Ethereum Holds Steady Amid Market Drop—but $4,500 Remains the Key Reversal Zone

Ethereum is poised for further gains but faces significant resistance at $4,500. Profit-taking by investors could slow its rise, with support at $3,742 offering stability if selling pressure intensifies. Ask ChatGPT Ethereum is poised for further gains but faces significant resistance at $4,500. Profit-taking by investors could slow its rise, with support at $3,742 offering stability if selling pressure intensifies.

Ethereum has seen a period of sideways movement over the last ten days, despite the broader cryptocurrency market experiencing significant price drops.

It has managed to hold steady, a sign of resilience, but ETH still hasn’t reached its absolute reversal point. This point is critical for triggering a broader price shift.

Ethereum Has A Long Way To Go

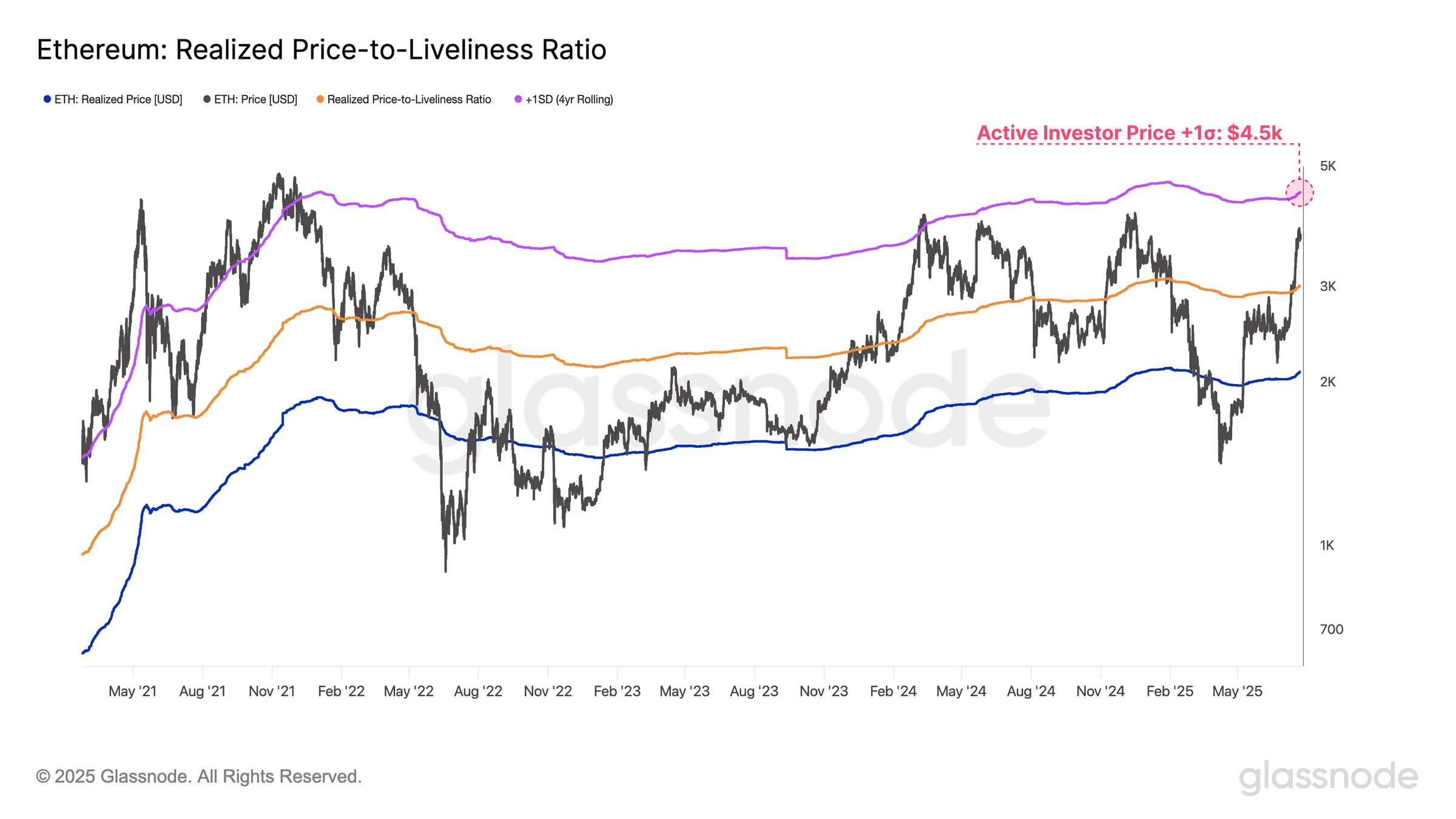

Ethereum’s Realized Price to Liveliness ratio is showing signs of an important threshold for the current rally. The ratio indicates that the current upside resistance for Ethereum is at $4,500, a level that has acted as a significant barrier in past market cycles. Notably, this price point acted as resistance in March 2024 and during the 2020–2021 market cycle.

Historically, breakouts above $4,500 signal market euphoria and an increased risk of structural instability, making it a critical structural pivot for Ethereum. As a result, this price level is not just a resistance but also the potential absolute reversal point for Ethereum.

Ethereum Realized Price to Liveliness. Source:

Ethereum Realized Price to Liveliness. Source:

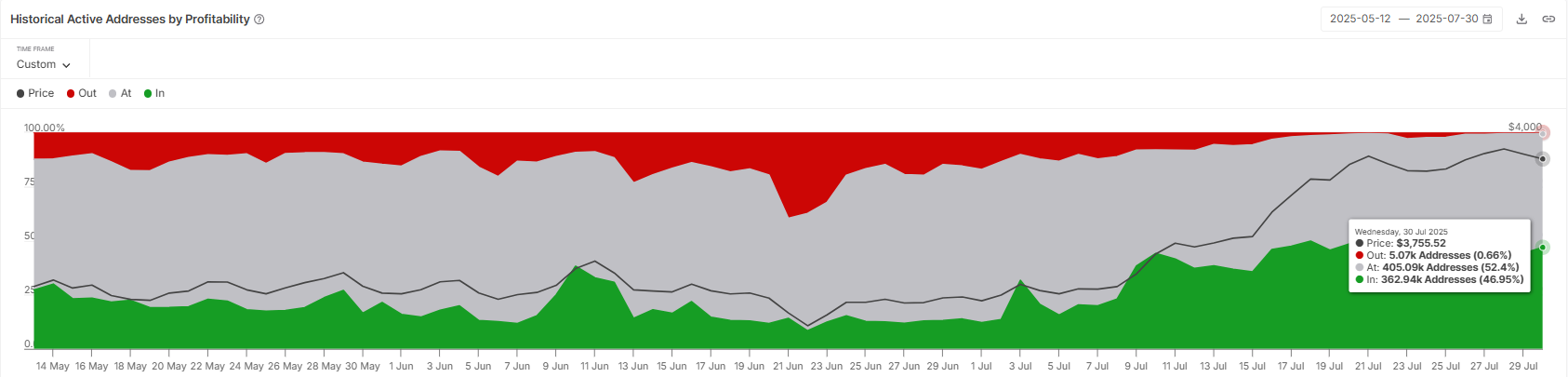

Ethereum’s macro momentum is influenced by the concentration of active addresses. Nearly 47% of these addresses belong to investors who are currently sitting in profit. While this may seem like a positive sign, it raises concerns in the short term.

Investors in profit are more likely to book their gains, which could lead to increased selling pressure on Ethereum. This could slow down Ethereum’s potential rise, preventing the altcoin from experiencing significant gains in the near future.

