StanChart predicts corporates will control 10% of Ethereum supply over time

A new report by Standard Chartered identifies publicly traded Ethereum (ETH) treasury companies as a distinct and rapidly evolving asset class, separate from exchange-traded funds (ETFs) and traditional crypto investment vehicles.

According to the report, these firms are not holding ETH for speculative purposes. Instead, they are positioning their balance sheets around staking yields, DeFi integrations, and equity market conditions that enable them to trade at premiums relative to their ETH holdings.

This gives investors regulated exposure to Ethereum, along with yield and leverage strategies unavailable to spot Ethereum ETFs.

Standard Chartered highlighted that these companies benefit from a structural edge over U.S.-regulated ETFs, which are prohibited from staking.

Many of the treasury firms have staked the majority of their ETH, raised capital through private placements or convertible debt, and deployed assets into on-chain protocols to generate additional returns.

According to the report, these companies are exploiting regulatory inefficiencies and retail limitations. As a result, they often trade above net asset value, serving as de facto ETH ETFs with built-in yield, operational flexibility, and balance sheet leverage.

BitMine Immersion Technologies leads the cohort, holding approximately 0.5% of Ethereum’s circulating supply and targeting a 10x increase in the future.

Other firms, including SharpLink Gaming, have raised hundreds of millions in ETH-focused funding rounds and launched staking-driven treasury strategies. The gaming-focused firm’s ETH holdings recently overtook the Ethereum Foundation.

Standard Chartered documented a broad industry shift, with companies in biotechnology, energy, and semiconductors repurposing operations to adopt ETH treasury strategies. Moss Genomics, Centaurus Energy, and IntChains Group were cited as examples of this cross-sector trend.

The report projected that if current trends persist, treasury companies could eventually control up to 10% of the ETH supply. This would represent a 10x increase from current levels and solidify Ethereum’s role in corporate capital allocation strategies.

Standard Chartered framed Ethereum treasuries as an emerging counterpart to ETFs, but with distinct structural advantages: staking income, composability, and strategic equity optionality in public markets.

The report emphasized that this is not simply a replay of the Bitcoin (BTC) corporate treasury model, but rather a new class of digital asset strategy driven by Ethereum’s programmability and yield mechanics.

If institutional demand continues alongside favorable regulatory conditions, ETH treasury firms could become a long-term fixture in the crypto-financial ecosystem.

The post StanChart predicts corporates will control 10% of Ethereum supply over time appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

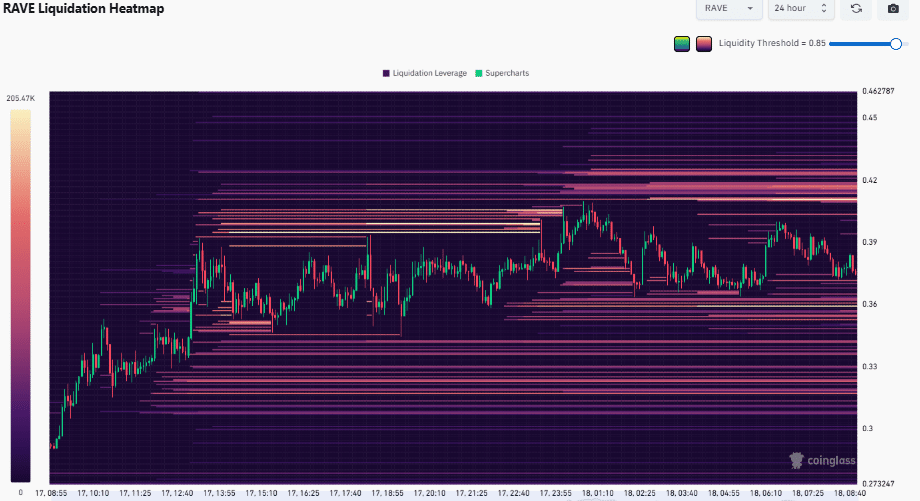

RAVE rallies 29%, but is the post-launch correction already over?

Stability World AI and Cache Wallet Collaborate to Redefine Asset Recovery and Digital Ownership

Solana, Aptos Move to Harden Blockchains Against Future Quantum Attacks

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence