Key Notes

- Jerome Powell’s second term as Fed chair is very close to its end.

- Donald Trump hinted at candidates from Wall Street.

- Kevins, Hassett and Warsh, lead the charts as top nominees for the role.

US President Donald Trump is on the hunt for a replacement for US Federal Reserve Chair Jerome Powell , who will be leaving the office in May 2026. Powell, who was brought to the Fed’s throne by Trump himself in November 2017, replacing Janet Yellen, seems to be “too independent” for the president’s policies. Trump even called him “TOO ANGRY, TOO STUPID, & TOO POLITICAL,” for the Fed chair position.

Now that Powell is heading out of the office, speculation about who the next Fed chair will be.

According to a Financial Times report , Kevin Hassett and Kevin Warsh are leading the charge to replace Powell. On Aug. 6, Trump hinted that the next Fed chair will be from Wall Street.

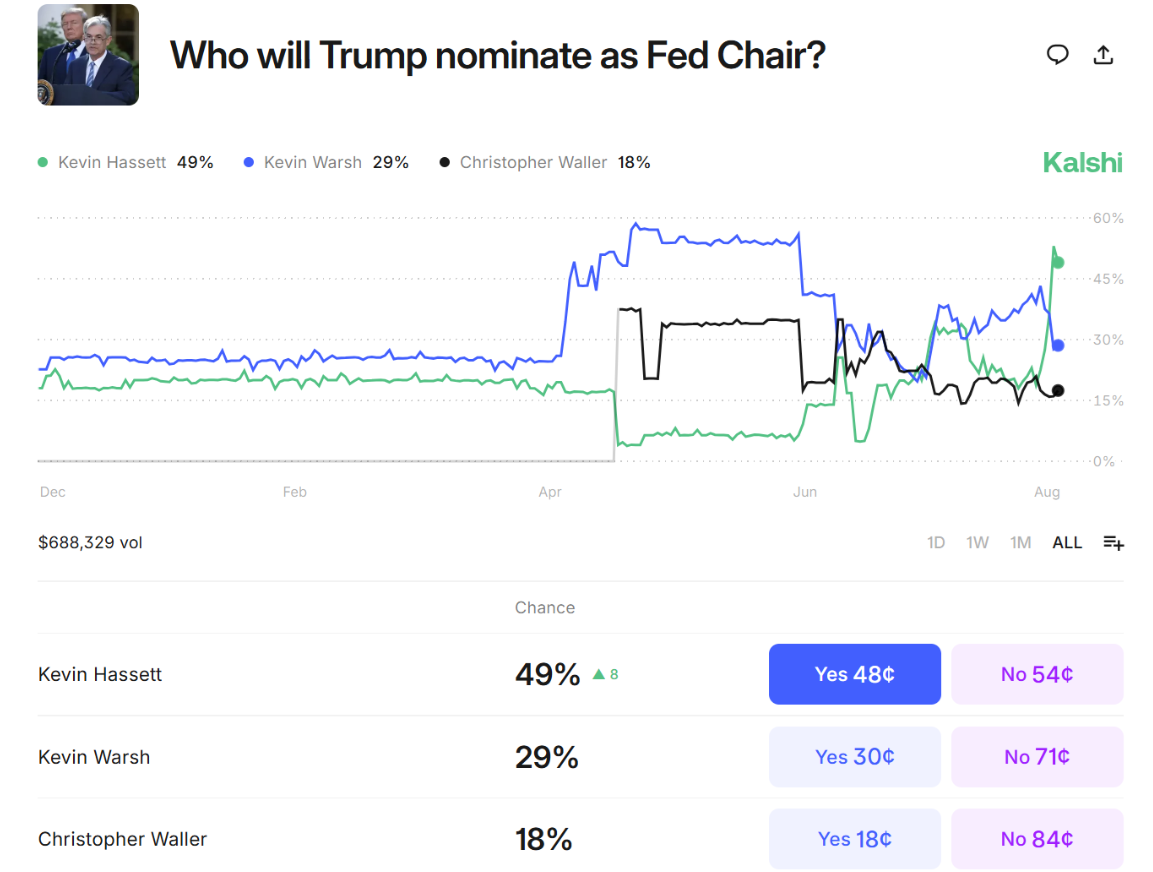

Hassett and Warsh are also the fan favorites on the market prediction platform Kalshi. According to a poll on the platform, Hassett has a 49% chance of becoming the next Fed chair, followed by Warsh’s 29% probability.

Who will Trump nominate as the next Fed chair? | Source: Kalshi

Christopher Waller is the third candidate on the list with an 18% probability.

While Hassett and Warsh come from a Morgan Stanley background, in this case, Wall Street, Waller is a career academic and economist; he was a research director at the Federal Reserve Bank of St. Louis.

What About the ‘Crypto Fed Chair’?

As always, the crypto community is always on the lookout for digital asset-friendly candidates with bullish policies and potentially fast rate cuts , which also aligns with what Trump wants as well.

With these characteristics, Hassett might be the perfect candidate to lead the Federal Reserve.

According to a researcher on X, claiming to be a former BlackRock employee, Hassett is “aligned with supply-side stimulus and fast drag-reduction strategies.”

3/

Leading the shortlist is Kevin Hassett, former director of the NEC under Trump

He’s aligned with supply-side stimulus and fast drag-reduction strategies

During Trump’s first term, Hassett supported aggressive monetary boosts

Under him, expect quick rate cuts intended to… pic.twitter.com/LDqPbgwibS

— Orbion (@cryptorbion) August 6, 2025

“Under him, expect quick rate cuts intended to fuel economic expansion,” Orbion wrote in an X post.

Hassett also has a $1 million stake in the leading crypto exchange Coinbase. His investment in Coinbase and advisory role suggest familiarity and interest in the digital asset space. However, specifics on his broader crypto policy perspectives are not detailed in public sources.

Warsh is also an early crypto adopter. He invested in the algorithmic stablecoin project Basis in 2018 and Bitwise, a crypto index fund manager, in 2021. He’s listed as an advisor on Bitwise’s site.

On the other hand, Warsh is more into central bank digital currencies than decentralized digital assets. In a 2022 op-ed in the Wall Street Journal, he clearly mentioned CBDCs as a way to counter China’s digital yuan.

The CBDC support might decrease Warsh’s chance of becoming the next Fed chair, as Trump has always been against centralized digital assets .