White House Pushes to Expand PATRIOT Act to Include DeFi and Toughens Stance on Crypto Privacy

A new White House report on digital assets generated strong reactions from the Crypto community on Wednesday (31), suggesting significant changes in the regulatory treatment of services defi, with emphasis on reinforcing the fight against money laundering based on the Patriot law. The analyzes of experts such as Eleanor Terrett and the commentator known as Lola, published in X (former Twitter), detail the implications of these proposals.

Eleanor Terrett highlighted Lola's analysis as "frank and direct," drawing attention to the White House's proposal to modernize the Bank Secrecy Act (BSA) to adapt it to the realities of blockchain technology. According to Terrett, this modernization is a demand both from the White House and from industry sectors, which are now asking Congress for concrete action.

⬇️ Lola with the candid, between-the-lines analysis on what's inside the White House crypto report pertaining to the treatment of DeFi and why amending/modernizing the BSA to consider blockchain technology is something the White House, and many in the industry, are urging… https://t.co/Im788Vrwm3

—Eleanor Terrett (@EleanorTerrett) July 31, 2025

Lola, in turn, gave a blunt reading of the digital asset report released by the Biden administration. “If you still believe that the Trump White House is in Qualquer "If you don't have a friendly capacity for these ventures, you're in for a rude awakening," he wrote. The criticism was made in reference to the expectation that a possible return of Donald Trump to power would bring regulatory relief to the sector, especially after the arrest of the developers of Samourai Wallet.

According to Lola, the report explicitly calls for FinCEN to classify as “primary money laundering concerns” common practices in cryptocurrencies such as:

-

use of single-use addresses, wallets and accounts;

-

exchange between networks and chains;

-

use of mixers;

-

aggregation of funds from multiple portfolios.

While the document also reinforces the importance of protecting self-custody, the White House links this protection to the existence of legal asset exchange mechanisms. To ensure regulatory compliance in the DeFi sector, the most controversial suggestion is the implementation of digital identities, linking transaction history to the user name.

"Even using ZKProofs, as the White House suggests, would turn a permissionless system into a permissioned system," Lola warned. She closes with a stark warning to the community: "Sometimes the things that shine are just a bunch of shit, my friends."

The proposal for expanding the PATRIOT Act and BSA to include DeFi services raises concerns about the boundaries between privacy, security, and digital surveillance — reigniting a crucial debate about the future of decentralized finance in the United States.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

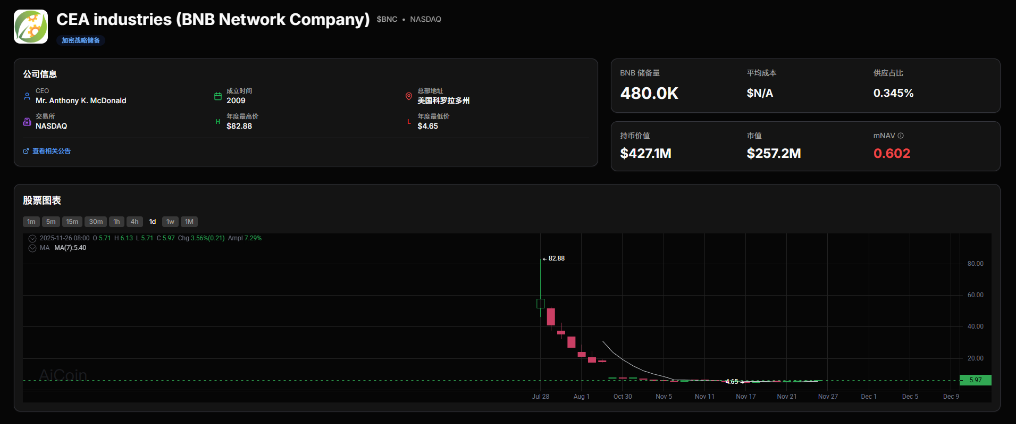

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage