Stellar (XLM) Risks a 40% Drop as Bearish Divergence Returns

XLM price sits around $0.47 after a 103% run. Bearish RSI divergence and a liquidation cluster below $0.40 raise deeper correction risk. Fibonacci supports at $0.44, $0.40, and $0.33 mark the path lower, while a close above $0.52 would negate the bearish view.

Stellar’s (XLM) price trades near $0.47 after a 103% month-on-month. The rally has stalled into small daily candles (mostly indecisive Doji candles).

And two daily signals now lean lower: a heavy block of leveraged longs sits under price, and slipping momentum. Key support levels might be at risk.

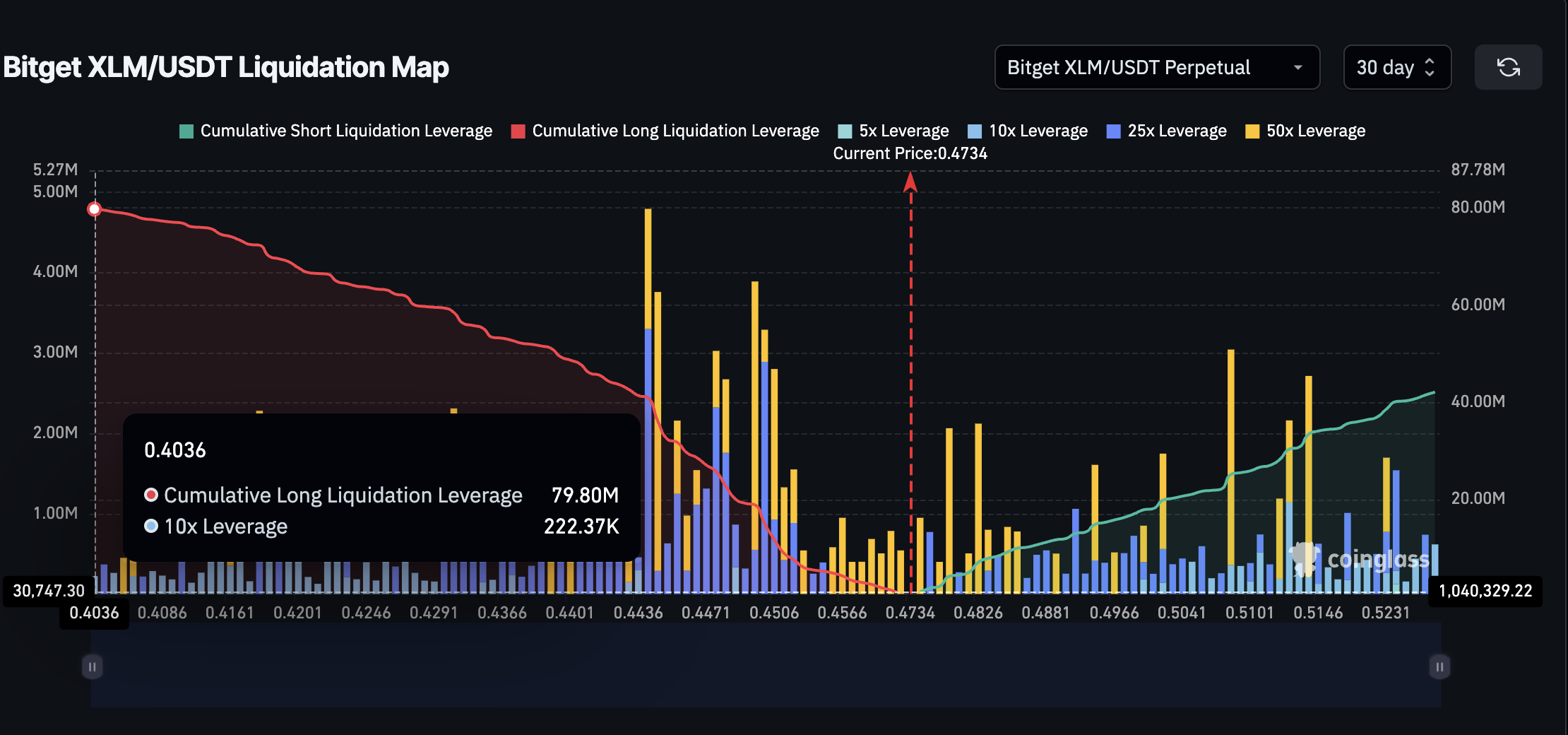

Leverage Pocket Below $0.40 Raises Cascade Risk

Price is hovering above $0.45, but Bitget’s 30‑day XLM/USDT liquidation map shows roughly $79.8 million of long exposure compared with about $42.1 million in shorts, with the cumulative cluster highlighted under $0.40.

XLM price and key liquidation cluster (Bitget):

XLM price and key liquidation cluster (Bitget):

Each step down would trigger smaller pockets first, then the dense area under $0.40 can amplify selling as forced closures hit the order book.

