Hong Kong imposes new custody rules for cryptocurrency exchanges

- SFC demands increased security and custody of crypto assets

- Measures include the use of cold wallets and continuous monitoring.

- Regime seeks to attract cryptocurrency companies to Hong Kong

Hong Kong's Securities and Futures Commission (SFC) has announced new mandatory guidelines for licensed cryptocurrency trading platforms, strengthening standards for the custody and security of client assets. The move is part of the region's plan to improve crypto infrastructure and follows international incidents that exposed flaws in the sector.

In statement , the SFC stressed that virtual asset trading platforms (VATPs) must critically review their custody practices. An analysis conducted by the agency earlier this year highlighted deficiencies in the cybersecurity controls of some of these platforms, increasing the urgency for implementing the new rules.

A published circular The regulator's draft outlines requirements ranging from senior management accountability to the adoption of cold wallet infrastructure, third-party wallet oversight, and real-time threat monitoring. "Going forward, these standards will also shape key expectations for virtual asset custodians and help foster an effective industry-wide framework for the custody of virtual assets," the SFC stated, noting that the rules take effect immediately.

For Alessio Quaglini, co-founder of Hex Trust, a Hong Kong-based cryptocurrency custodian, "this will likely concentrate the market around operators with the scale and experience to serve them, making advanced custody setups more viable."

The announcement comes after a surge in cryptocurrency-related security breaches in July. Data from PeckShield indicates estimated losses of $142 million for the month, a 27% increase compared to June.

While mainland China maintains its ban on cryptocurrency trading and mining, Hong Kong has taken a different approach, seeking to attract companies in the sector through a specific licensing regime for exchanges. Since August 1, a licensing system for stablecoin issuers has also been in effect, expanding the regulatory scope and reinforcing the city's position as a strategic hub for digital asset operations in Asia.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

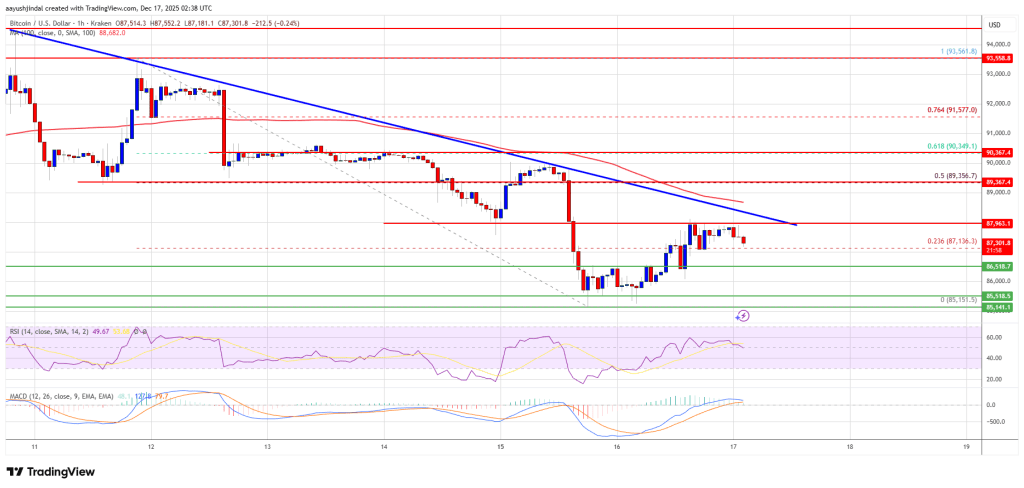

Bitcoin price regroups after decline—Is a directional breakout imminent?

Two main reasons why the current decline of ONDO is only temporary.