Dow Jones drops as tariff fears outshine tech earnings, Nasdaq breaks records

Strong tech earnings balanced ongoing fears over trade as Trump’s tariff deadline looms.

- Nasdaq hits record on Meta and Microsoft earnings.

- Key tariff deadline approaches for major U.S. trading partners.

- Apple’s upcoming earnings will reveal the real impact of tariffs.

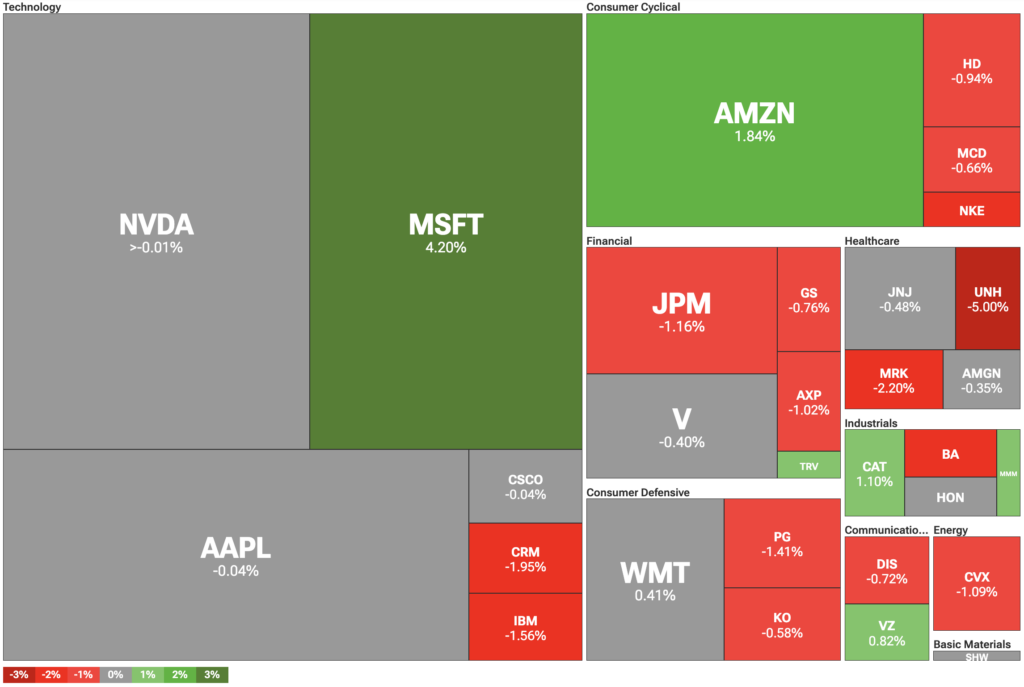

U.S. stock indices rose as strong tech earnings offset concerns about the approaching tariff deadline. On Thursday, July 31, the Dow Jones slipped 0.19% due to losses in financial and consumer defensive companies. Meanwhile, the S&P 500 gained 0.10%, and the Nasdaq reached a record high with a 0.45% increase.

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Markets were focused on tech earnings, particularly Microsoft and Meta , which reported strong quarterly results. After the announcements, Microsoft rose 9% and Meta gained 12%. Traders are now awaiting Apple’s earnings, scheduled after the market close on Thursday.

Apple’s report is critical because of the company’s globally distributed manufacturing. It will help gauge the effect of President Donald Trump’s tariffs on U.S. businesses, especially after Trump threatened a 25% tariff on iPhones if the company does not move production to the U.S.

Trump tariff deadline looms, as Mexico gets relief

On July 31, the White House extended the tariff deadline for Mexico by 90 days, giving the two countries more time to negotiate. Trump said he had a “very successful” conversation with Mexican President Claudia Sheinbaum and highlighted the unique relationship between the two nations.

For the U.S., Mexico is a key trading partner and a major recipient of American investment. Punitive tariffs could place U.S. companies with production in Mexico in a difficult position and significantly impact U.S. consumers.

Still, several other major U.S. trading partners, including Canada, India, and Brazil, still face increased tariffs starting on August 1. Still, White House aides stated that negotiations would continue even after that date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand