Key Notes

- Robert Kiyosaki recently bought more Bitcoin at $110,000, signaling strong confidence in its long-term value.

- He warns that Bitcoin is now in the "Banana Zone", a phase marked by FOMO-driven surges and extreme volatility.

- Despite whale-induced corrections, Kiyosaki remains bullish with a $250K target by 2025 and $1 million by 2030.

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad , has revealed that he recently bought more Bitcoin (BTC) at a hefty $110,000 per coin.

Meanwhile, BTC has hit a new all-time high of $118,000 and Kiyosaki claims that the market has entered the “Banana Zone.”

Another RICH DAD LESSON:

“PIGs get fat.

HOGs get slaughtered.”I state this lesson because I bought my latest BITCOIN at $110k. I am now in position for what Raoul Pal calls “the Banana Zone.”

In the Banana Zone the HOGS will

rush in….driven to insanity by the dreaded…— Robert Kiyosaki (@theRealKiyosaki) July 11, 2025

What Is the Banana Zone?

The term “Banana Zone,” popularized by macro investor Raoul Pal, refers to a late-stage bull market where price movements become emotionally driven, largely propelled by media hype, institutional frenzy, and retail FOMO (Fear Of Missing Out).

Kiyosaki described the current Bitcoin market as dangerously euphoric and volatile , warning that while BTC’s limited supply is the foundation for such surges, the same scarcity makes it vulnerable to sharp corrections when overenthusiastic buyers flood the market.

“PIGs get fat. HOGs get slaughtered,” Kiyosaki tweeted. “I bought my latest BITCOIN at $110K… Being a fat PIG with enough BITCOIN, I will wait for the coming HOG slaughter.”

A Seasoned Approach to Market Madness

Unlike newcomers blindly chasing the best crypto to buy , Robert Kiyosaki advocated a more measured approach. Having entered the Bitcoin market early at around $6,000, he has seen cycles of mania before and believes success lies in patient accumulation and disciplined investing.

While the Banana Zone may attract retail investors, Kiyosaki cautioned that it often ends in panic selling. His long-term targets remain ambitious, $250,000 by 2025 and $1 million by 2030 .

Volatility Lurks Beneath the Surface

According to analyst Darkfost, massive whale inflows to Binance, spiking from a $2.3 billion to $5.3 billion monthly average, suggest strategic selling may already be in motion.

A single 10,000 BTC transfer worth $2.1 billion on June 16th, just before Bitcoin fell from $108,600 to $99,200, underscores the role large players have in triggering volatility.

Yet the fact that the market absorbed this pressure and bounced back toward new highs indicates strong underlying demand.

The Bull Is Still Running

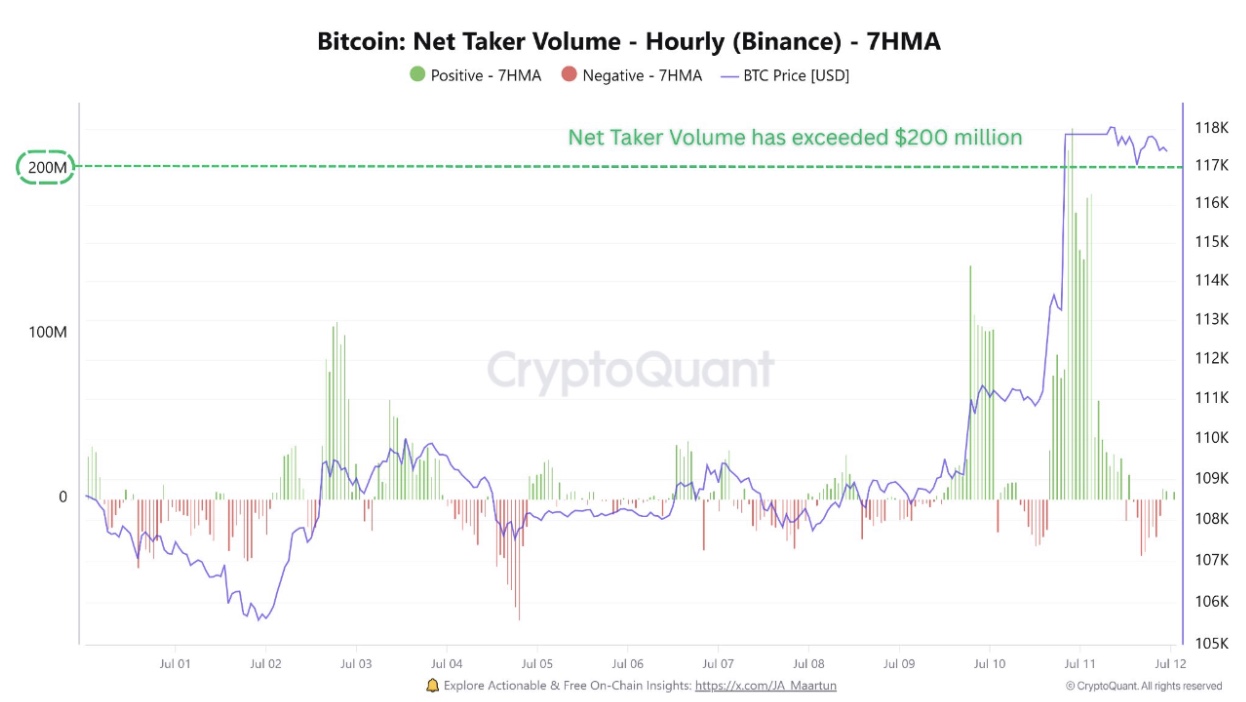

Market analyst Amr Taha reported that Binance’s Net Taker Volume recently exceeded $200 million, a signal of aggressive buying as BTC hit $118,000. This level of enthusiasm hasn’t been seen since early 2025.

Additionally, Binance recorded over 4,500 BTC in inflows, further supporting the idea that while demand is strong, the market may soon face a cooling-off period.

Net Take Volume | Source: Amr Taha

Kiyosaki remains unfazed. In his view, any correction will be a chance to accumulate more Bitcoin at a discount. “After the Hogs stop squealing and selling and blaming Bitcoin for their losses, my fellow PIGs and I will buy more Bitcoin on SALE,” he wrote.