Billionaire investor Ray Dalio recommends 15% allocation in long-term assets like bitcoin and gold

Quick Take The billionaire founder of Bridgewater Associates recommended that a risk-adjusted portfolio allocate 15% to gold or bitcoin in an appearance on CNBC’s Master Investor Podcast on Sunday.

Ray Dalio, billionaire founder of Bridgewater Associates, gave a soft recommendation for investors to keep 15% of their money in bitcoin in an appearance on CNBC’s Master Investor Podcast on Sunday.

"If … you were optimizing your portfolio for the best return-to-risk ratio, you would have about 15% of your money in gold or bitcoin," said Dalio, who earned his fame as an investor for managing what was for many years the world’s largest hedge fund. "I'm strongly preferring gold to bitcoin, but that’s up to you."

Dalio noted that he has "some bitcoin, but not much."

Like many of his public talks in recent years, Dalio spent much of the interview focused on the dire economic circumstances the U.S. government has found itself in as the national debt continues to accumulate. “The issue is the devaluation of money,” Dalio said.

“We are at the point of no return,” Dalio warned, arguing that the government will likely need to issue nearly $12 trillion more Treasuries next year simply to service its mounting debt. It isn’t just the U.S., either; all Western countries are facing a similar "debt doom loop," he argued.

"Just like in the ’70s or the ’30s, they will all tend to go down together," Dalio said of Western economies. "We’ll pay attention to their relative movements, but they will all decline in value — relative not to fiat currencies, but to hard currencies."

However, in times of crisis, long-term currencies like gold and bitcoin can act as “an effective diversifier,” he noted.

That said, Dalio has long had a bittersweet view of bitcoin , and this interview is no different. “I can't say exactly how effective [bitcoin] is as a form of money, but it’s being perceived by many as an alternative,” he said, also at times raising concerns about onchain privacy and the longevity of code.

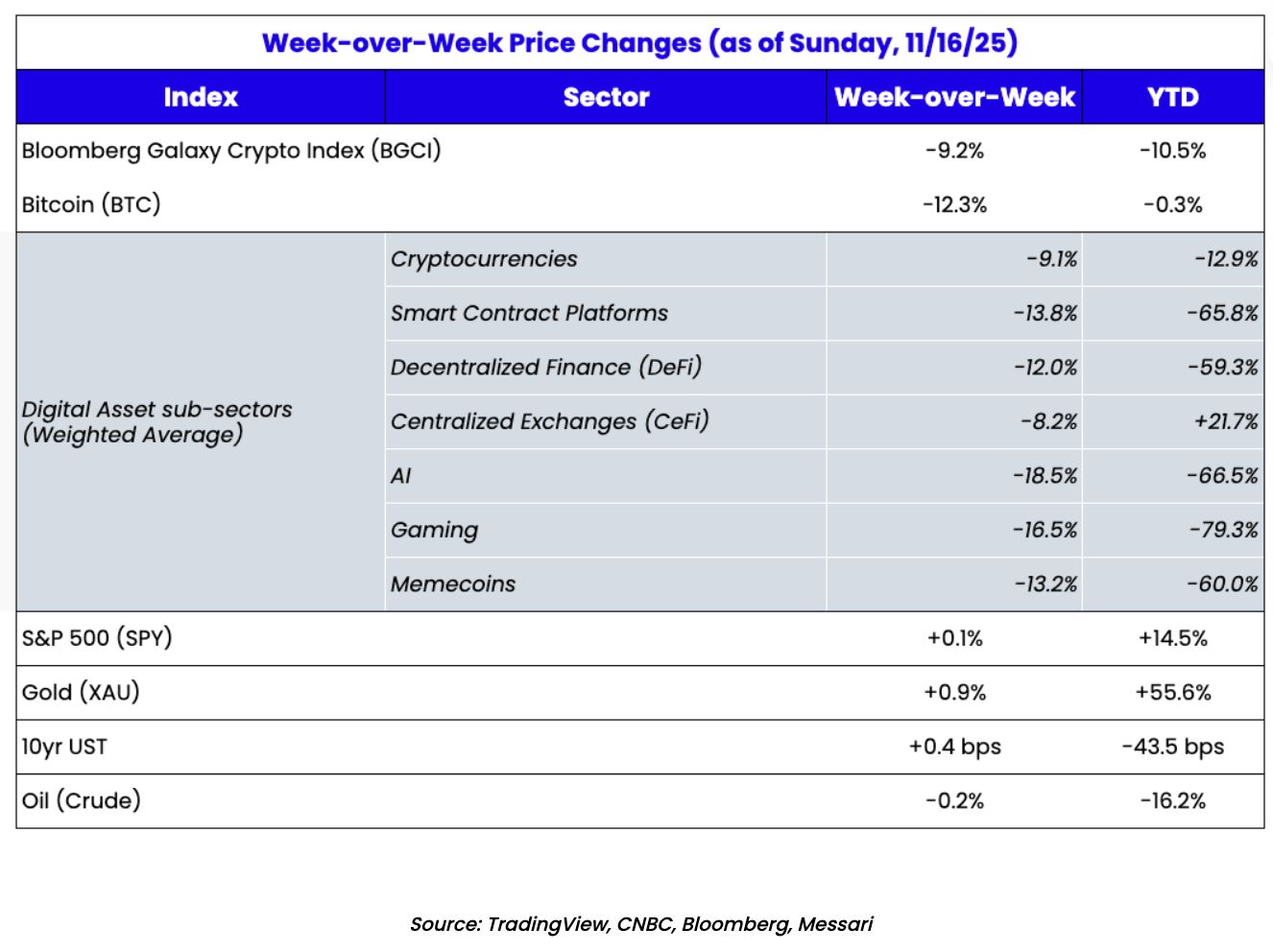

Both gold and bitcoin have hit record highs this year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.

Despite years of anticipated positive developments being realized, why does the crypto price keep falling?

Why does your favorite altcoin keep sinking deeper, even though the mainstream no longer sees the cryptocurrency industry as a scam?

Matrixport AMA Recap: On-chain Gold Economy Accelerates—XAUm and Creek Are Building a Sustainable Yield Network

In the future, gold will no longer be just a part of the RWA sector, but will become a key infrastructure of the Web3 financial system, driving the comprehensive formation of the on-chain gold economy.

Eight Altcoin ETFs Enter the Market: Attracting Only $700 Million, Failing to Stop Price Decline

Although ETFs for Solana and other altcoins are being accelerated onto Wall Street, their ability to attract capital is limited in a declining market environment, and coin prices are generally falling. In the short term, it will be difficult for ETFs to significantly boost market performance.