SharpLink Acquires Over 438,000 ETH for Treasury Reserve

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- SharpLink shifts focus to Ethereum reserve strategy.

- Potential increase in Ethereum institutional interest expected.

SharpLink Gaming, Inc., recently announced it holds approximately 438,190 ETH following leadership changes and treasury expansion.

This move positions SharpLink as a leading Ethereum corporate holder, indicating growing institutional acceptance of Ethereum.

SharpLink’s Ethereum Strategy

SharpLink Gaming Inc., known as the “Ethereum version of MicroStrategy,” has confirmed its holding of 438,190 ETH as of July 27, 2025. This significant acquisition followed notable treasury activity and executive changes. Joseph Chalom appointment as Co-CEO marked a pivotal move.

Joseph Chalom, formerly with BlackRock, joined SharpLink as Co-CEO on July 24, 2025. SharpLink now positions Ethereum as its primary treasury reserve asset, enhancing its corporate strategy. The firm’s actions underscore a broader acceptance of ETH in corporate treasury management.

The acquisition of 77,209.58 ETH, valued at an average of $3,756 per ETH, reflects a strategic move to strengthen SharpLink’s treasury . This resulted in a 21% increase in ETH holdings. The market observes SharpLink’s strategy as a significant milestone for Ethereum.

With the $279.2 million raised from its ATM equity facility, SharpLink’s financial maneuver indicates a proactive approach to leveraging ETH’s potential. No immediate regulatory responses have been documented from agencies like the SEC regarding this activity.

ETH-related markets may experience increased interest due to SharpLink’s treasury strategy, highlighting a shift toward Ethereum as a corporate asset. Sectors closely tied to ETH, such as DeFi governance tokens, could be indirectly influenced.

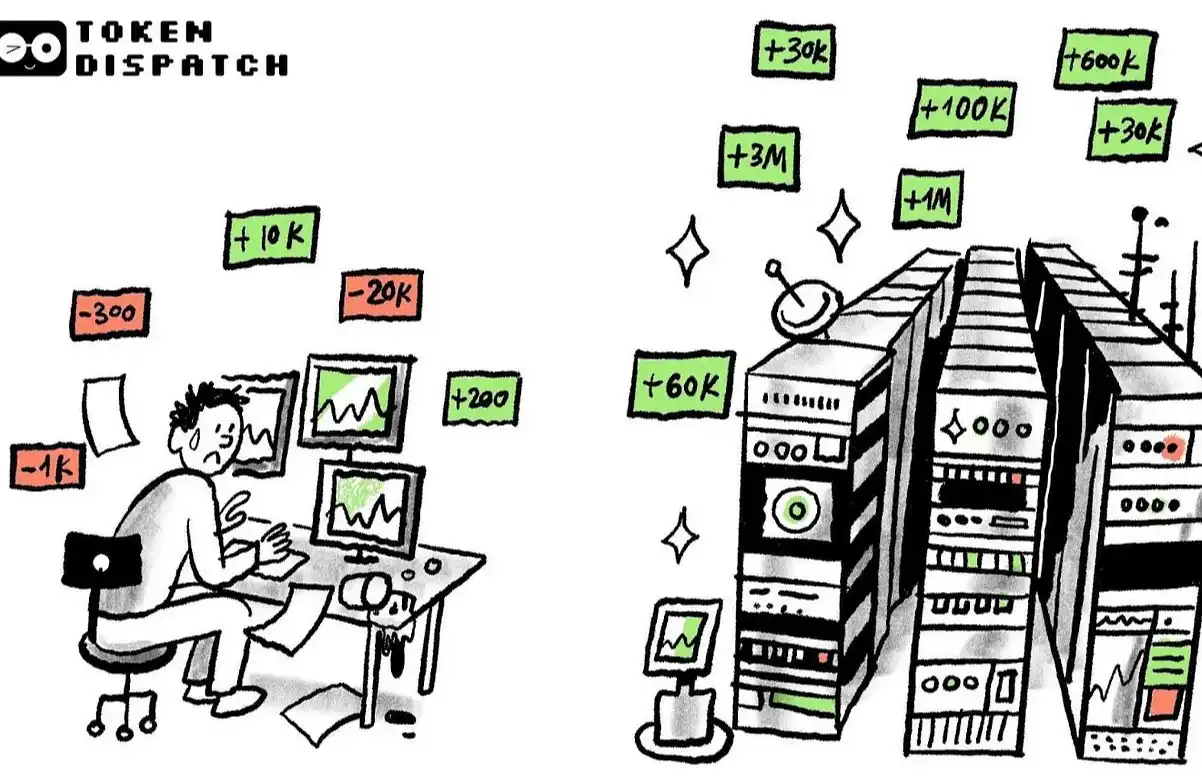

SharpLink’s actions parallel MicroStrategy’s Bitcoin strategy, illustrating a potential pathway for Ethereum’s acceptance in institutional portfolios. The lack of regulation-oriented reactions suggests a potentially unchanged regulatory environment, maintaining the focus on corporate strategies aligning with blockchain technology advancements.

“As recently announced, former BlackRock digital asset pioneer, Joseph Chalom, joined as Co-CEO effective July 24, 2025, signaling the company’s commitment to expanding its presence in the Ethereum ecosystem.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto treasury stocks plunging in August after massive run-up

Share link:In this post: Crypto treasury stocks fell sharply in August after major summer gains. Ethzilla led the sector with a 114% rise, while others like Strategy dropped 16%. Companies backed by Tom Lee and Peter Thiel held up better than others.

OpenAI mulls new revenue from AI infrastructure

Share link:In this post: OpenAI is considering leasing out its AI-ready data centers and infrastructure in the future. The plan mirrors Amazon Web Services, which turned excess computing into a trillion-dollar business. OpenAI is exploring new financial instruments beyond debt to fund large-scale projects.

Interpreting Galaxy Q2 Financial Report: Hundred Billion Revenue but Unprofitable, Transforming into AI "Gold Mining"

Galaxy's cryptocurrency trading business generated $8.7 billion in revenue, but only brought in $13 million in profit (a profit margin of only 0.15%).

ETH futures data reflects traders’ fear, while onchain data points to a price recovery