- Altcoin dominance hovers near cycle lows, mirroring 2019 accumulation patterns.

- RSI remains neutral with no clear momentum shift, confirming ongoing consolidation.

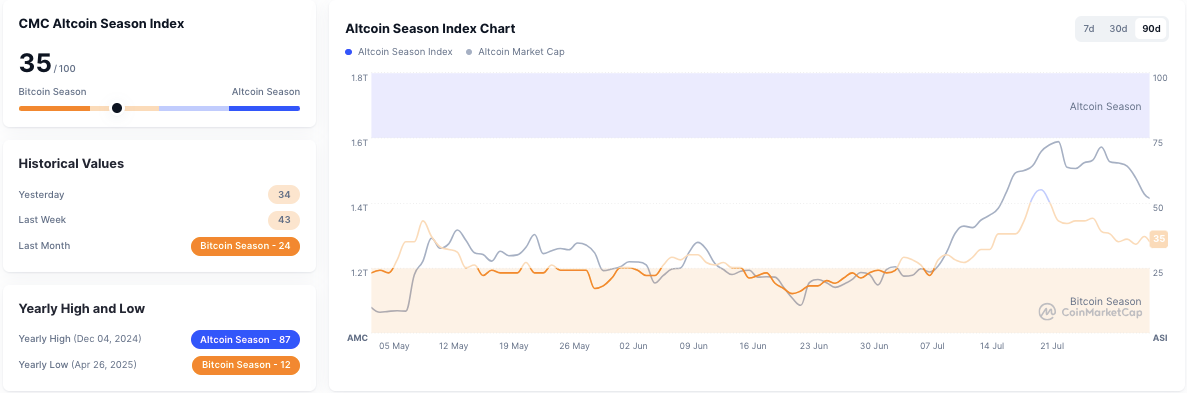

- Altcoin Season Index at 35 signals continued Bitcoin dominance in current market cycle.

Crypto analyst Michaël van de Poppe has noted that the altcoin market remains in its accumulation phase, with no indication yet of a trend reversal.

In a recent post, van de Poppe pointed to the Others.D chart, which tracks the market cap of all crypto assets outside the top 10, and compared the current market structure to the conditions seen in the summer of 2019.

Historical Parallel for Altcoins

The chart shows that altcoins outside the top 10 are still trading near their cycle lows. According to van de Poppe, the altcoin market has yet to show signs of a breakout, but historical data points out “there’s still a lot to come.”

The Others.D chart has been in a steady downtrend since its peak in late 2021. The latest reading is near 7.26%, just above long-standing support. In the past, major market reversals for altcoins began after this metric bottomed out, as it did around 4.25% in 2019 and near 6.5% in 2022.

Related: 2025 Altseason: Ethereum Surges 170% as Bitcoin Dominance Declines—Is a Blow-Off Top Near?

A breakdown from the current level could send the metric back toward that 4.25%–5% zone, which has historically marked a point of maximum opportunity.

Source: X

Source: X

Volume data supports this accumulation thesis, showing spikes near previous cycle bottoms. These spikes are often interpreted as signs of capitulation or renewed buying interest. The chart includes rectangular markers highlighting historical demand zones where dominance previously reversed upward.

Related: Altcoin Emissions Under Scrutiny as TGE Events Shape Market Behavior

“Bitcoin Season” Is Still in Effect

Van de Poppe’s thesis is supported by another key metric, the CoinMarketCap Altcoin Season Index. The index currently has a reading of 35 out of 100. A score this low signals that it is still very much a “Bitcoin Season,” where the world’s largest crypto is outperforming the majority of altcoins.

Source: CoinMarketCap

Source: CoinMarketCap

A score of 75 is needed to declare an “altcoin season.” The index has fallen from 43 last week and remains far below the peak of 87 seen in December 2024. This confirms that a broad, market-wide rotation into altcoins has not yet begun.

Technical Indicators Signal Lack of Momentum

The Relative Strength Index (RSI) on the Others.D chart is currently hovering around the neutral level of 50. The absence of extreme overbought or oversold readings aligns with the market’s sideways movement and lack of a strong trend signal. No momentum shift has been confirmed.

Volume patterns remain consistent with prior accumulation periods. Increased activity during dominance troughs has previously marked turning points for altcoins, but such confirmation remains absent at this stage.