Date: Fri, July 25, 2025 | 03:45 PM GMT

The cryptocurrency market is experiencing volatility after a strong multi-week rally, with Ethereum (ETH) pulling back to $3,600 from its recent high of $3,875. This dip has caused most major memecoins to correct, including Pepe (PEPE).

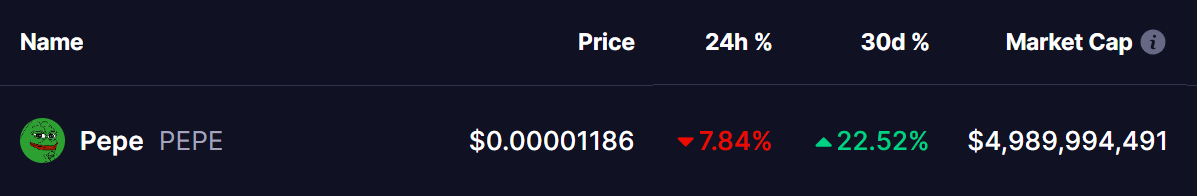

PEPE is currently down 7% today, trimming its monthly rally to 22%. However, a potentially bullish fractal pattern is emerging — one that strongly resembles the breakout cycle previously seen in Dogecoin (DOGE), suggesting a possible upside ahead.

Source: Coinmarketcap

Source: Coinmarketcap

PEPE Mirrors DOGE’s Breakout Setup

A comparison shared by prominent crypto analyst Max shows that PEPE’s current price structure is following a path nearly identical to DOGE’s historical two-cycle breakout.

DOGE, during its first cycle, consolidated in a prolonged base before exploding into a parabolic rally. In its second cycle, DOGE repeated a similar pattern — building another accumulation structure before igniting a massive move to new highs.

PEPE and DOGE Fractal Chart/Credits: @MaxBecauseBTC (X)

PEPE and DOGE Fractal Chart/Credits: @MaxBecauseBTC (X)

Now, PEPE appears to be entering its Cycle 2, just like DOGE. After forming a strong base and posting an initial rally, PEPE is consolidating in a way that mirrors DOGE’s pre-breakout phase. If this fractal continues, PEPE could be on the verge of its own explosive rally phase, similar to DOGE’s second cycle surge.

What’s Next for PEPE?

If this fractal plays out as DOGE’s past cycles suggest, PEPE could break out from its consolidation range and enter a significant rally phase over the coming weeks. Analysts note that confirmation will depend on PEPE holding its base and breaking past key resistance levels — a move that would likely mark the start of Cycle 2’s parabolic advance.

For now, the pattern suggests PEPE could be lining up for a DOGE-style run, potentially making it one of the most watched memecoins in the coming weeks.