Ethereum Price To Continue Rising in the Months Ahead Driven by One Catalyst, According to Bitwise CIO Matt Hougan

The chief investment officer of the crypto asset management firm Bitwise says that Ethereum should continue growing in the coming months as demand for ETH increases.

In a new thread on the social media platform X, Bitwise CIO Matt Hougan says that the second-largest digital asset by volume will continue rising due to overwhelming demand for it.

“ETH is on a tear. After trading steadily downward for the first four months of the year, it has rebounded strongly. It’s up 50%+ in the past month and more than 150% since its lows in April. The reason? Overwhelming demand from ETPs (exchange-traded products) and corporate treasuries.”

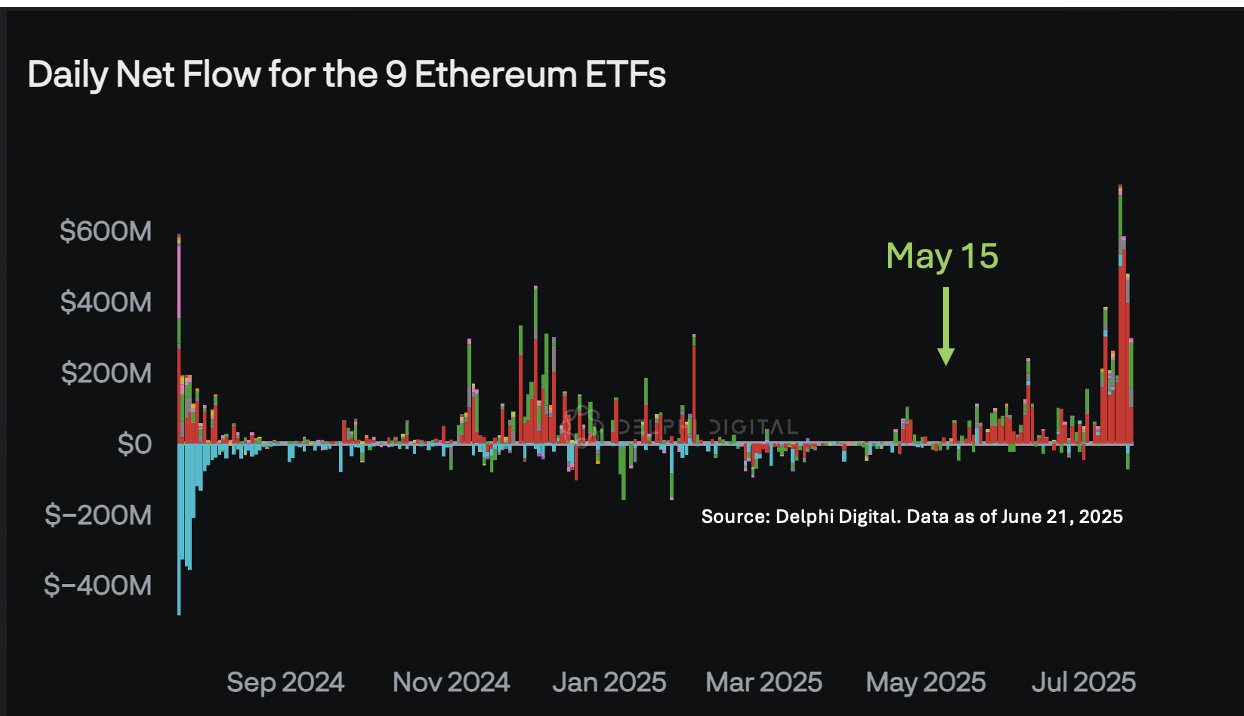

According to Hougan, since May, institutional demand for ETH has shot up, causing its price to skyrocket after its ETPs suffered a lackluster launch.

“ETH ETPs launched in July 2024, but the initial response was tepid… Something changed in mid-May. Since May 15, spot Ethereum ETPs have been on a tear, pulling in more than $5 billion. Corporations have also gotten into the game, with firms like Bitmine and SharpLink announcing Ethereum treasury strategies.

By our estimates, ETPs and Corporate Treasuries have combined to buy 2.83 million ETH since May 15 – more than $10 billion at today’s prices. That’s 32x net new supply over the same time period. No wonder the price of ETH has soared!”

Source: Matt Hougan/X

Source: Matt Hougan/X

According to Hougan, the blue-chip investors should continue ramping up their investments into the top altcoins, driving its price up for the coming months.

“The right question to ask is: Will this persist? I think the answer is ‘yes…’

With surging interest in stablecoins and tokenization, we expect strong ETH ETP inflows for a long time to come. Meanwhile, all signs suggest the ‘ETH treasury company’ trend will accelerate…

Looking out, I can imagine ETPs and Treasury Companies buying $20 billion of ETH in the next year, or 5.33 million ETH at today’s prices. Meanwhile, the network is expected to produce roughly 0.80 million ETH over the same period. That’s ~7x more demand than supply.”

ETH is trading for $3,635 at time of writing, a 3.2% decrease on the day.

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/geogif

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?

Can BNB price retake $1K in December?

Bitcoin’s strongest trading day since May cues possible rally to $107K

XRP faces ‘now or never’ moment as traders eye rally to $2.50