Tom Lee’s Ethereum treasury BitMine tops 1 million ETH worth nearly $5 billion

Key Takeaways

- BitMine Immersion Technologies holds over 1 million ETH, making it the largest ETH treasury in the world.

- BitMine rapidly grew its ETH holdings by $2 billion in one week and aims to acquire 5% of all ETH.

Share this article

BitMine Immersion Technologies, the largest corporate holder of Ethereum, said Monday it now holds over 1 million ETH valued at nearly $5 billion. That’s an increase of 317,126 tokens, worth around $2 billion, from over 833,000 ETH it disclosed last Monday.

With this boost, BitMine strengthens its lead as the top Ethereum treasury by holdings. The firm has been on an aggressive buying spree since late June, aiming to capture 5% of all Ethereum in existence.

“We are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” said Thomas “Tom” Lee of Fundstrat, Chairman of BitMine’s Board of Directors.

BitMine has climbed into the top tier of US stock trading activity, with a five-day average daily volume of 2.2 billion dollars as of August 8. This puts it at number 25 on the US list, between Costco Wholesale Corp and Micron Technology.

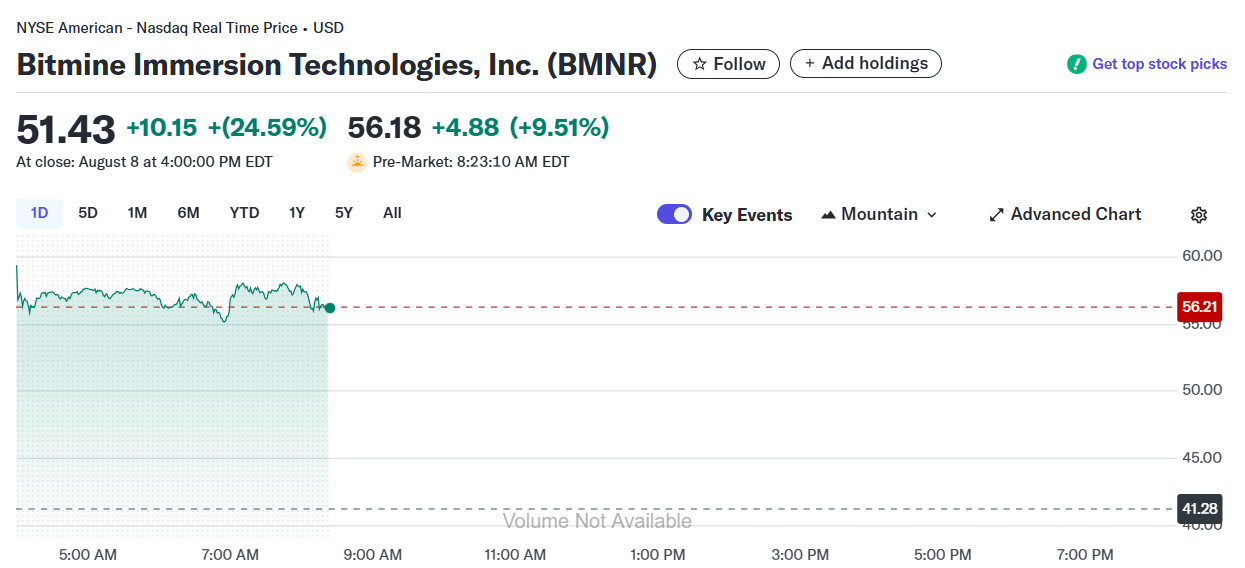

According to Yahoo Finance, BitMine (BMNR) shares ended Friday with a 24.5% rise. The stock climbed another 9.5% in pre-market trading on Monday.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"AI Godmother" Fei-Fei Li's Latest Interview: I Didn't Expect AI to Become So Popular, the Next Frontier Is Spatial Intelligence

If AI leads humanity into an extinction crisis, it will be humanity's fault, not the machines'. If superintelligence emerges, why would humanity allow itself to be taken over? Where are collective responsibility, governance, and regulation? "Spatial intelligence" may fundamentally change the way we understand the world.

Has the four-year cycle of Bitcoin failed?

The various anomalies in this cycle—including waning sentiment, weakening returns, disrupted rhythms, and institutional dominance—have indeed led the market to intuitively feel that the familiar four-year cycle is no longer effective.

At an internal Nvidia meeting, Jensen Huang admitted: It's too difficult. "If we do well, it's an AI bubble," and "if we fall even slightly short of expectations, the whole world will collapse."

Jensen Huang has rarely admitted that Nvidia is now facing an unsolvable dilemma: if its performance is outstanding, it will be accused of fueling the AI bubble; if its performance disappoints, it will be seen as evidence that the bubble has burst.

After a 1460% Surge: Reassessing the Value Foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.