Glassnode: Significant Decline in Bitcoin Long-Term Holder to Short-Term Holder Supply Ratio Indicates Profit-Taking

Foresight News reports that Glassnode data shows a significant decline in the Bitcoin long-term holder to short-term holder supply ratio, with the 30-day change rate shifting from accumulation to distribution, indicating early signs of profit-taking in the market. After several months of steady inflows from long-term holders and rising prices, this could signal a turning point for the market. This indicator is worth monitoring to determine whether the trend is reversing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

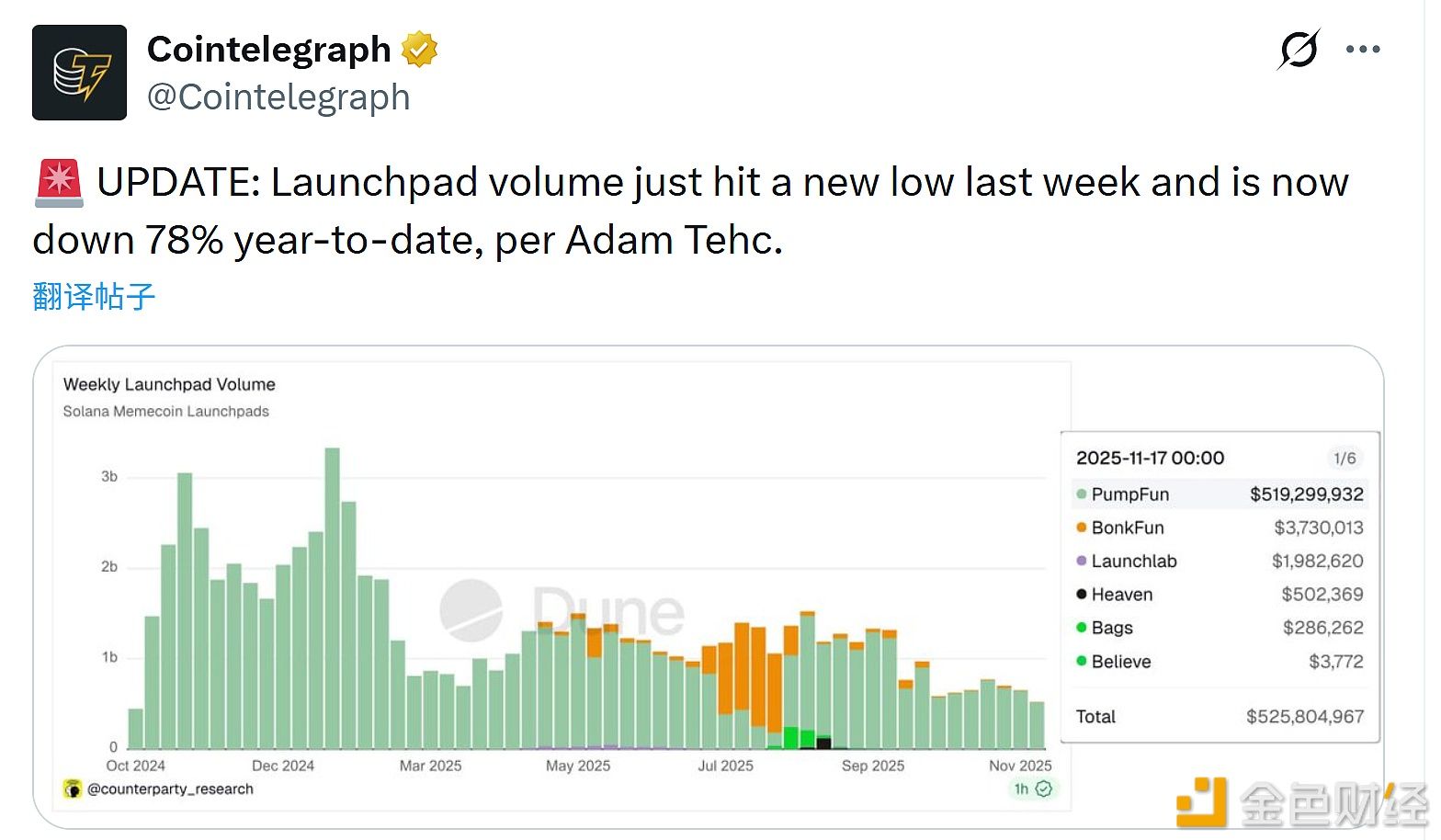

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93