XLM Price Faces Risk: Can Strong Outflows Undermine 22% Rally?

XLM’s rally may be threatened by strong outflows; resistance at $0.470 could cap gains, with price potentially dropping to $0.424.

XLM has experienced a solid 23% rally this month, surging to $0.451. However, the altcoin now faces potential headwinds owing to the rising outflows from investors and the declining strength of the uptrend.

This raises concerns about the sustainability of this price movement, suggesting a reversal could be on the horizon.

Stellar Investors Are Bearish

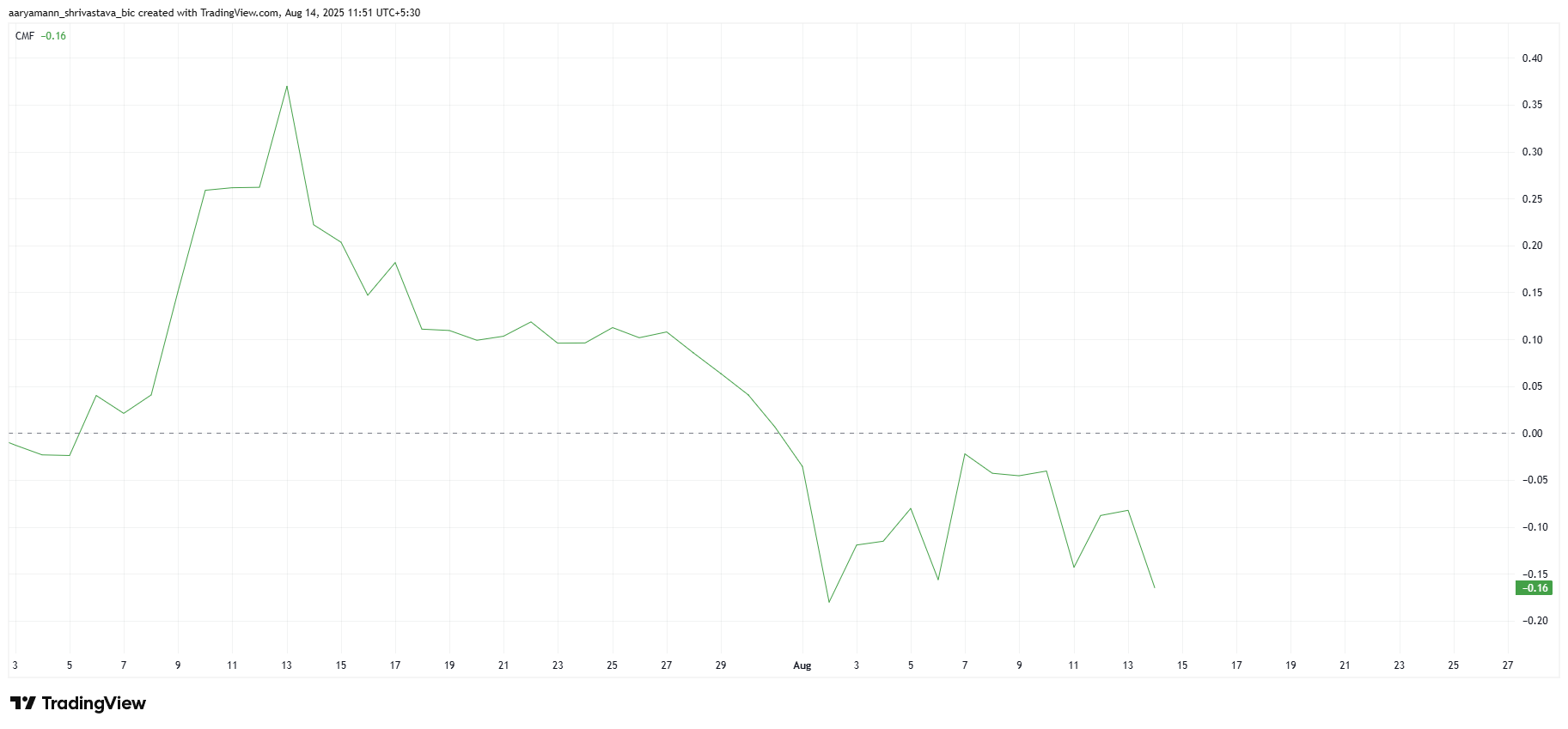

The Chaikin Money Flow (CMF) for XLM has dropped below the zero line, indicating an uptick in outflows. This shift is a sign that investors may be selling off their holdings, potentially as a result of the recent price surge.

As investors take profits, these outflows could weaken the support for XLM’s price, leaving it vulnerable to a decline without solid buying support. With more investors exiting, the demand for XLM could diminish, causing the price to lose momentum and drop.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XLM CMF. Source:

XLM’s recent uptrend, confirmed by the Parabolic SAR below the candlesticks, is showing signs of waning strength. The Average Directional Index (ADX), which measures trend strength, is nearing the critical 25.0 threshold.

XLM CMF. Source:

XLM’s recent uptrend, confirmed by the Parabolic SAR below the candlesticks, is showing signs of waning strength. The Average Directional Index (ADX), which measures trend strength, is nearing the critical 25.0 threshold.

A drop below this level could signal that the active uptrend is losing its power. If the trend weakens, XLM’s price could face a reversal, pulling back from its recent gains.

XLM ADX and SAR. Source:

XLM ADX and SAR. Source:

XLM Price Is Facing A Barrier

XLM’s price is currently trading at $0.451, holding above the support at $0.445. The altcoin has rallied nearly 23% over the last 11 days, but the crucial resistance at $0.470 remains a challenge. If XLM fails to breach this level again, it could result in a pullback to $0.424, where it might consolidate.

The inability to break the $0.470 resistance could cause a price decline, with XLM consolidating above the $0.424 level. While the altcoin’s recent rally has been significant, these resistance levels and outflows suggest that XLM might face difficulty maintaining its upward trajectory without strong support.

XLM Price Analysis. Source:

XLM Price Analysis. Source:

However, if XLM’s investors manage to push past the $0.470 resistance and convert it into support, the price could continue rising. A successful breakout could drive XLM toward the $0.500 level, marking a strong continuation of the uptrend. This would depend on sustained buying interest and a reversal of the current bearish indicators.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MiCA regulation poorly applied within the EU, ESMA ready to take back control

$674M Into Solana ETF Despite Market Downturn

Here’s What Could Happen if XRP ETFs Reach $10 Billion