Chainlink is approaching a crucial $15.5 demand zone where selling pressure may ease, potentially halting the recent 17.2% retracement from $19.5. On-chain data indicates profit-taking is slowing, but a rebound is not guaranteed yet.

-

Chainlink prices have declined 17.2% since late July, mirroring Bitcoin’s 4.9% drop.

-

On-chain metrics such as Dormant Circulation and MVRV ratio signal that the selling wave might be ending.

-

Expert analysis from COINOTAG highlights $15.5 as a key support level reinforced by the 50-day moving average and volume profile data.

Chainlink nears $15.5 demand zone amid easing profit-taking; analyze key on-chain signals and market structure to anticipate LINK’s next move.

Chainlink Faces Critical Demand Zone at $15.5 Amid Price Retracement

Chainlink LINK price has experienced a significant retracement of 17.2% since July 28, falling from $19.5 to near $15.5. This decline coincided with Bitcoin’s price dropping 4.9%, reflecting broader market weakness. However, recent on-chain data suggests that the intense selling pressure may be subsiding, making the $15.5 level a pivotal support zone to watch for potential trend reversal.

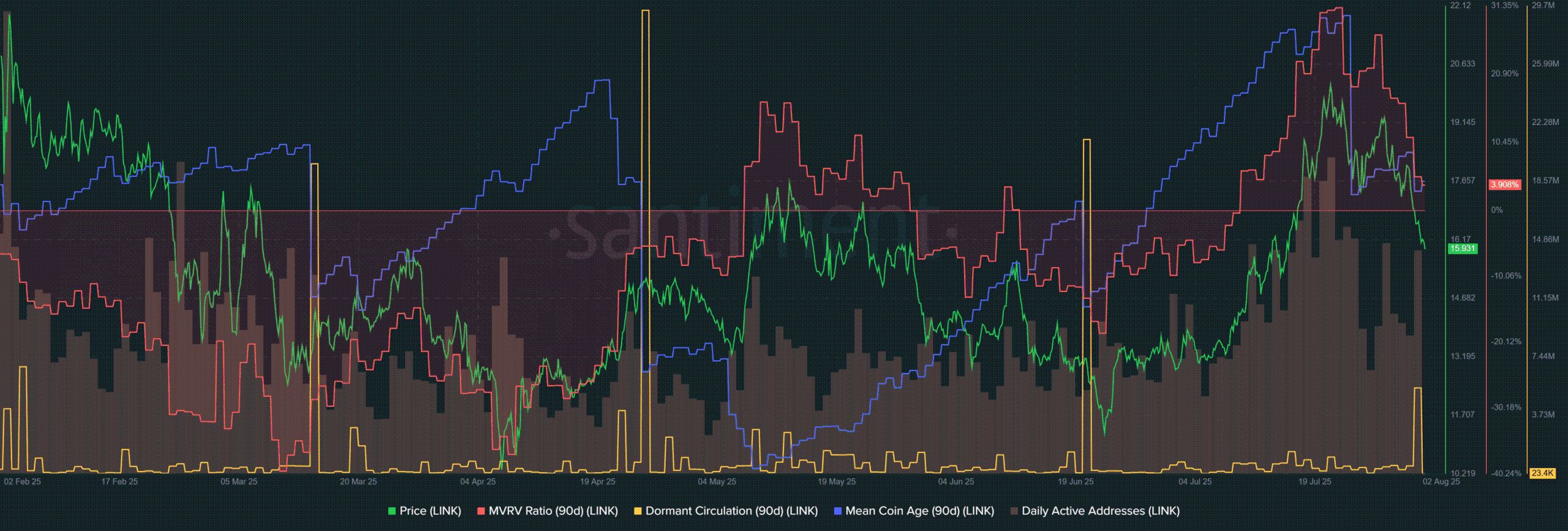

On-Chain Metrics Indicate Distribution Phase May Be Ending

Data from Santiment reveals a spike in Dormant Circulation on August 1, signaling heightened token movement typically associated with profit-taking. This spike corresponded with a 5.08% daily price drop for LINK. Meanwhile, the Mean Coin Age over 90 days has steadily decreased, indicating increased token distribution among holders. The MVRV ratio, which measures market value relative to realized value, has also declined, showing that holders are sitting on fewer profits. These metrics collectively suggest that the recent wave of selling might be reaching exhaustion.

Source: Santiment

What Factors Could Enable Bulls to Regain Control at $15.5?

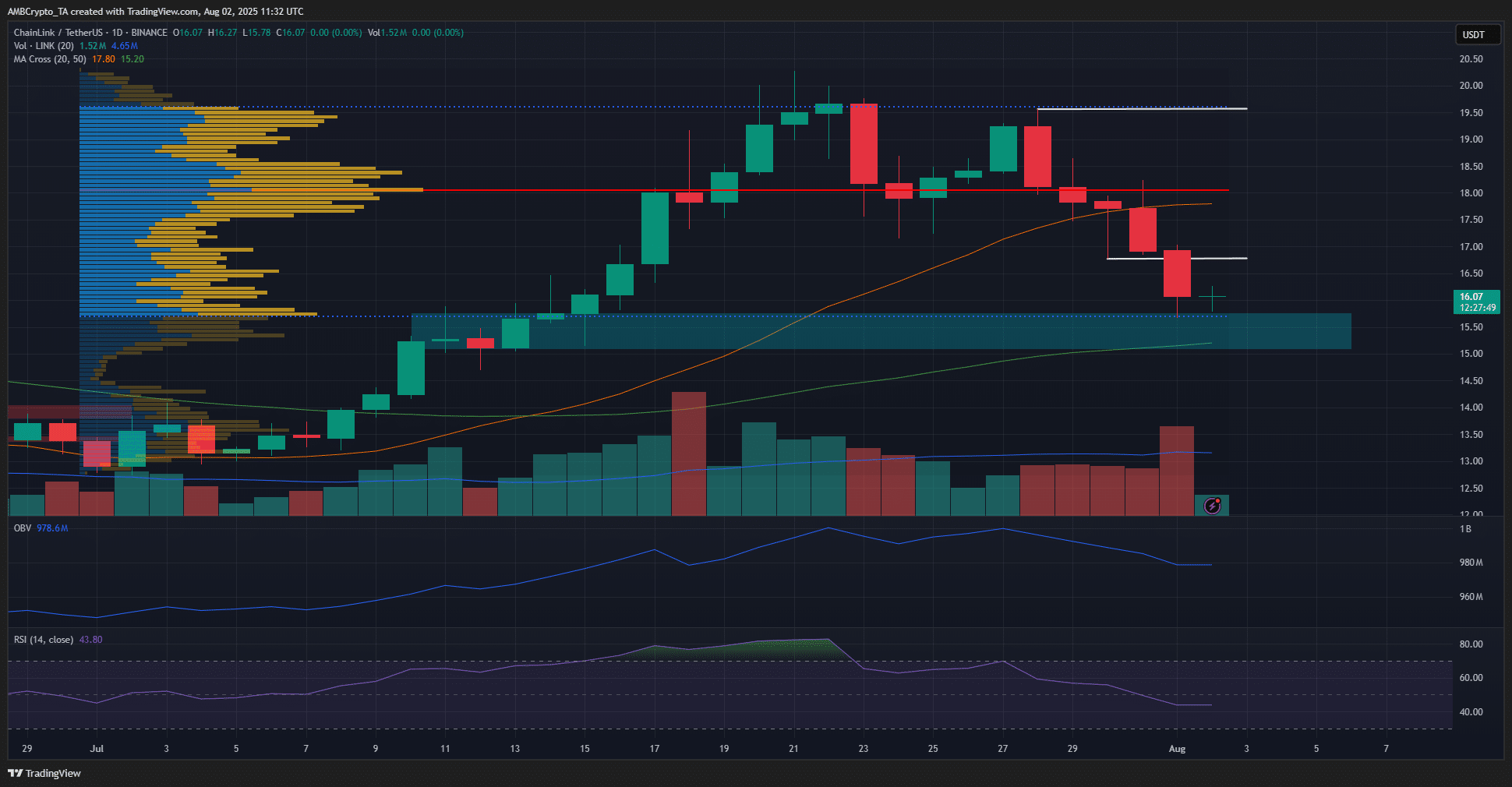

The $15.5 demand zone is critical because it previously acted as a consolidation area in early July before prices surged higher. This level coincides with the 50-day moving average, adding technical significance. The Fixed Range Volume Profile from July shows the Value Area Low near $15.7, indicating strong historical trading activity around this price. For bulls to reclaim control, LINK must hold this zone and show increased buying volume. However, current bearish momentum is evident as the Relative Strength Index (RSI) remains below 50 and the On-Balance Volume (OBV) is declining, signaling sellers’ dominance.

Source: LINK/USDT on TradingView

How Does Bitcoin’s Performance Impact Chainlink’s Price Movement?

Bitcoin’s price trends often influence altcoins like Chainlink. The recent 4.9% drop in Bitcoin from $119.8k to $113.6k coincided with LINK’s sharper decline, highlighting this correlation. Traders monitoring Bitcoin’s recovery or further weakness can gain insights into LINK’s potential price direction. A sustained Bitcoin rally could provide bullish momentum for Chainlink, while continued Bitcoin weakness may prolong LINK’s retracement.

| Chainlink Price Drop | 17.2% | Since July 28 |

| Bitcoin Price Drop | 4.9% | Same Period |

| MVRV Ratio | Approaching 0 | Lower than prior weeks |

Frequently Asked Questions

What are the key support levels for Chainlink in the current market?

The primary support level for Chainlink is the $15.5 demand zone, reinforced by the 50-day moving average and historical volume data. Holding this level is crucial for preventing further declines.

Why is Bitcoin’s price important for Chainlink investors?

Bitcoin’s price movements often set the market tone for altcoins like Chainlink. A Bitcoin rally can boost investor confidence and drive LINK prices higher, while Bitcoin weakness can prolong altcoin retracements.

Key Takeaways

- Chainlink is nearing a critical $15.5 demand zone: This level is supported by technical indicators and past price action.

- Profit-taking activity appears to be slowing: On-chain metrics like Dormant Circulation and MVRV ratio suggest selling pressure is easing.

- Bitcoin’s price movement remains a key factor: LINK’s recovery depends partly on Bitcoin’s market direction.

Conclusion

Chainlink’s recent retracement to the $15.5 demand zone marks a potential turning point, supported by on-chain data signaling reduced selling pressure. While bearish momentum currently dominates, monitoring Bitcoin’s price and key technical levels will be essential for anticipating LINK’s next move. Investors should watch this zone closely as it could define Chainlink’s near-term trend.