A liquidation map plots where leveraged positions get auto-closed; when the largest clusters sit below spot, even a modest drop can snowball.

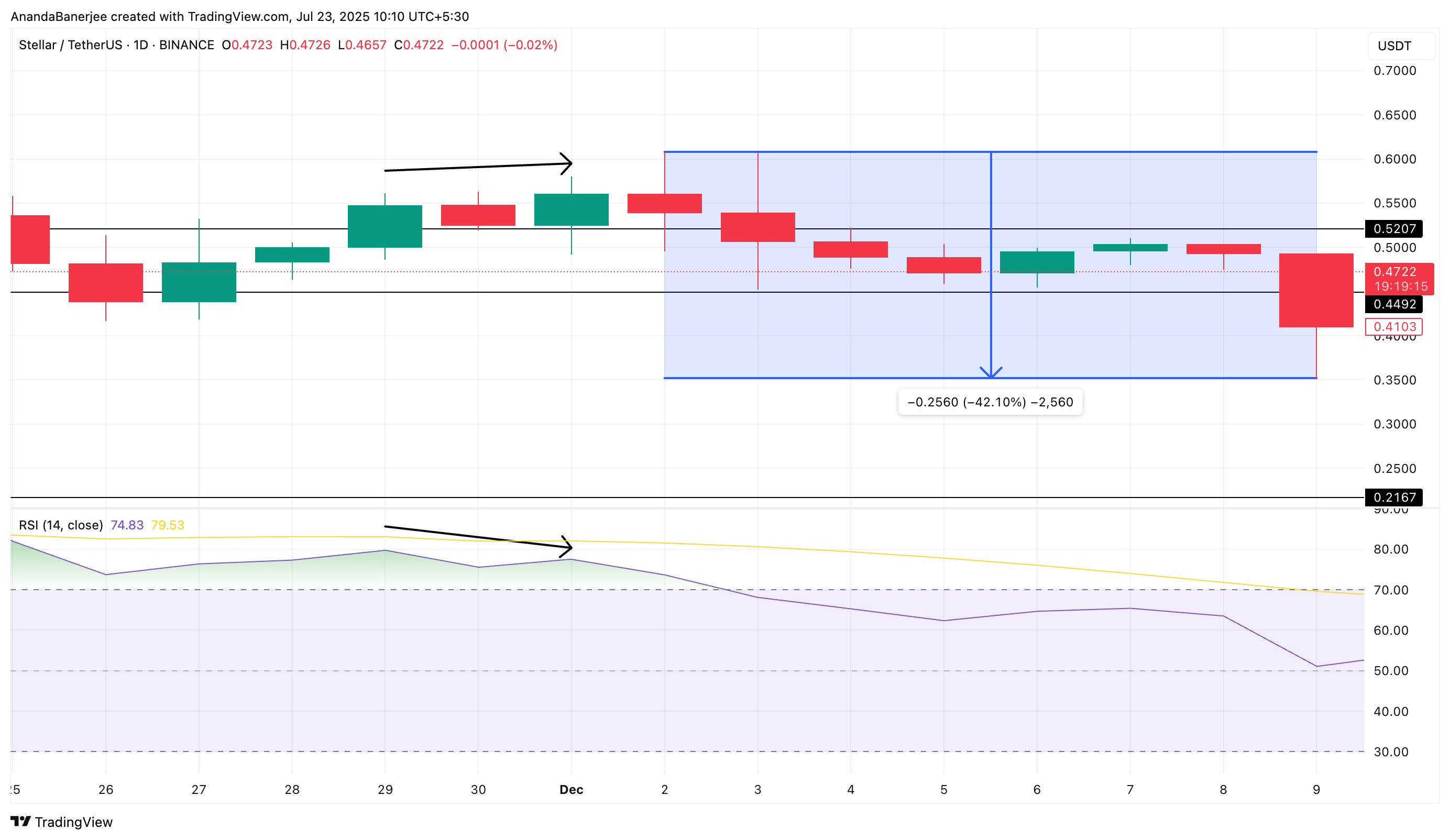

Daily RSI Divergence Mirrors December Slide

Since July 14, the price has held near the highs while the Relative Strength Index (RSI) on the daily chart has made lower highs.

Stellar price and RSI divergence:

Stellar price and RSI divergence:

The last time XLM showed this pattern, in late December, the price fell over 40%.

RSI divergence pattern from December 2024:

RSI divergence pattern from December 2024:

RSI measures the strength of recent price movements on a 0–100 scale. When price is steady or rising but RSI eases, momentum is not confirming the move, and pullback risk increases.

