CryptoQuant: Increased Trading Activity in Ethereum and Altcoins

According to a report by Jinse Finance, data from CryptoQuant shows that after Bitcoin's price surpassed $120,000, there has been a significant shift in the cryptocurrency market landscape. The data indicates that Ethereum's price has surged 170% from its recent low, now just 23% away from its all-time high of $4,871. One of the main drivers behind this rally is SharpLink's $1.3 billion investment to acquire 438,190 ETH. In the cryptocurrency derivatives market, trading volume for altcoin and Ethereum futures contracts has reached $22.36 billion, marking a five-month high. Notably, on centralized exchanges, altcoin and Ethereum futures trading now accounts for 83% of the total volume, while Bitcoin futures make up only 17%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETFs hold over 24.2 million SOL, worth approximately $3.44 billion.

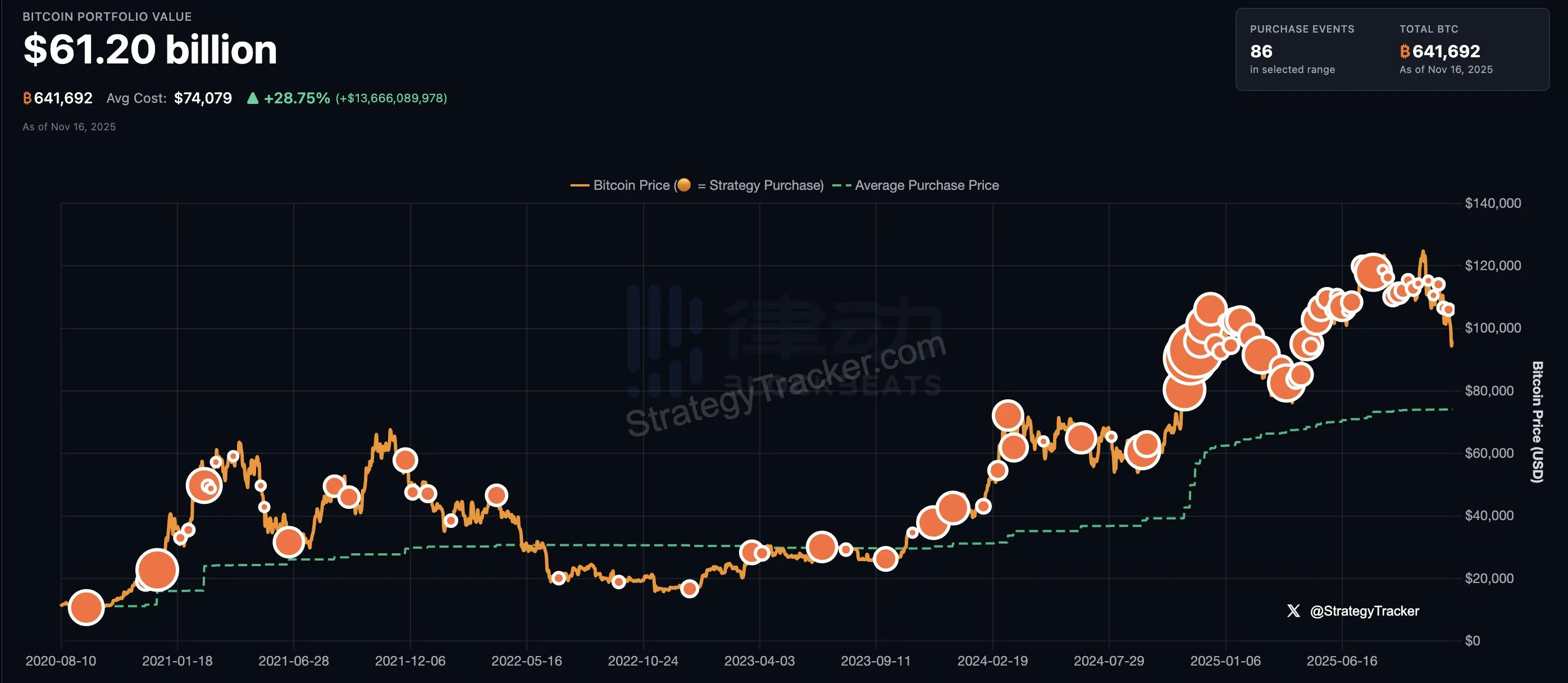

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase