Arkham Reveals Bitcoin Heist at LuBian Mining Pool

- LuBian Mining Pool suffered major Bitcoin theft, revealing significant losses.

- 127,426 BTC stolen, now valued at over $14 billion.

- Incident remained undisclosed for years, with no direct market outcome.

Arkham Intelligence revealed that 127,426 BTC were stolen from the Chinese mining pool LuBian in a December 2020 hack, marking it as the largest Bitcoin heist.

The incident highlights severe security flaws within crypto ecosystems, surpassing previous thefts, and raises concerns about unacknowledged breaches affecting market stability.

Arkham Intelligence uncovered one of the largest Bitcoin thefts in history. The Chinese mining pool, LuBian, lost 127,426 BTC worth $14 billion today. The sophisticated hack occurred in December 2020.

The event involves LuBian Mining Pool, which held 6% of Bitcoin’s hash rate. No statements from LuBian’s leadership followed Arkham’s disclosure.

LuBian’s abrupt shutdown in early 2021 was previously linked to regulatory issues. However, the massive financial impact from the theft is now clear. It overshadows past breaches like Mt. Gox and Bitfinex.

Arkham’s report indicates the stolen BTC remains largely unmoved, with no laundering evidence. The hack surpassed previous thefts in scale, marking a new height in cryptocurrency losses.

The disclosure lacks comments from Chinese authorities or global agencies as of now. Major industry figures have also refrained from public statements regarding the issue.

Speculation mounts on future regulatory actions and technology approaches to safeguard against such incidents, leveraging historical insights and advanced cryptographic solutions. Here’s what Arkham tweeted about the significant crypto market trends .

Miguel Morel, Founder/CEO, Arkham Intelligence: “Based on analysis of on-chain data, it appears that 127,426 BTC was stolen from LuBian in December 2020, worth $3.5 billion at the time and now worth $14.5 billion. Neither LuBian nor the hacker has publicly acknowledged the hack.” Arkham

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: L2 is supposed to be secured by Ethereum, but this is no longer true

Two-thirds of L2 assets have left Ethereum's security protection.

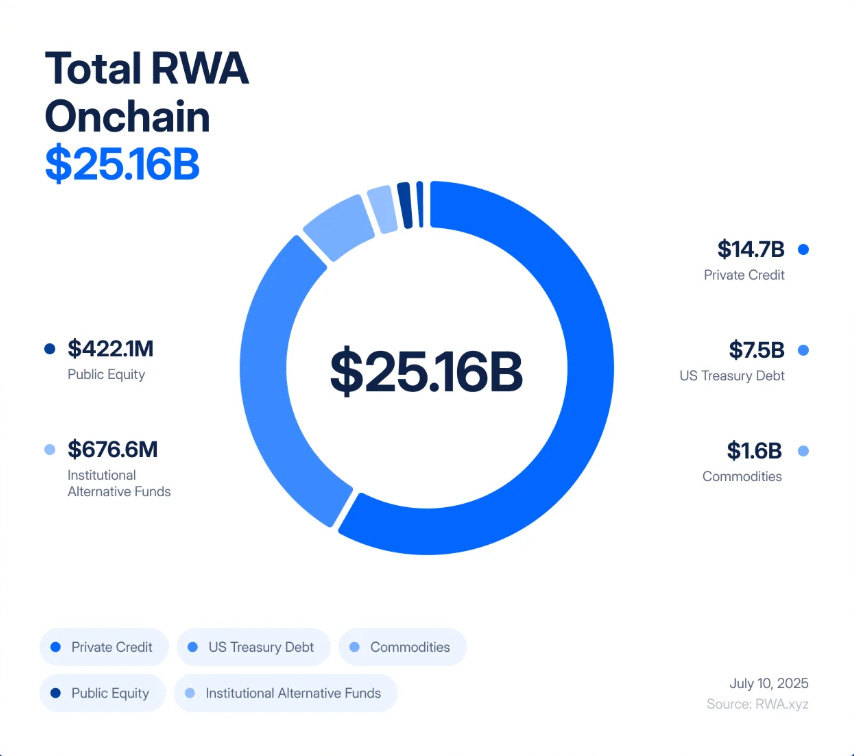

When Slow Assets Meet a Fast Market: The Liquidity Paradox of RWA

Illiquid assets wrapped in on-chain liquidity are repeating the financial mismatches of 2008.

XRP Ledger Activates Credentials Amendment for Compliance and Identity

Solana Emerges as Top Crypto Performer Amid Altcoin Rotation