Will Ethereum Price Sustain the $3,000 Support or Face Corrections?

Ethereum's price surge faces resistance from profit-taking, but strong support at $2,500 may stabilize ETH, pushing it toward higher targets. Ask ChatGPT Ethereum's price surge faces resistance from profit-taking, but strong support at $2,500 may stabilize ETH, pushing it toward higher targets.

Ethereum (ETH) has experienced a notable 19% surge over the past week, bringing its price close to $3,000.

The rally has been impressive, driven by broader market optimism. However, Ethereum faces a potential challenge from profit-taking, which could hinder its ability to maintain the $3,000 level.

Ethereum Holders Move To Sell

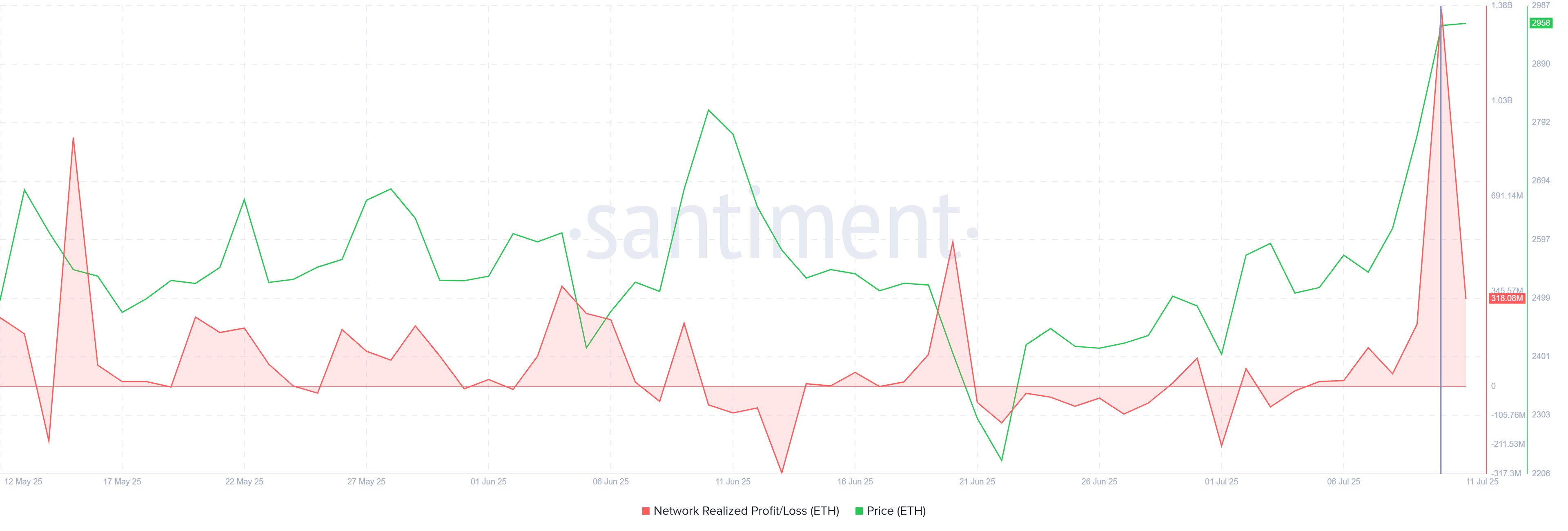

Ethereum’s Network Realized Profit/Loss metric has spiked to $1.36 billion, marking the largest increase since December 2022. This sharp uptick in realized profits indicates a significant amount of selling pressure.

The selling observed in the last 24 hours is the highest in 31 months, suggesting that many investors are capitalizing on recent price gains.

Historically, such large sell-offs have been followed by price corrections. Given the magnitude of the current selling activity, investors should be cautious, as it may signal a near-term pullback in Ethereum’s price.

