Date: Sun, Aug 03, 2025 | 07:00 AM GMT

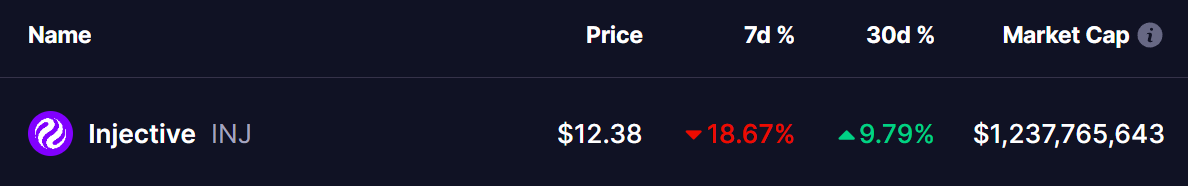

The cryptocurrency market is currently in a corrective phase, with Ethereum (ETH) retreating sharply from its $3,940 resistance down to around $3,440 — an 8% weekly decline that has sent bearishness across the major altcoins . Injective (INJ) hasn’t been spared, sliding 18% this week and trimming its monthly gains to a modest 9%.

Yet despite the recent weakness, INJ’s chart is showing signs of a familiar — and potentially bullish — pattern. The current structure bears a striking resemblance to a fractal setup that previously preceded a strong upward rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

On the daily chart, INJ has been trading within a broad falling wedge, a pattern typically associated with long-term accumulation and eventual breakouts.

Looking back to late 2024, INJ broke out of a smaller falling wedge, reclaimed its 200-day moving average (200 MA), and then pulled back slightly in a healthy correction (highlighted by a green circle). This brief dip retested the 200 MA, which held as support — and from there, the token surged 60% to test the wedge’s upper boundary.

Injective (INJ) Fractal Chart/Coinsprobe (Source: Tradingview)

Injective (INJ) Fractal Chart/Coinsprobe (Source: Tradingview)

Fast forward to the present, and history appears to be rhyming. INJ has once again broken out of a falling wedge and reclaimed the 200 MA before entering another short-term correction — right in the same price zone that acted as a launchpad in 2024.

What’s Next for INJ?

The key level now is the 200-day moving average, currently near $12.47. If INJ can hold or reclaim this level and begin pushing upward, it could set the stage for another move toward the upper wedge resistance — sitting near the $15.75 mark, representing roughly a 25% potential upside from current prices.

If the fractal structure plays out similarly to before, a successful breakout above this wedge could open the door to an even broader rally.

However, confirmation is key. Traders will be watching closely for a decisive move above the recent consolidation zone and the 200 MA. Failure to reclaim that level could lead to further downside or extended consolidation.