Crypto’s Golden Age Starts But Altseason Falters: Here’s Why

The wider altcoin market, led by Ethereum, has so far failed to fully take off, with key market cap charts trapped below major resistance levels.

According to crypto analyst Dan Gambardello, the altcoin market remains in a “consolidation choppy mode” despite what should be a crypto “golden age” backed by policy recommendations from President Donald Trump’s working group.

The TOTAL3 market cap, which is a key chart to watch as it excludes both Bitcoin and ETH, has failed to rally above the crucial $1 trillion resistance level so far this year. At the same time, the TOTAL2 chart, which excludes only Bitcoin, has also failed to break its all-time high of around $1.65 trillion.

Related: Billions in Institutional Money Bets Ethereum to Break $4,000 This Time

Analysts’ Take on Altseason 2025

Gambardello notes that unless the Ethereum price can consistently close above the key $4,000 resistance, a retrace back towards the $2,900 to $3,500 support range is a real possibility in the short term.

Crypto’s GOLDEN AGE Begins! ALTCOINS TRAPPED! (Here's Why)

— Dan Gambardello (@cryptorecruitr) July 30, 2025

Intro 00:00

Altcoin manipulation 1:20

Digital Asset Report 3:10

Altcoin compression 4:45

Ethereum and altcoin price action 6:40 pic.twitter.com/Bo6wZfLFuh

However, he also highlighted that the monthly MACD for the altcoin market has flashed a major buy signal, suggesting the long-term outlook remains incredibly bullish.

According to crypto analyst Benjamin Cowen, Ethereum price is ready to break through $4.1k after dropping below $2k during the first half of 2025. Dan noted that the macro bullish outlook for altcoins is backed by the consolidation of the TOTAL2 at the resistance level around $1.45 trillion.

From a technical analysis standpoint, Dan highlighted that the parabolic altseason 2025 will be confirmed after the monthly Relative Strength Index (RSI) of the TOTAL2 breaks above the established falling logarithmic trend.

Related: Don’t Panic Sell Your Altcoins. Here’s What the Monthly Chart Shows

Additionally, the crypto analyst highlighted that the monthly MACD indicator has flashed a buy signal after the bullish histogram amid a rallying signal and MACD lines above the zero line.

Investors Prepare for Altcoins’ Euphoric Ride

The demand for altcoins by institutional investors has experienced a sharp uptick in the past few weeks. More publicly traded companies have been raising funds to implement altcoin treasuries, led by Ethereum, Solana, Tron, and BNB coins.

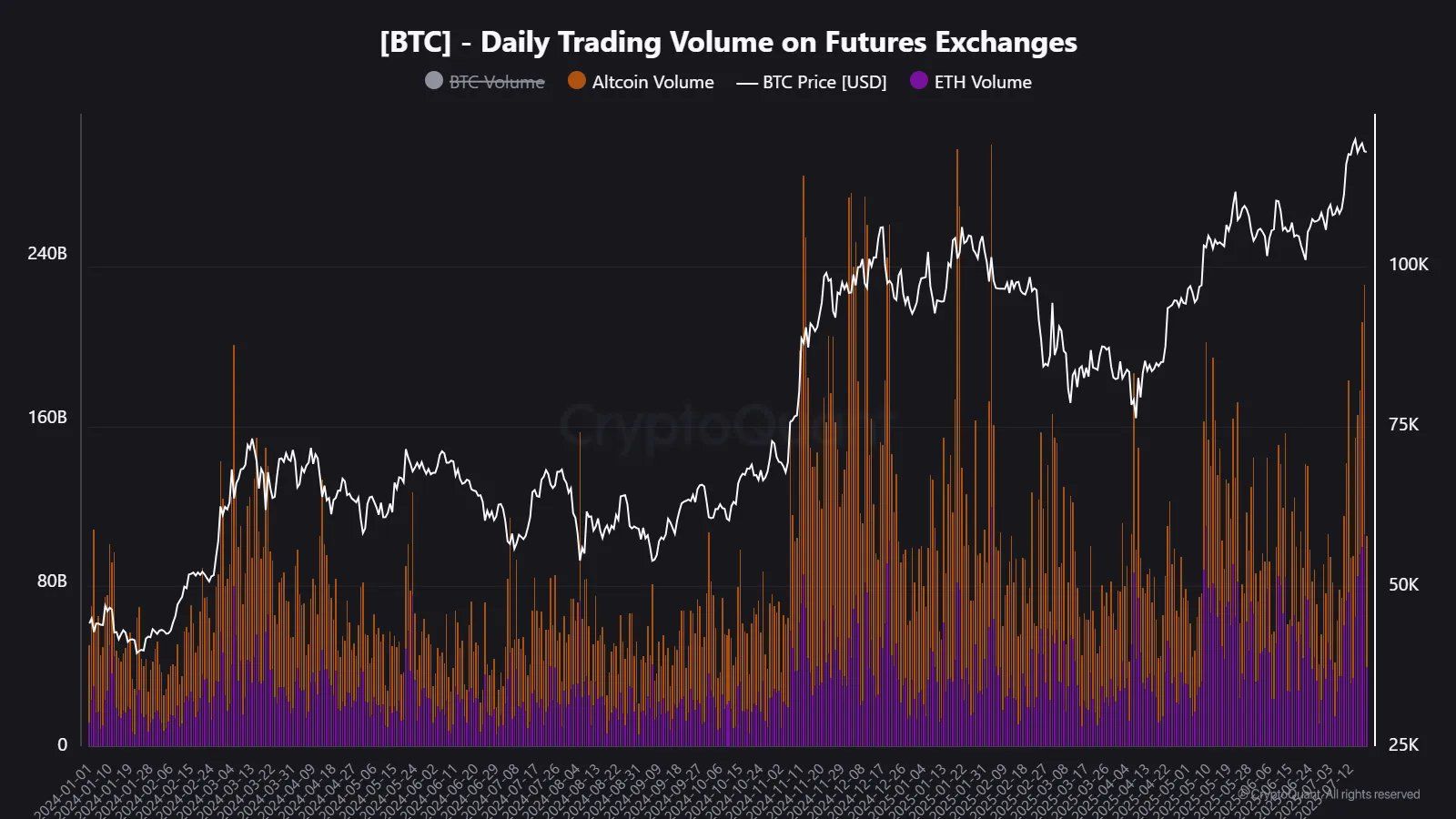

On-chain data analysis from CryptoQuant has hinted at a potential altcoin breakout in the near term. Furthermore, the altcoins futures volume has surged to $223.6 billion, a 5-month high, amid renewed demand from retail investors.

According to on-chain data analysis from CoinShares, Ethereum’s investment products recorded a net cash inflow of $1.59 billion last week compared to Bitcoin’s $175 million. Meanwhile, Ripple’s XRP and Solana recorded a net cash inflow of about $189 million and $311 million respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Weekly Report | Polkadot Hub launches user growth plan! Hydration TVL surpasses $250 millions!

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.