policy and front-end yields.

Issuers of stablecoins already rank 17th globally among U.S. Treasury holders, ahead of countries like South Korea and Saudi Arabia. Meanwhile, the stablecoin market share of U.S. M2 money supply has surged from 0.04% in 2020 to over 1%, and could reach 10% by 2030. These developments signal a shift in both liquidity flows and regulatory considerations for central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

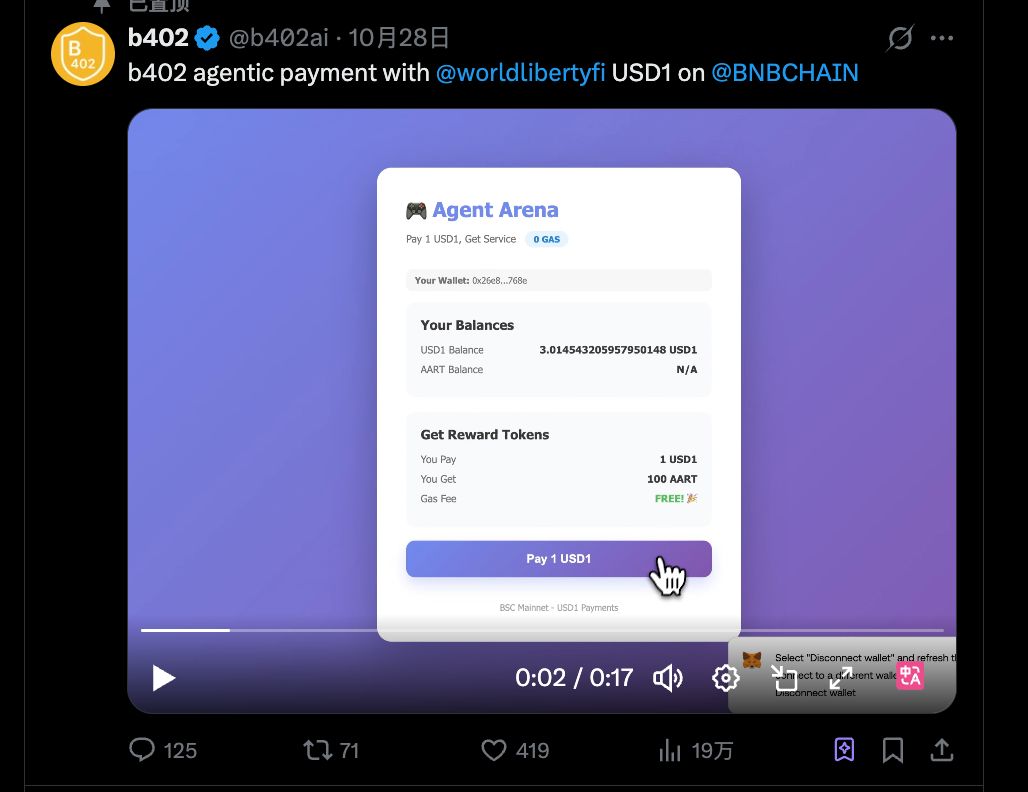

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?