MicroStrategy and Trump Double Down on Bitcoin Amid All-Time High Hopes

Strategy and Trump Media increase Bitcoin investments, with Trump Media's Bitcoin ETF drawing attention and boosting crypto market demand.

As Bitcoin price surges above $120,000 again, MicroStrategy and Trump Media are laying the groundwork for huge investments. The President’s media firm amended its Bitcoin ETF application in a latest SEC filing.

MicroStrategy, for its part, made a relatively small purchase last week. This follows a massive investment the week prior, however, and the firm remains committed to constant stockpile growth.

Strategy and Trump Media’s Bitcoin Plans

Since President Trump enabled crypto investments in retirement portfolios, Bitcoin has been taking off. There was already a global trend of corporate BTC acquisition, but consumption is even more incentivized now.

Following along this trend, Strategy (formerly MicroStrategy) and Trump Media have made serious moves to boost their holdings:

Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin. $MSTR $STRC $STRK $STRF $STRD

— Michael Saylor (@saylor) August 11, 2025

Strategy posted impressive returns last quarter, and its Chair, Michael Saylor, has encouraged all sorts of altcoin investment. Compared to its massive acquisition last week, the firm’s $18 million commitment seems rather small.

It still represents steady progress, but Trump Media is arguably making a bigger impact than Strategy with its own announcement.

“Trump Media announced today the filing with the (SEC) of the first amendment to the registration statement on Form S-1 (the “Registration Statement”) for the Truth Social Bitcoin ETF. The ETF will hold bitcoin directly and offer its shares to investors, aiming to reflect Bitcoin’s price performance,” a recent press release claimed.

Truth Social ETF: A New Demand Spike?

When the Bitcoin ETFs first hit the scene over a year ago, they revolutionized the crypto market. President Trump’s business empire is heavily integrated with crypto right now, and his firms recently initiated an ETF strategy.

This has involved a dual BTC/ETH product and a five-token basket ETF, but the Truth Social Bitcoin ETF is currently receiving the most attention.

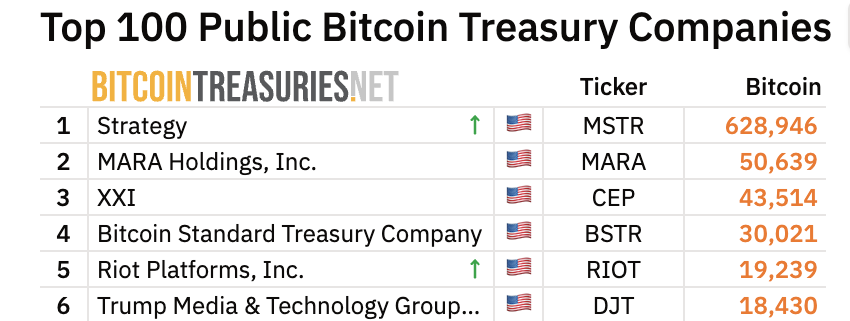

Furthermore, some of the other filings have hit regulatory setbacks in recent weeks, while Bitcoin ETFs are a well-established market. To better prepare for this future offering, Trump Media has become the sixth-largest private BTC holder, but it has a long way to go to surpass Strategy.

Strategy and Trump Bitcoin Holdings. Source:

bitcointreasuries.net

Strategy and Trump Bitcoin Holdings. Source:

bitcointreasuries.net

President Trump has already been a huge influence over crypto, but a Trump-branded ETF could initiate huge flows of capital. Of course, the firm can only sell as many ETFs as it has underlying assets, so Trump Media will need to keep buying.

Trump is setting standards for many ‘firsts’ for a sitting president. It’s unprecedented in any previous term where a President’s private enterprise would directly apply for ETFs, let alone with crypto exposure.

However, given the current spree of pro-crypto regulations, such funds might receive relatively easier approval.

In the short term, Trump Media could plausibly continue acquiring Bitcoin as fast as Strategy. This demand will likely impact BTC’s price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?