Bitcoin Hits New All-Time High – What’s the Next Target for Bulls?

Bitcoin price has set a fresh record at $123,505, fueled by easing miner sell pressure and aggressive buy-side activity in perpetual futures. With $124,000 now the key level to beat, bulls are eyeing $127,000 as the next target — but the rally’s strength will depend on defending $120,000.

Bitcoin price has broken into uncharted territory, hitting a fresh all-time high of above $124,000. BTC is now up nearly 8% over the past week.

The move comes as a key on-chain shift line up in the bulls’ favor. Aggressive buying in perpetual futures has been building for days. But this time, the bulls might just aim higher than the current all-time high zone, as a key plot twist has turned in favor of the Bitcoin price action.

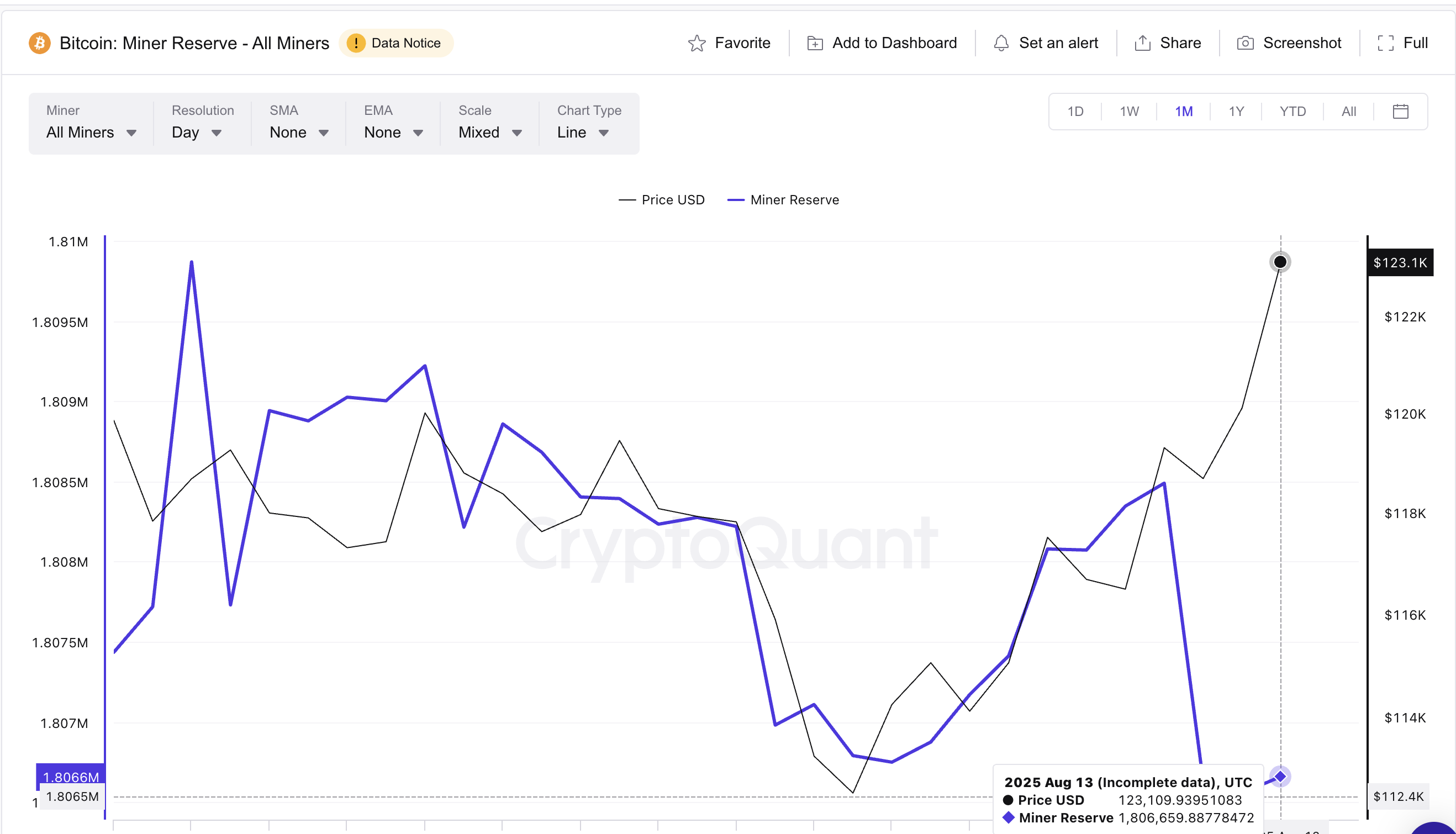

Miner Reserves Retreat As Sell Pressure Eases

Earlier this month, miner reserves swelled from 1,806,790 BTC on August 2 to 1,808,488 BTC on August 10. This raised the risk of a supply wave hitting the market. This uptick reflected higher sell-side pressure from miners—a move often seen as a headwind for rallies.

Over 2,000 Bitcoin $BTC sold by miners in 3 days!

— Ali (@ali_charts) August 12, 2025

But as the Bitcoin price tried breaking out, reserves fell to 1,806,630 BTC and have since held steady, signaling that the immediate selling risk has eased. This plot twist retreat has cleared the runway for buyers to push the market higher without heavy miner liquidation overhead.

