El Salvador’s Bitcoin Reserves Reach $760 Million

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- El Salvador holds $760M in Bitcoin reserves.

- President Bukele leads continual Bitcoin acquisitions.

El Salvador’s escalating Bitcoin reserves exemplify the country’s dedication to integrating cryptocurrency into its monetary framework. Despite the IMF’s guidance to limit such purchases, the government remains steadfast, reflecting potential shifts in global economic discussions.

The National Bitcoin Office reported that El Salvador’s Strategic Bitcoin Reserve has achieved a new high in terms of value. Under President Bukele’s leadership, the country consistently adds to its holdings, recently acquiring 8 BTC. With current holdings over 6,230 BTC, the government aims to leverage cryptocurrency for financial inclusion. President Nayib Bukele emphasized this by stating:

“We continue to add to our Bitcoin reserve on a daily basis, proving our long-term commitment to this technology and its benefits for financial inclusion.”

El Salvador’s Bitcoin purchases continue despite contrasting forecasts from the IMF. The government’s approach illustrates potential tensions in traditional financial circles. Public Bitcoin usage, however, remains low in El Salvador, as noted in reports of limited adoption and challenges in widespread acceptance.

This accumulation reflects a growing unrealized gain of over $333 million in El Salvador’s portfolio. While internal adoption struggles persist, the global community remains attentive to potential regulatory and economic consequences of such investments. The El Salvador government has introduced a public Bitcoin portfolio tracker, aiming to increase transparency and track real-time reserve metrics.

The country’s commitment to Bitcoin may inspire financial and policy shifts. As the cryptocurrency’s value fluctuates, the strategic rationale of El Salvador’s reserves could influence other nations’ considerations of digital currency assets. Presidential statements emphasize continual advancement irrespective of external market pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paxos proposes to back Hyperliquid’s new USDH stablecoin

Share link:In this post: Paxos has submitted a proposal to support Hyperliquid’s launch of the USDH stablecoin on its platform. The company plans to use 95% of the interest generated by its reserves backing USDH to repurchase HYPE and redistribute it back to ecosystem initiatives. Paxos Labs has also acquired Molecular Labs in a bid to accelerate stablecoin adoption in the Hyperliquid ecosystem.

Crypto sentiment moves into fear terriroty as traders weigh next moves

Share link:In this post: Crypto sentiment has moved into the fear region as investors are now holding off from taking more risks. Santiment has highlighted the focus on larger-cap tokens, noting that traders are presently not open to risks. Analysts and traders question the near-term direction of some of these major assets.

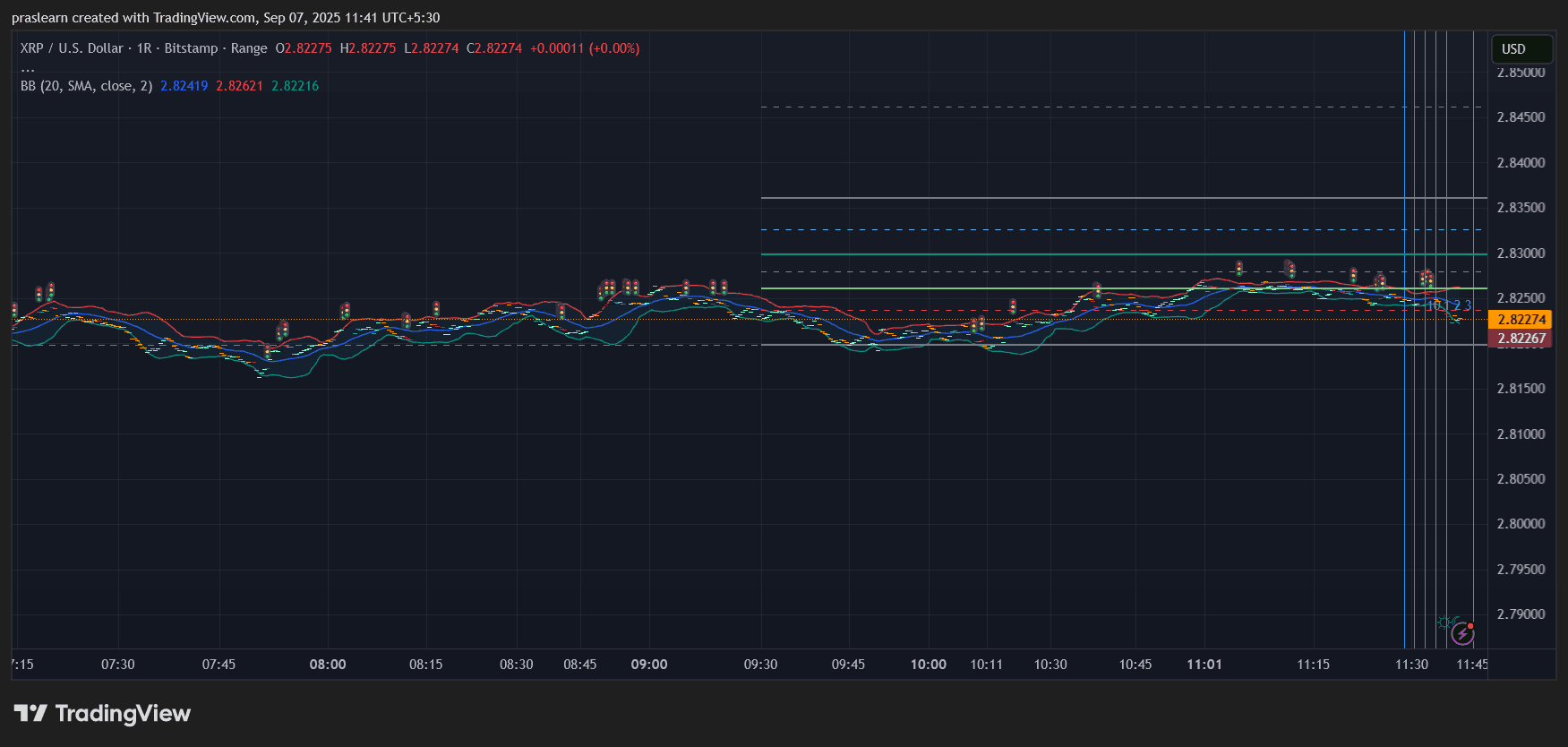

Is XRP about to break through $3?

XRP is currently fluctuating within a narrow range around $2.80, but with the Federal Reserve almost certain to cut interest rates this month, volatility is about to return.

Top 3 Altcoins Worth Buying in September 2025

The crypto market is in a stagnant state, but bitcoin's stability and the altcoin season index indicate opportunities. Here are the top three altcoins worth buying right now.