Bros who tricked MEV bots with their own medicine must face trial, says judge

Two MIT-educated brothers have failed to get fraud charges dismissed in court in connection with a $25 million cryptocurrency theft from the Ethereum blockchain.

US District Judge Jessica Clarke denied a motion to dismiss by Anton and James Peraire-Bueno on Wednesday, stating the government adequately alleged their conduct met the criteria for fraud.

The federal government charged the pair in May 2024 with executing a fraudulent scheme, whereby they exploited a vulnerability on the Ethereum network to steal $25 million of cryptocurrency from “victim traders.”

“Taking the government’s allegations as true, which the court must do at this stage, the wire fraud statute provided defendants with adequate notice that their alleged conduct was criminal, despite any novel means used by defendants,” she said.

The brothers executed a first-of-its-kind exploit, netting the haul in just 12 seconds by allegedly using their computer science expertise to manipulate automated trading ( MEV ) bots by luring them into trades and interfering with the validation process.

MEV bot manipulation

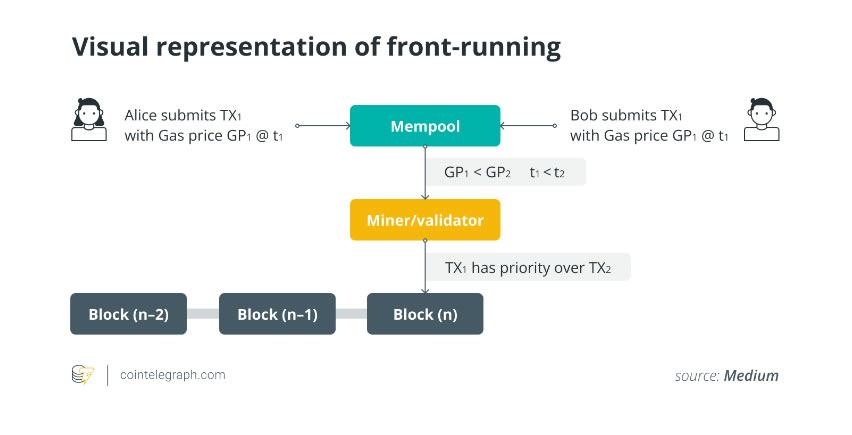

MEV (maximal extractable value) bots are designed to front-run transactions in order to profit from higher fees for priority transactions.

Visual representation of front-running. Source: Cointelegraph

Visual representation of front-running. Source: Cointelegraph

According to the indictment, MEV bots also scan the mempool for “profitable arbitrage opportunities” by exploiting price differences or predictable price movements based on pending transactions they can see in the mempool.

It also detailed how the brothers created a detailed four-step plan, “bait, block, search, and propagation,” and established 16 Ethereum validators using 529.5 ETH to execute the scheme using “lure transactions” to attract the bots.

Counterarguments by the brothers

The brothers argued that the wire fraud statute did not provide fair notice that their conduct was criminal since their actions were “permitted by the system’s code.”

They also claimed that they were unfairly targeted when their victims’ trading bots allegedly engaged in manipulative trading themselves.

The prosecutors dropped one charge of conspiracy to receive stolen property after the brothers cited a Department of Justice memo about avoiding regulatory overreach on digital assets.

Pre-trial motions phase continues

In an August 2024 hearing, Judge Clarke ordered that Anton Peraire-Bueno and James Peraire-Bueno would stand trial in October 2025.

That trial still stands now that the motion to dismiss has been denied, though the date was not confirmed in the ruling and the case is still in pre-trial motions phase.

The pair face charges of wire fraud, conspiracy to commit wire fraud and conspiracy to commit money laundering. Federal wire fraud and money laundering charges typically carry significant prison sentences and fines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jito Foundation Returns to US: A Hopeful Signal for Crypto’s Regulatory Future

Revolutionary XRP Algorithmic Trading Service Launches for Accredited Investors