Vitalik Buterin’s Ethereum Holdings Top $1 Billion as Whales Fight For Limited ETH Supply

Buterin’s billion-dollar ETH stake and a squeeze in OTC liquidity are reshaping market chatter. On-chain data and whale flows hint at rising demand.

Vitalik Buterin’s Ethereum holdings have surpassed $1 billion. The milestone arrives as over-the-counter ETH liquidity appears tight, drawing fresh scrutiny. As a result, large traders and institutions are competing for supply and revisiting Ethereum’s standing against Bitcoin.

On-chain dashboards and industry reports back the claims on both fronts. Moreover, prominent blockchain explorers offer open visibility into Buterin’s portfolio. Social posts reflect the tense mood and speculation around what scarcity could mean for ETH’s price path.

The Billion-Dollar ETH Portfolio: Full Transparency

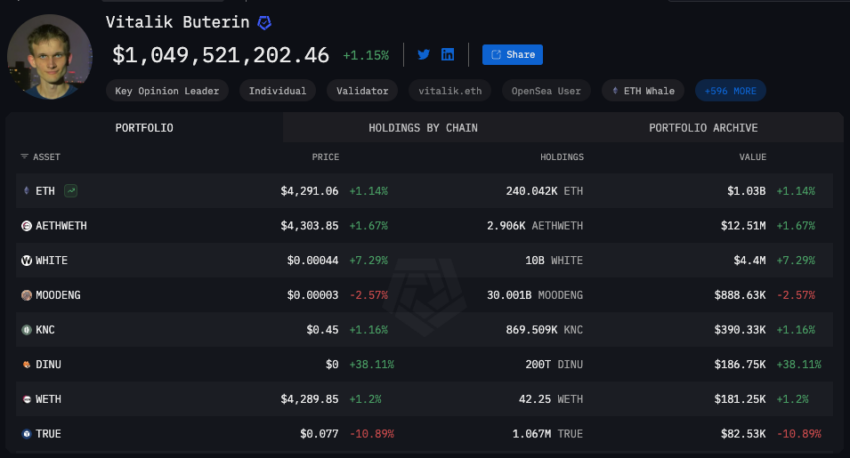

As of mid-2024, Buterin’s known Ethereum addresses are documented with holdings above $1 billion. Both entity-level dashboards and public explorers list these wallets. Arkham’s platform shows more than 240,000 ETH and details validator roles and transactions. Arkham entity data on Vitalik Buterin remains a central reference for monitoring balances.

Vitalik Buterin Public Portfolio. Source:

Vitalik Buterin Public Portfolio. Source:

While Buterin’s fortune draws headlines, a different story is building among OTC desks. The private market for large ETH trades is reportedly facing a sharp supply squeeze.

“In the past hour, Binance, Coinbase & Bitstamp moved ~$160M in ETH to Galaxy Digital’s OTC desk. Largest single tx: 4.5K ETH ($18.99M). Ethereum whales are moving heavy today,” CryptosRus said.

Large transfers reveal the scale of activity moving through OTC channels. However, observers also report shortfalls at active desks.

“WinterMute, known Market Maker, have run out of Ethereum on their OTC desk. This means the only way to buy ETH is by the public open market. I wonder if Ethereum can punch $5,000 soon?” yourfriendSOMMI wrote on X.

hearing there is just 42 ETH left on OTC desksif true, ETH is going straight to $80,000!!

— borovik (@3orovik) August 10, 2025

Such posts illustrate broad speculation. If demand persists, scarce OTC supply could push buying back onto public markets.

The ETH vs. BTC Debate Returns

The debate over Ethereum’s place relative to Bitcoin tends to flare when liquidity tightens. It also resurfaces when ETH gains market share.

A popular post recalls a moment when ETH nearly matched Bitcoin’s dominance:

“You may not know, but Ethereum almost surpassed BTC to become the coin with the largest market capitalization on June 18, 2017. At that time, BTC held 37.8% of the market share, while ETH reached 31.2%. However, in the end, that didn’t happen; BTC regained its dominance and has maintained a significant gap with ETH ever since.”ThuanCapital said.

Bitcoin vs Ethereum Dominance Chart. Source:

Bitcoin vs Ethereum Dominance Chart. Source:

That history colors current analysis. With OTC supply tight, some market voices again mention a possible flippening, even if brief. Meanwhile, Buterin’s on-chain stake, visible on mainnet and via third-party trackers, signals his alignment with Ethereum’s future.

Greater transparency across on-chain assets and OTC channels keeps attention on Ethereum. Ultimately, traders will gauge whether scarcity and demand can challenge the status quo in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.