UK Fintech Firm Revolut Faces Setback in Banking License Approval

According to Jinse Finance, global fintech company Revolut has been waiting for over three years for approval of a full banking license in the UK, and is now caught in a public dispute between UK Chancellor Rachel Reeves and Bank of England Governor Andrew Bailey. The controversy arose when Reeves attempted to expedite the approval process by arranging a meeting between Revolut and Bank of England regulators, but Bailey blocked the move, citing concerns over interference with the central bank’s independent regulatory authority. This incident has raised concerns about the future prospects of the UK’s fintech industry, especially as Revolut considers a potential listing in the United States, which could impact the UK’s status as a global fintech hub.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin OG opens 5x ETH short position worth $15.04 million

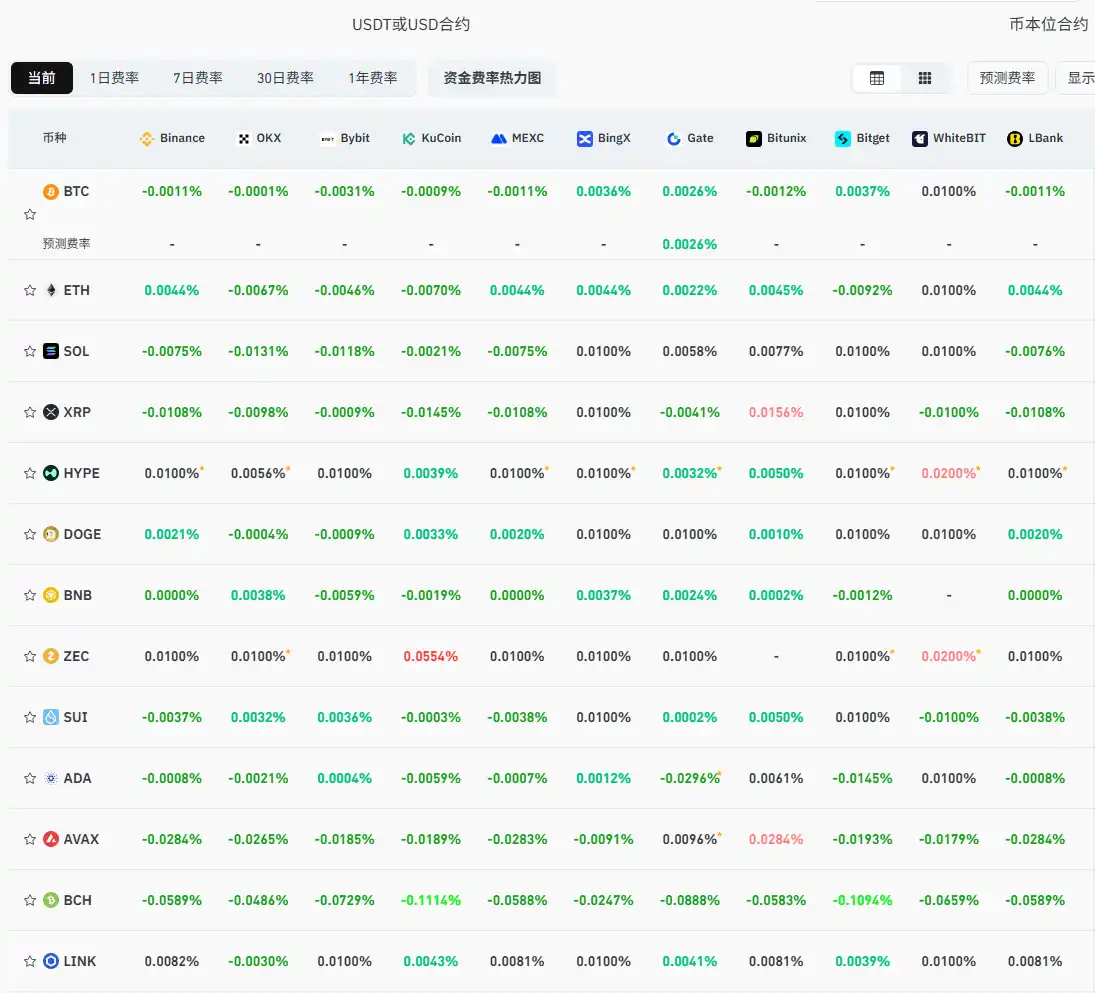

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise