ENA Eyes Breakout Toward $1.25 as Price Reclaims Key Support

- ENA price reclaims crucial support, signaling a bullish pattern similar to its 2024 breakout.

- Analyst projects a potential rally to $1.25 if it breaks and holds above the resistance level.

- Rising open interest and positive funding suggest strong trader confidence in ENA’s uptrend.

Ethena’s native token, ENA, is showing signs of a major breakout. After months of consolidation, the asset is reclaiming key levels. This move has sparked interest across the crypto market, with traders watching for a repeat of last year’s rally. In November 2024, ENA surged 120% in just 22 days. That breakout began at the same $0.51 support level the price has now reclaimed. At press time, the token was trading near $0.63 after gaining over 1.5% in 24 hours.

Retesting Crucial Resistance After Failed 2024 Breakout

ENA previously struggled at the $0.65 resistance zone. In late 2024, the asset briefly broke above this level. However, it quickly reversed, forming a potential bull trap. Prices fell sharply afterward, bottoming out near $0.24. That reversal formed the basis for a long accumulation phase. As buying momentum returned, the token began a strong upward trend.

As of this week, ENA is once again testing the $0.65 resistance. This time, the chart shows a stronger market structure. Analysts point to increased volume and conviction. A breakout above this level could signal a move toward the $1.25–$1.40 zone.

Crypto analyst Ali shared the chart comparing the current setup to the 2024 breakout. He noted that the previous rally followed a similar reclaim of support. A grey projected path shows a possible breakout above $0.70. That path targets $1.25 as a medium-term goal. Key levels include the mid-range at $0.65 and resistance above $1.25.

Bullish Momentum Builds as Open Interest Rises

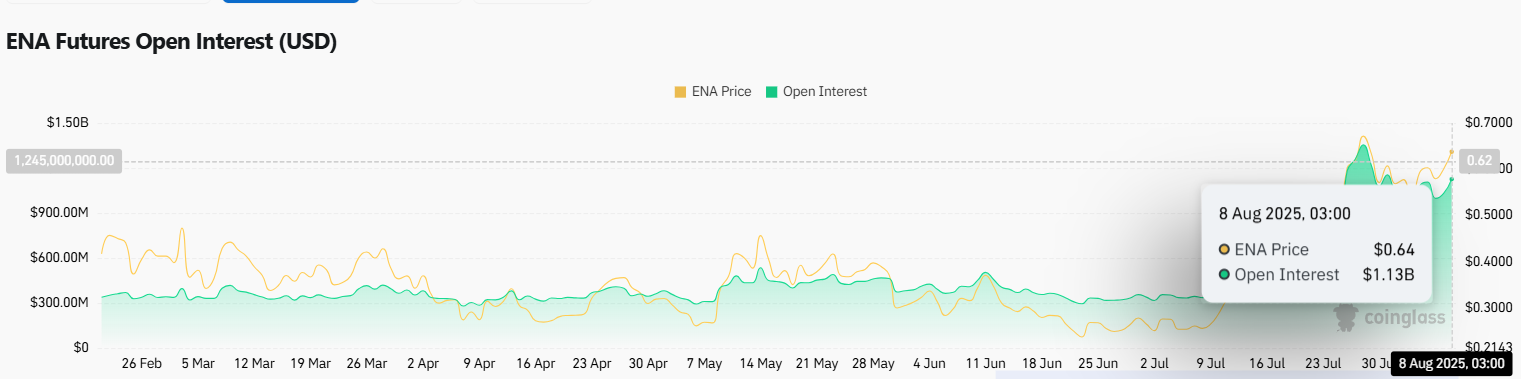

Recent market activity supports the bullish view. Open Interest (OI) in ENA futures has climbed back above $1 billion. This follows a short dip to $916 million after last week’s price drop. Open Interest reflects the number of outstanding contracts. Increased OI is usually an indication of increasing trader conviction. Many investors are entering long positions, betting on continued upside. Funding rate also remains positive, which also confirms a bullish sentiment.

Source:

Coinglass

Source:

Coinglass

Technical momentum matches this trend. ENA is forming higher lows and higher highs on the 12-hour chart. It has broken out of months of sideways movement and strongly followed through above $0.60. The next major resistance is at $0.70. In case ENA breaks and sustains above this level, it may aim at $1.00 and $1.25. This might happen in case bulls defend the support levels.

Related: Altcoin Momentum Builds as BTC Dominance Continues to Drop

Ethena Labs is gaining traction in the DeFi space with its latest offering, Liquid Leverage, which debuted in late July. The new tool enables users to earn yield on USDe, Ethena’s synthetic dollar, by staking it. It integrates with Aave to boost leverage strategies. The product drew $1.5 billion in deposits within days of launch. This increase in demand reflects rising interest in the Ethena ecosystem. It also adds credibility to ENA’s recent price gains.

With a strong technical structure and mounting interest, traders are observing ENA’s next move. Once it breaks out of $0.70 and holds, it could see another rally. The momentum in market, along with derivatives data and historical trends, suggests further upside as long as key levels hold.

The post ENA Eyes Breakout Toward $1.25 as Price Reclaims Key Support appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.