Tom Lee's BitMine expands equity offering to $24.5B for more Ethereum acquisitions

Key Takeaways

- BitMine Immersion Technologies expanded its equity offering to $24.5 billion for more Ethereum acquisitions.

- The offering is a five-fold increase from the previous $4.5 billion authorization and will be sold through at-the-market methods.

BitMine Immersion Technologies, headed by Fundstrat founder and CIO Thomas “Tom” Lee, has filed to raise its at-the-market equity program by $20 billion, pushing its total capacity to $24.5 billion. The proceeds are expected to finance the company’s future ETH acquisitions.

The expansion represents more than a five-fold increase from the company’s previous authorization of $4.5 billion. BitMine has already utilized approximately $4.5 billion of its prior authorization through sales under its existing agreement.

The common stock offering will be conducted through sales agents from Cantor Fitzgerald & Co. and ThinkEquity LLC, who will receive a commission of up to 3% on gross proceeds. The shares will be sold through various methods, including direct trading on the NYSE American exchange, where BitMine trades under the symbol “BMNR.”

BitMine, the largest corporate holder of Ethereum, now holds over 1 million ETH valued at approximately $5 billion, according to a Monday announcement.

BitMine has aggressively accumulated ETH with a goal of holding 5% of the total supply, solidifying its leadership in Ethereum treasuries.

Tom Lee told Bankless in a recent podcast that Ethereum has the potential to exceed Bitcoin’s value. He expects ETH prices to surge to between $7,000 and $15,000 by year’s end and is actively acquiring ETH to boost BitMine’s liquidity and reserves.

Ethereum was trading at around $4,400 at press time, up 4% in the last 24 hours, TradingView data shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go?

XRP News Today: Ripple Moves 65M XRP as Market Remains Under Pressure

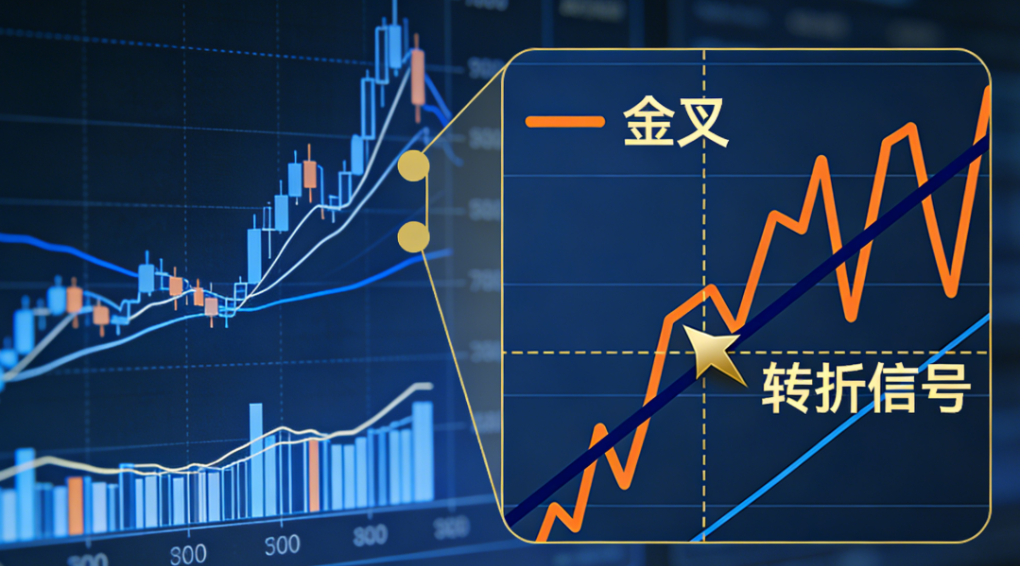

A rare "golden cross" appears, signaling a technical turning point for the US dollar