Bitcoin price and Miner Reserves:

Cryptoquant

Bitcoin price and Miner Reserves:

Cryptoquant

Miner Reserves: The total BTC held by miners. Rising reserves can signal incoming sell pressure; falling reserves often remove a major supply-side threat.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

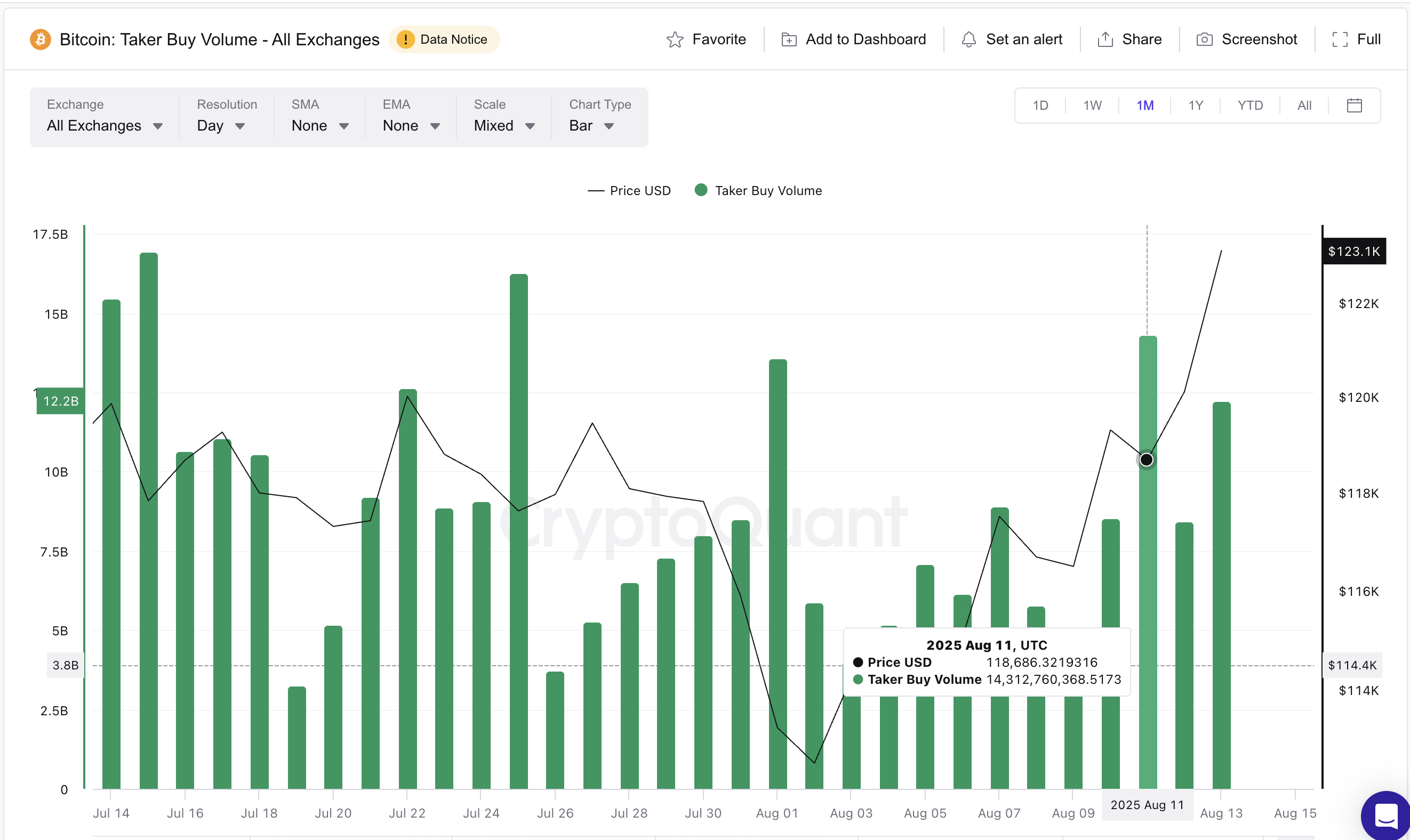

Taker Buy Volume Shows Bulls Were Ready

Taker Buy Volume; the total notional value of market buy orders lifting sell-side liquidity, surged to $14.31 billion on August 11 during a failed breakout attempt.

Here’s the key part — in order for a market buy order to get filled, it has to “hit” the sell orders already sitting on the order book. So even though they’re buying, they’re doing it immediately at the seller’s price, not waiting for a dip or a better deal.

In other words, high Taker Buy Volume means aggressive buyers are removing liquidity from the sell side of the order book — they’re clearing out sellers quickly, which can drive the price higher if the pressure keeps up.

This metric has remained elevated at $12.24 billion, showing traders are still chasing price at the ask instead of waiting for dips.

Bitcoin price and taker buy volume:

Cryptoquant

Bitcoin price and taker buy volume:

Cryptoquant

Historically, such sustained buy-side aggression often precedes successful breakouts. In this case, it was less a question of if the rally would break to new highs and more a question of when.

Key Bitcoin Price Levels to Watch

With momentum now tilted heavily toward the bulls, the immediate test lies at $124,300, which stands as the last significant barrier before higher targets come into play.

Bitcoin price analysis:

TradingView

Bitcoin price analysis:

TradingView

A clean break and daily close above this level could open the Bitcoin price path toward $127,600, aligning with the 1.0 Fibonacci extension and representing the next major upside objective.

On the flip side, if Bitcoin fails to hold above $121,600, especially in combination with a rebound in miner reserves, the bullish setup could face a sharper pullback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.