Solana’s $200 Surge Driven by Adoption Growth

- Solana’s value increase surpasses $200, reflecting substantial network adoption.

- Institutional investments drive growth, reinforcing Solana’s financial appeal.

- Core infrastructure upgrades support Solana’s rising status in the market.

Solana’s price surged past $200 recently, driven by expanding network adoption, institutional interest, and infrastructure improvements, highlighted on Anatoly Yakovenko’s Twitter and reflected in the market’s enthusiasm.

The surge underscores Solana’s evolution beyond speculative trading, signaling significant institutional backing and robust ecosystem growth, impacting crypto markets with increased adoption and liquidity.

Solana’s recent rise above $200 highlights expanding network adoption and institutional support. Institutional investments solidify Solana’s standing beyond mere speculation.

Key players include Anatoly Yakovenko, Solana Labs’ co-founder. Institutional investors such as Upexi Inc. have committed significant capital, enhancing Solana’s market reputation. Infrastructure contributions ensure reliability and speed.

Market responses include increased interest in Solana futures, with open interest reaching $993 million. Whale wallets surge, contributing to the price rise. Solana’s on-chain TVL exceeds $11 billion, underscoring a strong ecosystem.

“As wallets surpass 3 million and SOL’s DeFi TVL hits over $11 billion, it’s clear we are witnessing an unprecedented adoption wave.”

The financial landscape shifts as Solana attracts new funds, impacting the broader cryptocurrency market. The move also influences Layer-1 capital flows, benefiting other significant players like ETH and BNB.

Whale wallets increasing to 5,224 highlights heightened investor interest in Solana. The expansion is not just financial; application development and token use cases also grow. Developers see Solana as key infrastructural technology.

Solana’s progress hints at a future with stronger financial structures, regulatory advancements, and tech upgrades. Historical data suggests parallels to earlier network booms, reinforcing beliefs in sustained growth. Solana’s trajectory suggests persistent demand and institutional trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

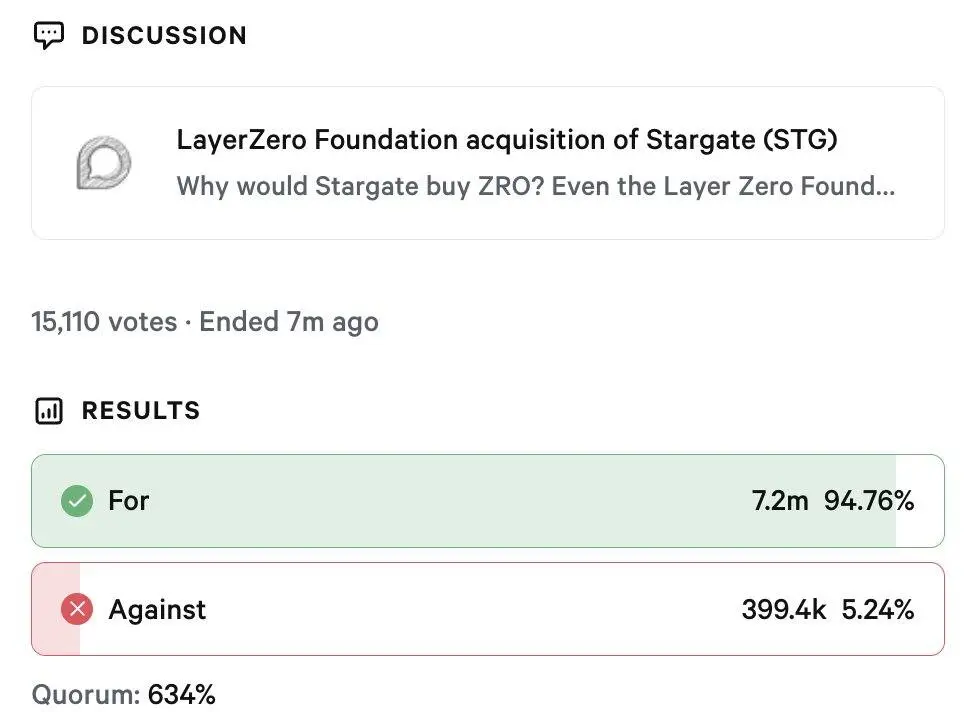

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated