FaZe crypto drama deepens as leaked chats expose backdoor dealings

Leaked messages show FaZe Banks pressuring the MLG team into giving him preferential treatment.

- Influencer Ricky “Faze” Banks is accused of dumping MLG token.

- Leaked texts show him pressuring the team.

- MLG token is down 93% since ATH.

The FaZe Banks crypto pump-and-dump controversy is once again heating up. On Wednesday, July 31, leaked texts appeared that appear to show Ricky Bengston, also known as FaZe Banks, pressured the MLG team into giving him preferential treatment.

Messages show FaZe Banks asking to buy large amounts of tokens over the counter, alongside influencer Aydin Ross and another investor. He also explicitly stated that he was not interested in buying at the current market price, instead asking for a special discount. After the founder refused, he threatened to stop promoting the token.

The texts also revealed that FaZe held 0.6% of the token supply and wanted to accumulate at least 1%. This conflicts with his earlier public statements that MLG was a passion project and that he did not receive any compensation from the team.

FaZe Banks’ apparent intention was to buy large amounts of tokens without moving the market, all while continuing to promote the token to his audience. This strategy aligns with a classic “pump-and-dump” scheme, suggesting that FaZe Banks intended to pull the rug on his followers.

MLG token dump costs users up to $150m

The controversy stems from FaZe Banks’ promotion of 360noscope420blazeit (MLG) memecoin in October 2024. His tweets sent the token skyrocketing to more than $150 million in market cap before collapsing to just $10 million.

MLG memecoin, based on gaming culture, partnered with influencers such as FaZe Banks and Aydin Ross, both popular among gamers. The memecoin appealed specifically to their audience, who saw it as a nod to gaming nostalgia. On July 28, following public scrutiny over his role in the MLG crash, FaZe Banks stepped down as CEO of FaZe Clan gaming.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

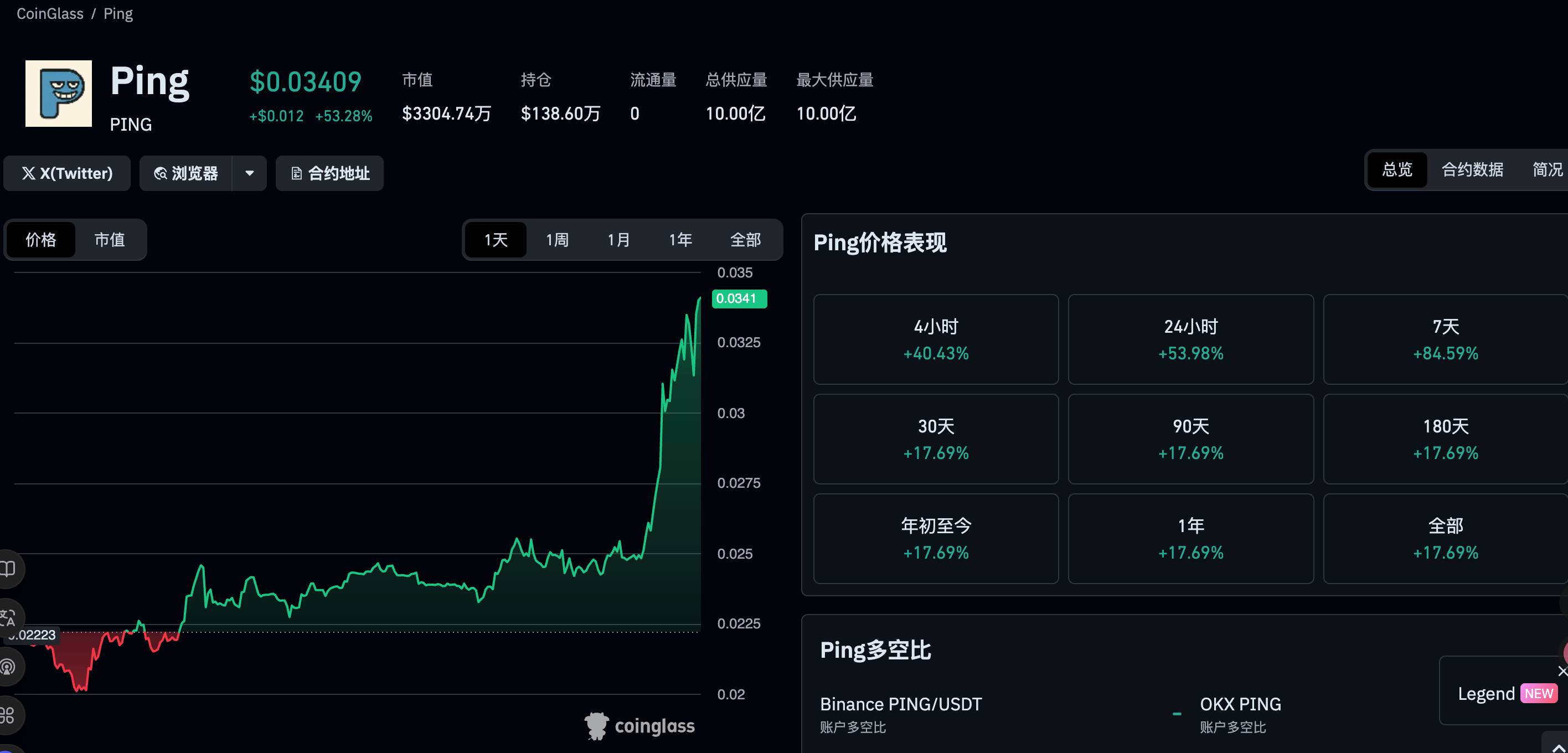

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

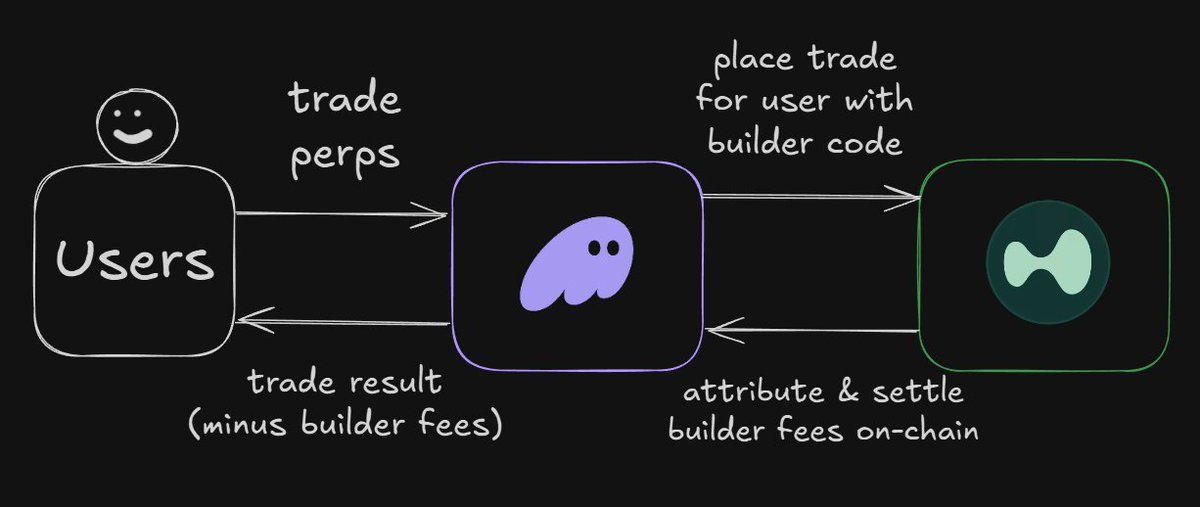

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

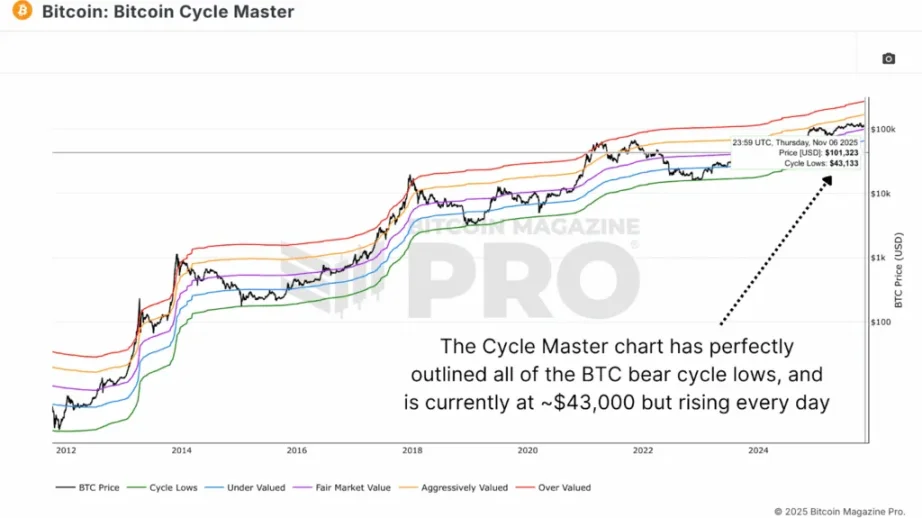

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.