Ethereum Active Addresses By Profitability. Source:

Ethereum Active Addresses By Profitability. Source:

ETH Price Is Holding Above Support

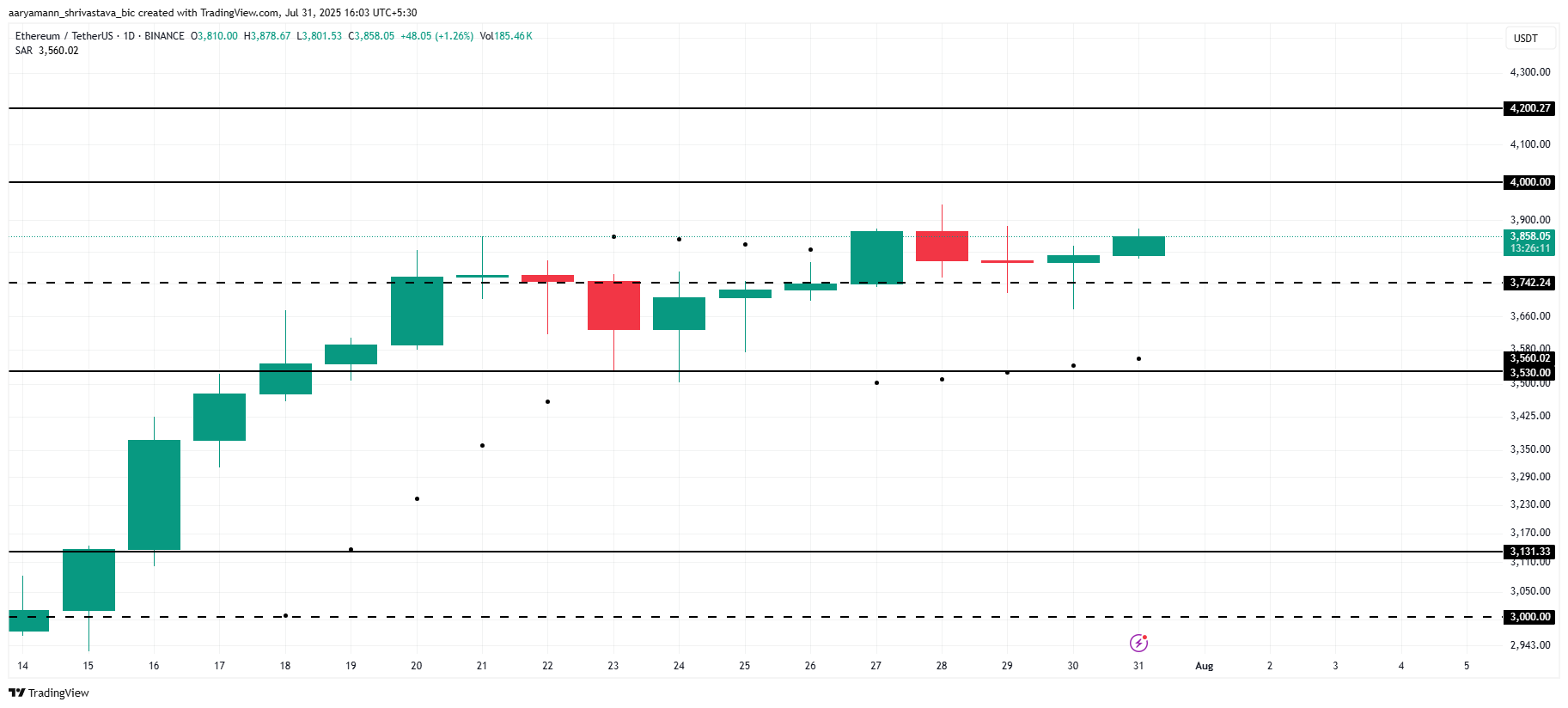

Ethereum is currently trading at $3,858, sitting comfortably above the local support level of $3,742. The Parabolic SAR indicator is positioned below the candlesticks, signaling an active uptrend.

This suggests that Ethereum is showing a moderately bullish trend at the moment, with the potential to rise further. Given the current market sentiment and price action, Ethereum could move towards the $4,000 level, with the potential to flip it into support and push higher to $4,200 in the near future.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

However, there’s a caveat. Should Ethereum experience intensified selling pressure, driven by investor profit-taking or broader market conditions, the price could slip down to the $3,530 support level. If Ethereum falls below this crucial support, it would invalidate the bullish thesis and indicate a reversal in market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens