Ethena’s native token, ENA, surged 15% over the past 24 hours, showing renewed strength as its Ethereum-based synthetic stablecoin, USDe, hit a major milestone, becoming the third-largest stablecoin by market capitalization. However, a major ENA token unlock scheduled for this week could introduce price volatility in the near term.

ENA Price Soars on Ecosystem Momentum

ENA jumped nearly 21% on Sunday, briefly touching $0.624 before pulling back to around $0.60.

Ethena (ENA) price soars. Source: Tradingview

Ethena (ENA) price soars. Source: Tradingview

Trading volume rose by 35% to $1.15 billion, reflecting heightened market activity. Ethena now ranks as the sixth-largest DeFi protocol with total value locked (TVL) reaching $9.48 billion.

Sponsored

July marked a breakout month for Ethena, with the platform recording $2.96 billion in USD inflows, up sharply from $47 million in June. Platform fees also more than doubled, climbing from $19.96 million to $36.5 million, underscoring robust user engagement and ecosystem growth.

USDe Supply Spikes, Driving ENA Momentum

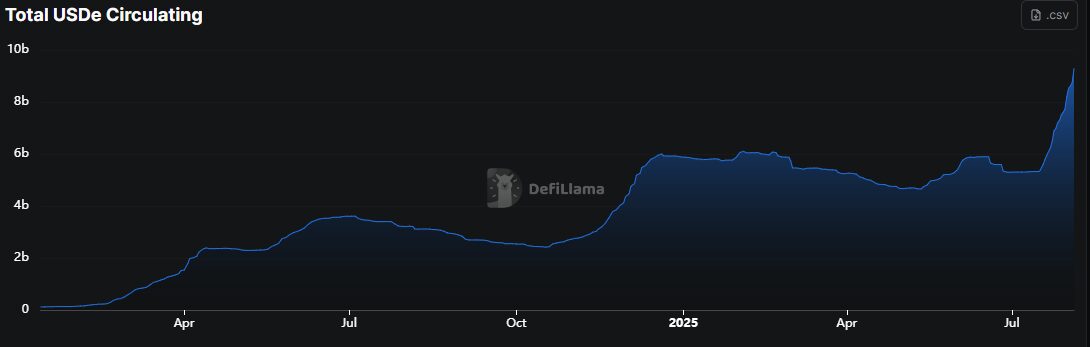

One of the key drivers behind ENA’s impressive rally is the rapid expansion of its synthetic stablecoin, USDe.

According to DeFiLlama, USDe’s supply on Ethereum surged 75% since mid-July, pushing its market cap to $9.3 billion.

USDe circulating supply spike in July.Source: DeFillama

USDe circulating supply spike in July.Source: DeFillama

This growth allowed USDe to surpass First Digital USD (FDUSD) and secure the number-three spot behind Tether (USDT) and Circle’s USDC.

Massive Token Unlock Threatens Volatility

Despite the bullish momentum, the week ahead could bring heightened volatility. Ethena is set to unlock $101.87 million worth of ENA tokens, according to data from CryptoRank.

Crypto analyst Ali Martinez reported that 250 million ENA tokens have been transferred to exchanges over the past two weeks, likely signaling profit-taking.

Adding to the concerns, veteran investor Arthur Hayes sold 7.76 million ENA tokens last week, worth approximately $4.62 million, according to Lookonchain.

What’s Next For ENA Price?

On the weekly chart, ENA appears to be forming a potential double bottom pattern. However, for the token to break above the neckline and confirm this bullish setup, it would need to reach the $1.20 level, also marking the upper boundary of a multi-month downtrend.

On the daily chart, technical indicators show positive momentum. While the MACD has entered negative territory, the signal appears to be weakening. Meanwhile, the RSI is climbing toward the overbought zone (currently at 63) and is approaching a potential crossover above the signal line, typically interpreted as a bullish sign.

Additionally, the 50-day and 200-day moving averages are nearing a Golden Cross formation, which could further support a breakout and drive ENA’s price higher.

Why This Matters

Ethena’s rapid growth and upcoming token unlock could significantly impact short-term price action and signal broader investor sentiment toward emerging stablecoin-driven DeFi protocols.

Read DailyCoin’s hottest crypto news:

HBAR Price Locked In Consolidation: Will ETF Spark Rebound?

Pi Price Dumps 28%; Lock-Up Blunder Sparks Pioneer Fury

People Also Ask:

Ethena is a decentralized finance (DeFi) protocol built on the Ethereum blockchain, designed to offer a synthetic stablecoin called USDe. It aims to provide a scalable, crypto-native stablecoin that maintains price stability without relying on traditional banking infrastructure.

ENA is the native governance token of the Ethena protocol. It allows holders to participate in decision-making processes, such as protocol upgrades and parameter adjustments, and may be used for incentives within the ecosystem, depending on Ethena’s evolving governance framework.

Ethena’s key differentiator is its crypto-native design. Unlike fiat-backed stablecoins (e.g., USDT or USDC), USDe relies on decentralized collateral and automated hedging strategies. This reduces dependence on centralized entities and aligns with DeFi’s ethos of transparency and decentralization.