First crypto bill vote fails to get 100% Republican support despite Trump’s call

Cryptocurrency-related bills backed by US President Donald Trump failed to clear a key procedural step in the House of Representatives on Tuesday, despite the president’s public push for action.

Trump had urged Republican lawmakers to “get the first vote done this afternoon” on legislation to regulate payment stablecoins as part of a larger effort to pass crypto legislation before the August recess.

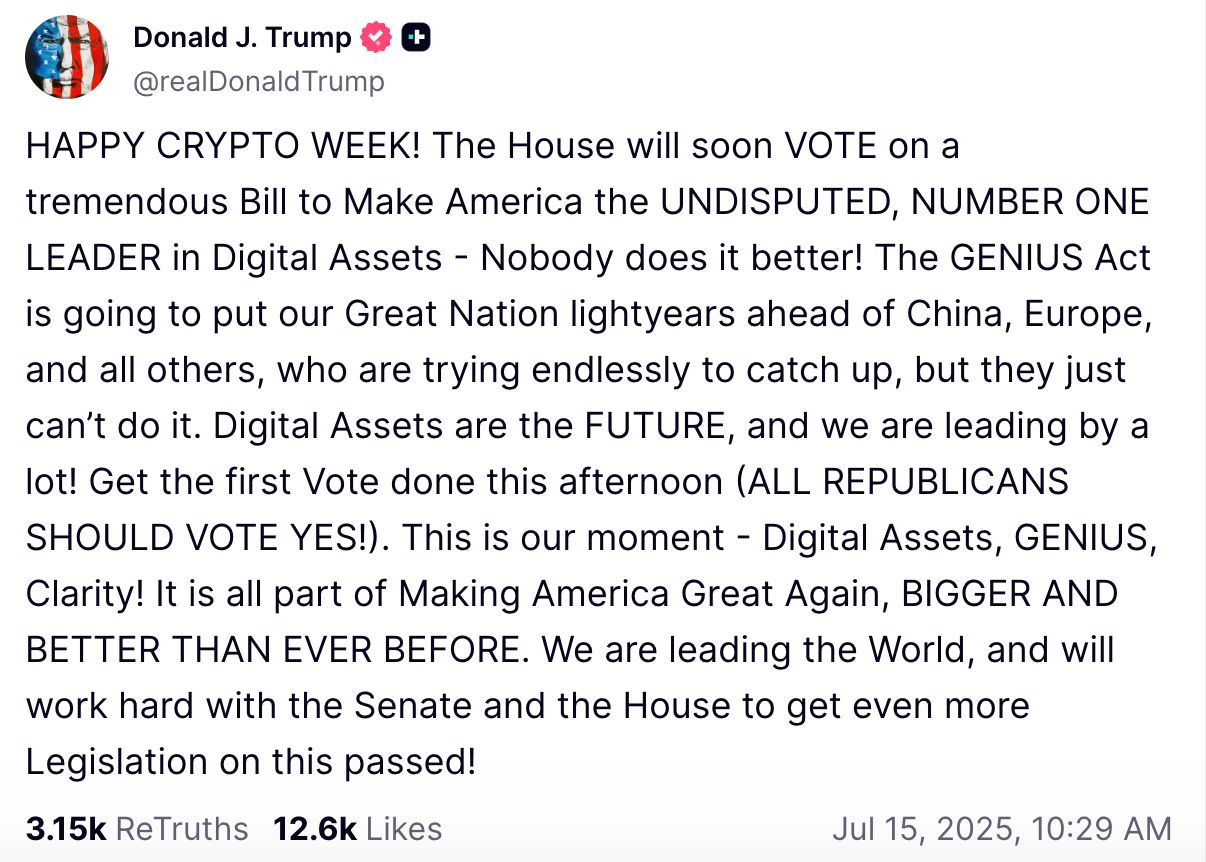

In a Tuesday post on his social media platform Truth Social, Trump ordered all Republicans to vote yes on the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, a bill designed to regulate payment stablecoins in the US.

The legislation is one of three bills, along with ones to address market structure and central bank digital currencies, that Republican House leaders had been pushing as part of the party’s “crypto week” plans.

The president may have been referring to a House resolution to consider the three bills and a defense bill, which failed to get support from a majority of lawmakers present on Tuesday — at least 13 Republicans may have voted against the resolution.

House Speaker Mike Johnson reportedly said the chamber would take up another vote “this afternoon.”

Source: Donald Trump

Source: Donald Trump

The GENIUS Act, which passed through the Senate in June with bipartisan support despite initial resistance from many Democrats, is expected to head for a floor vote in the House by Thursday. At the time of publication, the bill was scheduled to be considered by the House sometime this week, but it was unclear whether the chamber planned a separate floor vote on Tuesday.

Signing off on a stablecoin law while investing in stablecoins?

Trump has personally come under scrutiny for his role in pushing the stablecoin legislation due to his involvement in his family-backed crypto company World Liberty Financial (WLF), which issued its own stablecoin and suggested a conflict of interest. Bloomberg reported on Friday that Binance helped create WLF’s USD1 stablecoin, also used by an Abu Dhabi-based investment firm to settle a $2 billion investment into the crypto exchange.

“World Liberty Financial has received a significant portion of its funding from overseas, which has brought about serious ethical and national security concerns,” said California Representative Maxine Waters’ office on Tuesday, adding: “[F]oreign investment is not just a business deal, it’s a direct payment to the sitting US president with the goal of currying favor and influence within the White House.”

Many Democratic leaders have responded to Republicans’ push for the digital assets bills with their own “anti-crypto corruption week” agenda. They are calling for amendments in the three bills to address consumer protection and prevent the president, vice president, and members of Congress from holding or promoting crypto over concerns with conflicts of interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030