Circle and FIS join forces to integrate USDC payment into banks

Fidelity National Information Services is partnering with global stablecoin issuer Circle to bring stablecoin adoption into banking infrastructures. What will the partnership entail for customers?

- Fidelity National Information Services is partnering with Circle to offer services to banks interesting in facilitating stablecoin transactions.

- Circle has collaborated with a number of payment institutions to bring stablecoins into the traditional finance fold.

On July 29, the two companies declared the collaboration aims to help financial institutions, particularly U.S. banks, to facilitate transactions for customers using USDC ( USDC ). Once established, banks will be able to facilitate domestic and cross-border payments in stablecoin .

According to a recent report by Bloomberg, the joint stablecoin service is scheduled to go live by the end of this year. The unified service would enable customers to make local and international transactions in USDC through FIS-supported banks.

On one hand, financial institutions that use Fidelity National Information Services’ financial technology solutions will be granted the ability to jump on the stablecoin bandwagon, as the digital asset type continues to dominate the U.S. and many other regions, following regulator changes like the GENIUS Act from the Trump Administration and the Stablecoin Ordinance in Hong Kong .

On the other hand, the partnership will provide a wider channel of distribution for USDC, linking it to thousands of financial institutions that use FIS’ financial technology. According to the latest data from FIS Global, the company processes around $10 trillion in transaction volume per year.

Global head of corporate strategy at FIS’ Jacksonville office, Himal Makwana, said in an interview with Bloomberg that he considers stablecoins as a much more mature and grounded form of payment that can “actually solve client-end problems.”

“This time its no longer a fringe thing, it’s becoming foundational to all parts of financial services,” said Makwana.

Circle’s growth in the banking industry

Aside from FIS, other financial institutions have been eyeing partnerships with Circle in a bid to start integrating the USD-backed stablecoin into banking institutions. Such efforts continue to bridge the gap between decentralized and traditional finance.

According to the report , the global financial services company Fiserv has also expressed interest in collaborating with Circle Internet Group Inc. to develop products for financial institutions and merchants. This follows the firm announcing plans to launch its own stablecoin, FIUSD.

Last June, Circle announced a partnership with financial infrastructure provider OpenPayd to build a joint-platform for managing fiat and stablecoin transactions. The partnership would allow clients to send and manage money worldwide using both traditional banks and blockchain networks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

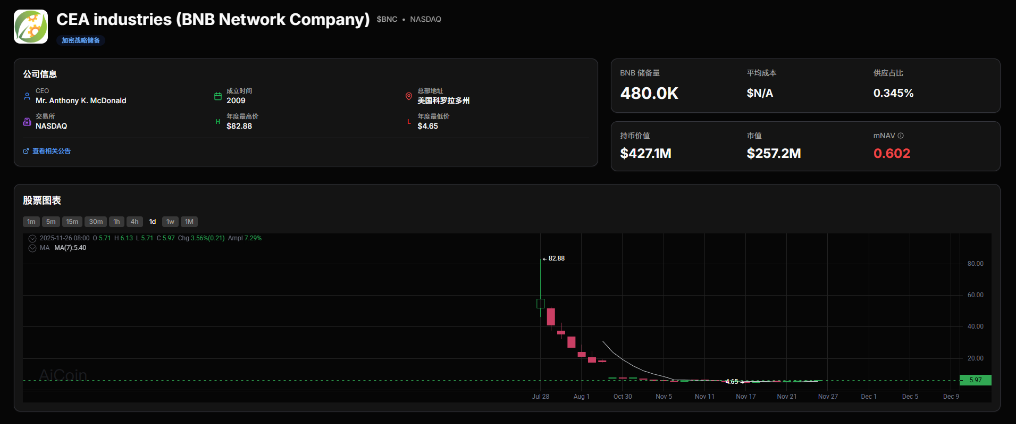

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage