Bank of America Issues Warning, Says Bond Market Looking at ‘Dissapointing’ FOMC Meeting – Here’s Why

A top Bank of America executive is warning that today’s upcoming decision on interest rates from the Federal Open Market Committee (FOMC) will likely result in disappointment among bond investors.

In a new interview with CNBC, BofA Securities’ head of U.S. rates strategy, Mark Cabana, says that while much of the market is eager to see a rate cut from the Fed, he expects a continued pause, with little to no new guidance from Chair Jerome Powell.

A prolonged pause on rate cuts may hit the bond market harder than expected, according to Cabana.

“We expect the Fed to keep rates on hold, we expect fairly limited forward guidance from Chair Powell. We think he’s going to retain a data-dependent, ‘wait and see’ type of approach. And we do think this is going to be a bit disappointing to at least what the bond market is expecting. Because the bond market is pricing in better-than-even odds that the Fed will be cutting in September, we just don’t think that we’re going to necessarily get the signal from Powell today.”

The analyst also believes that certain FOMC members will begin to dissent from the consensus, pushing for rate cuts sooner than the majority anticipates.

President Trump has repeatedly called for the Federal Reserve to cut rates, referring to Chair Powell as being “too late,” and floating the idea of removing him.

However, BofA’s Cabana says the bank is confident there will be no cuts at all for the remainder of 2025, especially given how hot most markets are.

“Our economists have had a great call, they don’t think that the Fed will be cutting at all in 2025, so that’s almost 45 basis points that are priced in for the year that could potentially come out…

How restrictive is monetary policy today? I think it’s a very good question, but if you look at equity markets, I think they’re telling you that it’s not terribly restrictive. If you look at the dollar, it’s not telling you it’s terribly restrictive; if you look at the labor market, it’s not telling you that it’s terribly restrictive.”

Featured Image: Shutterstock/Salamahin/Paul Fleet

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

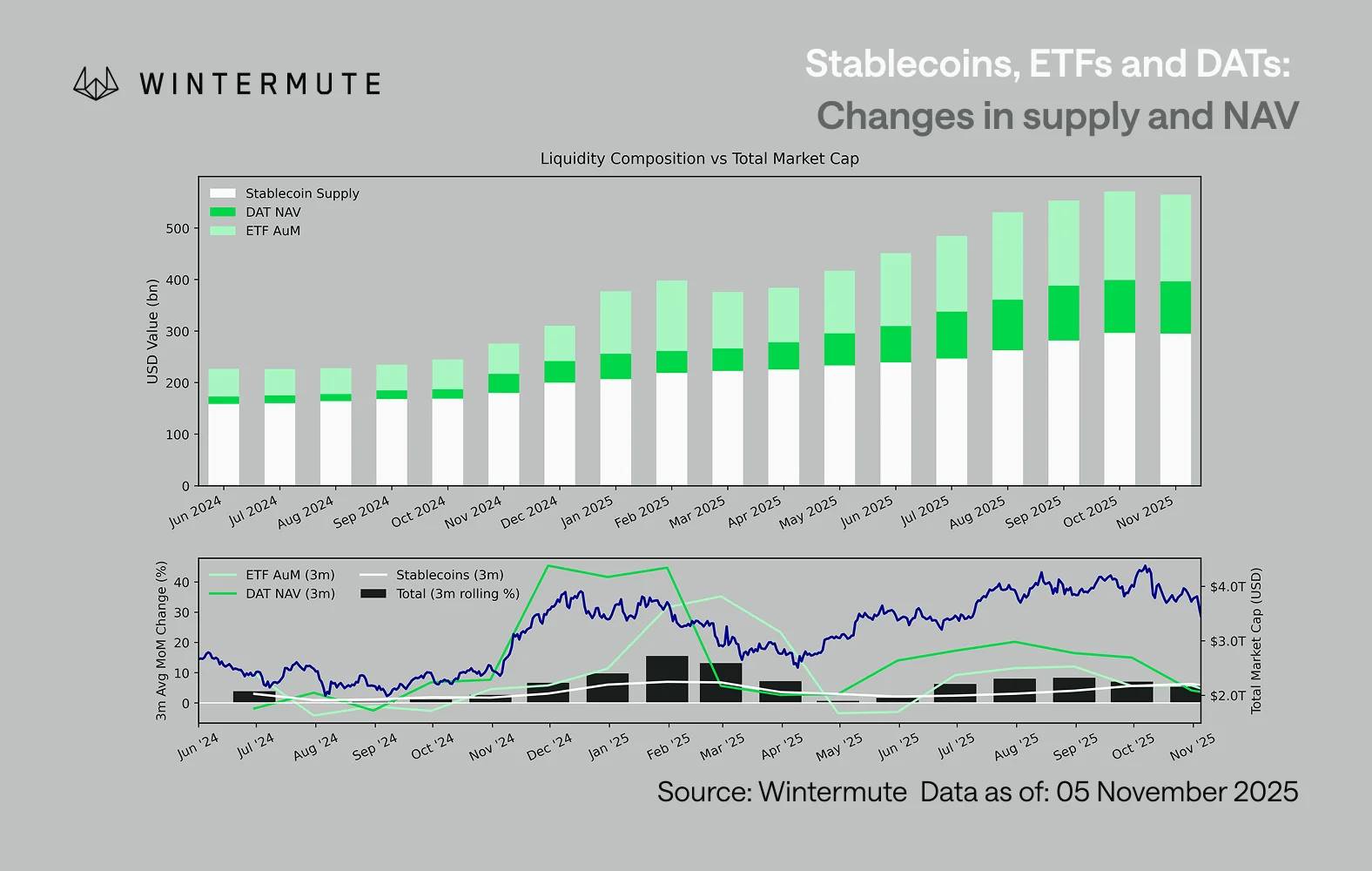

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.