Kazakhstan Allocates National Reserves to Crypto Assets

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- National reserves allocated to cryptocurrency industry funds.

- Seized crypto assets managed by National Bank custody.

National Bank of Kazakhstan’s Crypto Initiative

The National Bank of Kazakhstan is taking strategic steps toward incorporating cryptocurrency into national reserves. Overseen by Timur Suleimenov, the initiative aims to utilize experience from other sovereign funds. Development began in January 2025, focusing on mined and confiscated crypto assets.

“We looked at the experience of the Norwegian fund, the American experience, the experience of the Middle East funds. They have certain investments either in crypto assets directly or in ETFs and shares of companies that are closely related to crypto assets. They are quite small.” — Timur Suleimenov, Governor, National Bank of Kazakhstan

Bitcoin (BTC) and Ethereum (ETH) are primary candidates for inclusion. The program’s design stresses both direct investment from national reserves and management of government-seized digital assets. No official figures or specific amounts have been disclosed.

Market Implications

This has led to speculation on broader market implications, as Kazakhstan’s regulatory framework signals potential impacts for global cryptocurrency dynamics. Strict oversight is indicated for unlicensed crypto activities, mirroring global regulatory trends. The move is viewed as a balancing act between potential high returns and inherent volatility.

Kazakhstan’s alignment with international strategies may enhance its role in the crypto sphere, although on a smaller scale. As institutions observe the initiative’s success, global impact remains uncertain, requiring close scrutiny of future inflation and market volatility trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paxos proposes to back Hyperliquid’s new USDH stablecoin

Share link:In this post: Paxos has submitted a proposal to support Hyperliquid’s launch of the USDH stablecoin on its platform. The company plans to use 95% of the interest generated by its reserves backing USDH to repurchase HYPE and redistribute it back to ecosystem initiatives. Paxos Labs has also acquired Molecular Labs in a bid to accelerate stablecoin adoption in the Hyperliquid ecosystem.

Crypto sentiment moves into fear terriroty as traders weigh next moves

Share link:In this post: Crypto sentiment has moved into the fear region as investors are now holding off from taking more risks. Santiment has highlighted the focus on larger-cap tokens, noting that traders are presently not open to risks. Analysts and traders question the near-term direction of some of these major assets.

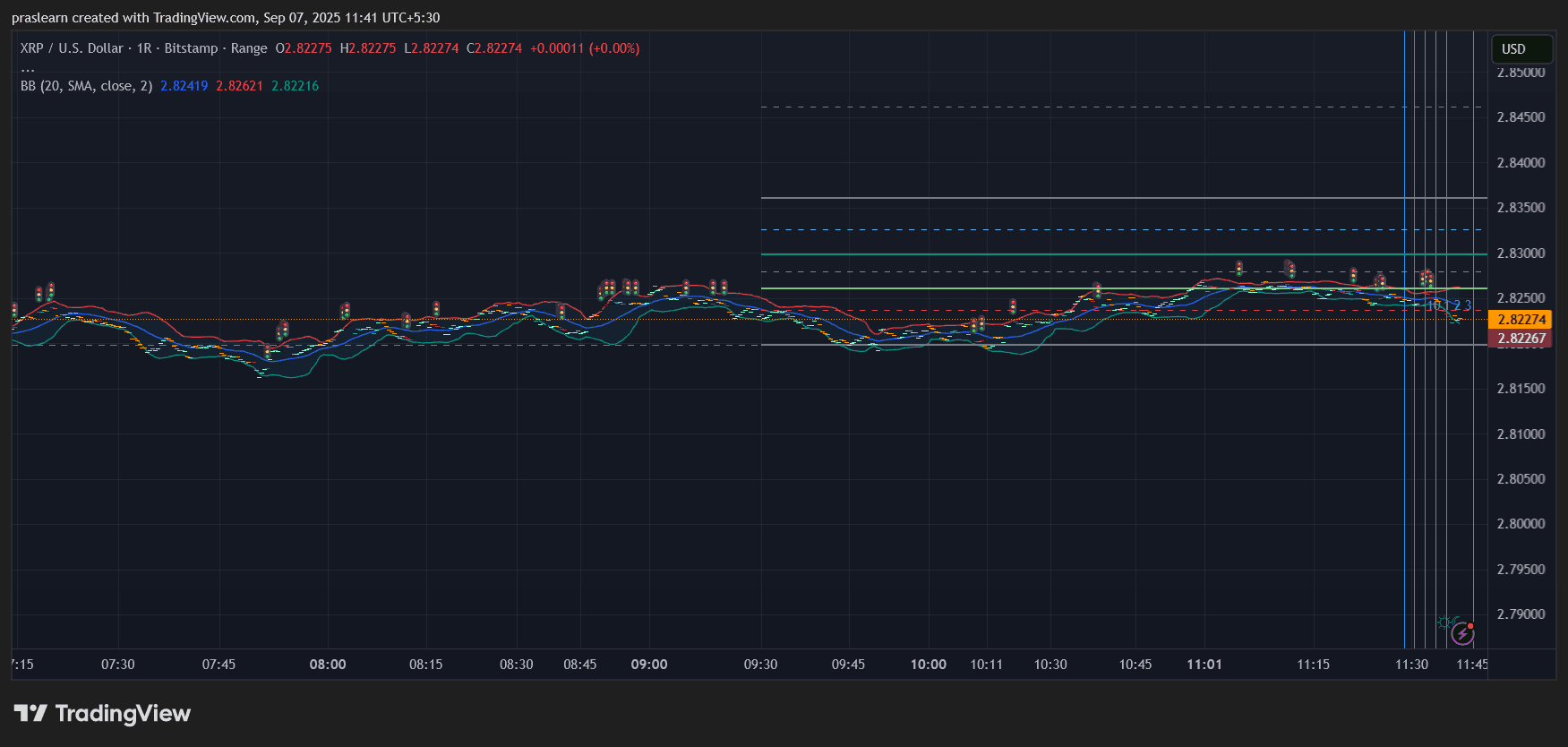

Is XRP about to break through $3?

XRP is currently fluctuating within a narrow range around $2.80, but with the Federal Reserve almost certain to cut interest rates this month, volatility is about to return.

Top 3 Altcoins Worth Buying in September 2025

The crypto market is in a stagnant state, but bitcoin's stability and the altcoin season index indicate opportunities. Here are the top three altcoins worth buying right now.