With leverage and liquidation risks waiting below, that loss of momentum becomes more dangerous, supporting the “XLM price correction” logic.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

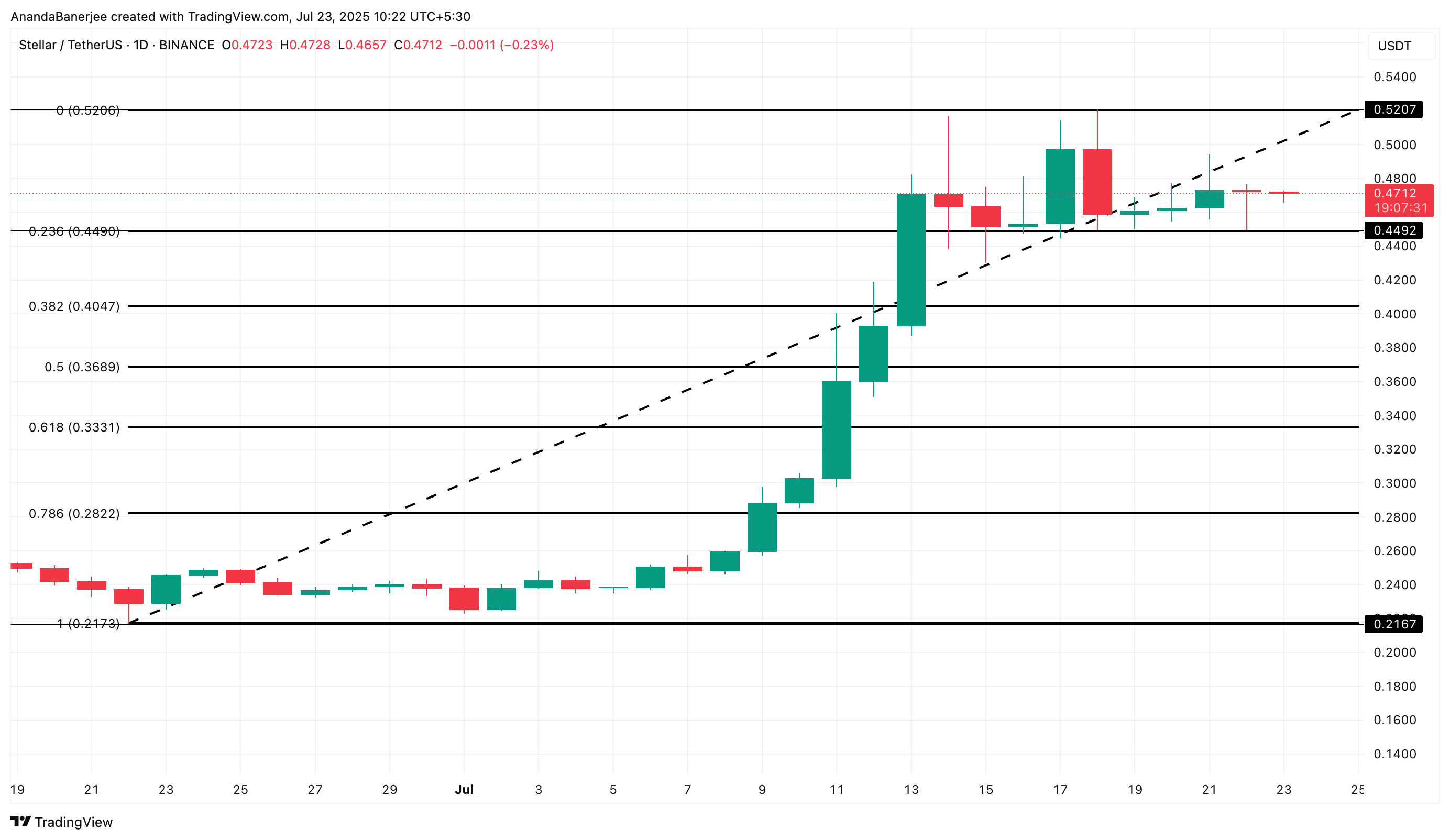

XLM Price Now Eyes Key Support Levels

A Fibonacci retracement drawn from the $0.21 low to the $0.52 high frames the likely supports if selling starts: $0.44 (0.236) being the strongest level will multiple support hits.

Fibonacci levels mark common pullback areas, and when they overlap with liquidation clusters, reactions tend to be sharper.

XLM price analysis:

XLM price analysis:

XLM is currently sitting above $0.44. A daily close beneath that level would put $0.40 in focus. Below $0.40, the liquidation hypothesis wins, so a break there could speed a move toward $0.33. A 40% decline (inspired by the December 2024 pattern) from the $0.52 high lands under $0.33.

Under $0.28 (if the $0.33 level breaks), the entire XLM price structure could turn bearish in the short term.

Invalidation is straightforward: a firm daily close back above $0.52, with RSI turning up and liquidation risk thinning out, would neutralize this bearish setup and restore the upside case.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?