Australian fintech Finder wins court battle over crypto yield product

The Australian Federal Court ruled in favor of fintech company Finder.com, clearing it and its yield-generating product, Finder Earn, in a legal battle with the Australian Securities and Investments Commission (ASIC) that lasted almost three years.

In a Thursday court decision , Justices Stewart, Cheeseman and Meagher confirmed a previous judgment that Finder Wallet and Earn complied with consumer financial laws.

The federal court “confirmed the initial finding that Finder Earn was not a financial product,” Finder said in a Thursday blog post .

The ruling came three months after ASIC appealed a March court decision on the Australian fintech firm’s Earn product, in which it had been found compliant with Australia’s financial laws .

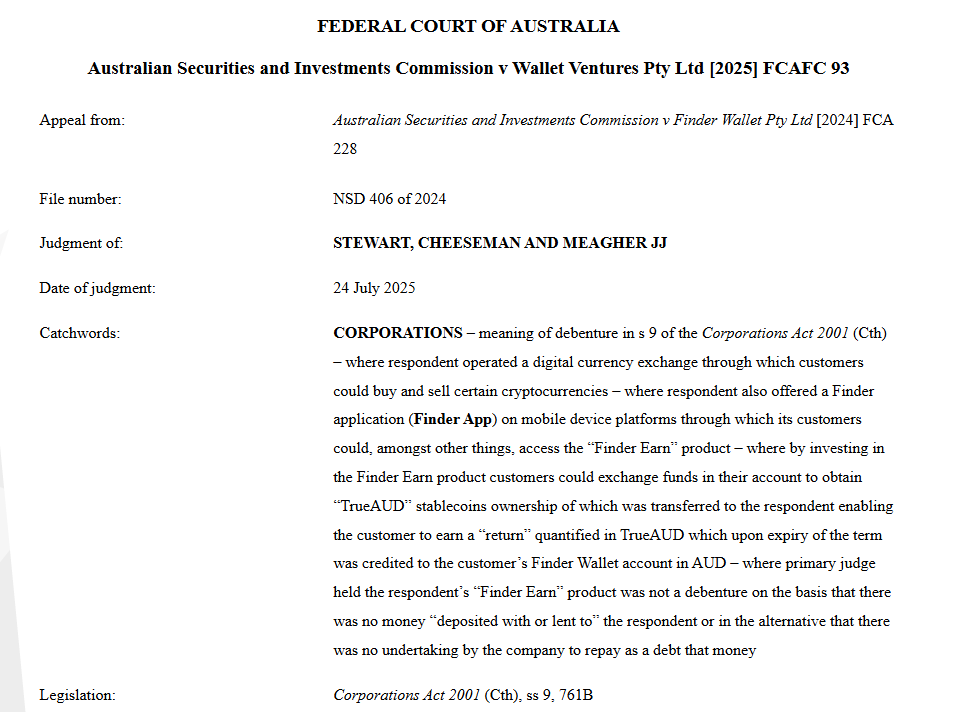

Finder court ruling. Source: Federal Court of Australia

Finder court ruling. Source: Federal Court of Australia

The case marked the first time that the legal definition of debenture had been tested in an Australian court concerning cryptocurrency, according to Finder.

Finder Earn, which operated between February and November 2022, allowed users to convert Australian dollars into stablecoins on the platform and transfer them to Finder Wallet in exchange for a 4% to 6% annual yield.

The company said it returned all customer funds, totaling more than 500,000 TrueAUD (TAUD), or roughly $336,000.

Finder case marks “win” for Australian fintech industry

Finder welcomed the decision, calling it a milestone for the fintech industry in Australia.

“This is a win not just for Finder, but for fintech in Australia,” said Fred Schebesta, the founder of Finder.com. “We need to give Australians compliant, secure access to the next generation of investment opportunities, from staking and yield to NFTs and beyond, because these emerging crypto services deserve trusted, well-regulated pathways just like any other asset class,” he told Cointelegraph.

“We built Finder Earn with transparency and integrity from day one, consulting ASIC throughout,” he said, adding that the legal case was “about innovation pushing ahead of regulation.”

When asked about what’s next after the legal victory, he hinted at a new project in the works. “I have something massive I’ve been working on that will build upon this win,” he said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.