Fundstrat Touts Ethereum as Decade’s Top Trade, Sees $15K Price Target by 2025

Ethereum could become the most lucrative macro investment of the next decade, according to market strategy and research firm Fundstrat, which projects the cryptocurrency could climb to $15,000 before the end of 2025.

Ethereum could become the most lucrative macro investment of the next decade, according to market strategy and research firm Fundstrat, which projects the cryptocurrency could climb to $15,000 before the end of 2025.

Thomas Lee, Fundstrat Capital’s chief information officer, said on Wednesday that artificial intelligence, combined with Wall Street’s growing embrace of blockchain, will drive a massive “token economy” — with Ethereum at its core. “ETH is arguably the biggest macro trade for the next 10 to 15 years as AI creates a token economy on the blockchain and as Wall Street financializes on the blockchain,” Lee stated, pointing to upcoming U.S. regulatory and institutional shifts.

Lee expects the momentum to be fueled by the GENIUS Act’s stablecoin framework and the U.S. Securities and Exchange Commission’s “Project Crypto,” an initiative aimed at modernizing financial oversight for the digital age. He added that most stablecoins and Wall Street blockchain ventures are already being built on Ethereum.

Sean Farrell, Fundstrat’s head of digital asset research, echoed the bullish outlook, saying ETH could hit $12,000–$15,000 this year, leaving “plenty of upside” for investors.

Source

:

RWA.xyz

Source

:

RWA.xyz

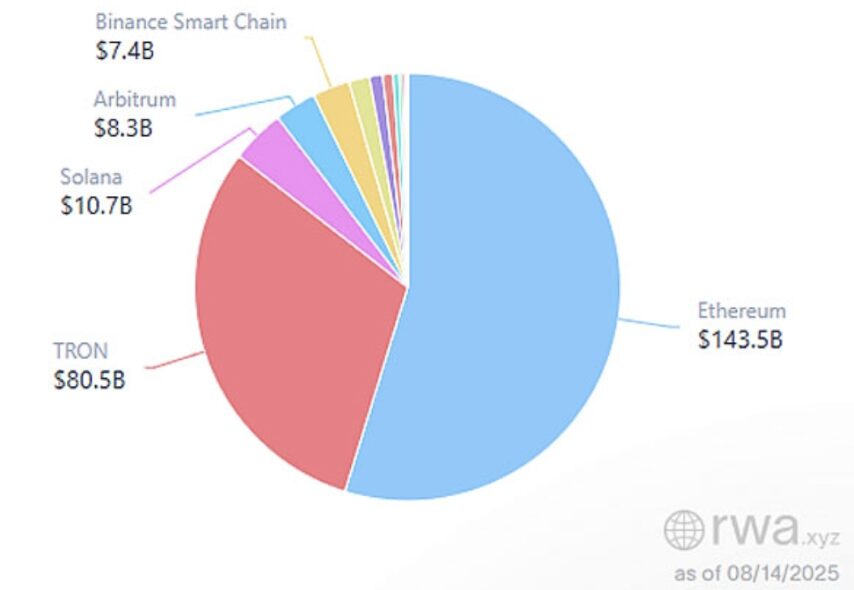

Data from RWA.xyz shows Ethereum currently commands 55% of the $25 billion real-world asset tokenization market. Over the past month, ETH has surged 60% to a four-year high of $4,770 — just 2.5% shy of its 2021 all-time high. Year-to-date, Ethereum has outperformed Bitcoin, gaining 28% compared to Bitcoin’s 18%.

Meanwhile, BitMine Immersion Technologies — the world’s largest Ethereum treasury holder — has ramped up its accumulation strategy, amassing 1.2 million ETH since July. The stash is now worth roughly $5.5 billion, and the firm is targeting a $20 billion raise to expand its holdings. BitMine’s stock (BMNR) has soared 1,300% in the same period, and in July, the company suggested Ethereum’s implied value could eventually reach $60,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2026: The Year of Federal Reserve Regime Change

The Federal Reserve will shift away from the technocratic caution characteristic of the Powell era and move toward a new mission that explicitly prioritizes lowering borrowing costs to advance the president’s economic agenda.

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)