Ethereum Network Realized Profit/Loss. Source:

Santiment

Ethereum Network Realized Profit/Loss. Source:

Santiment

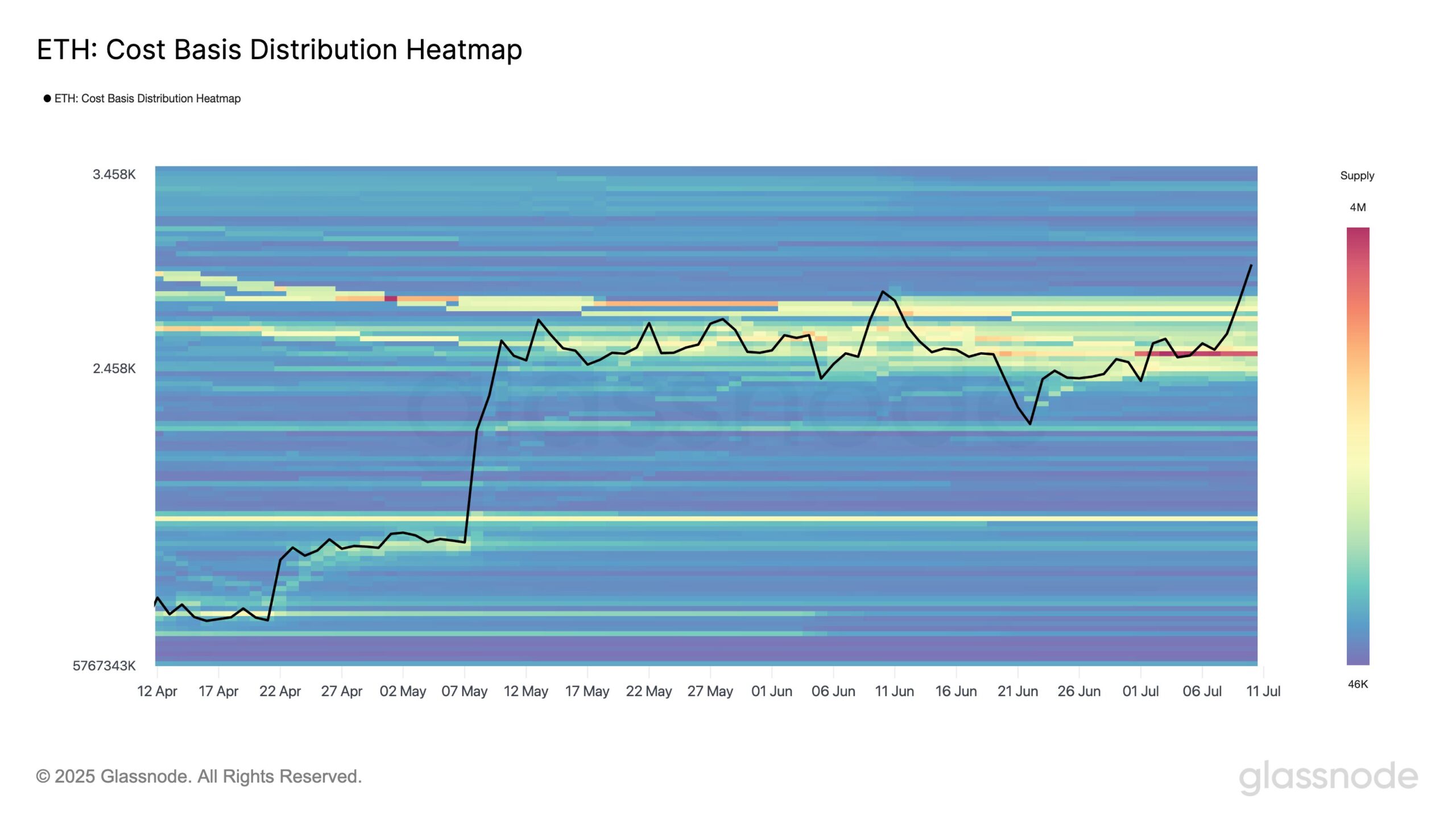

A key indicator of Ethereum’s potential support lies in its cost basis distribution, which shows that $2,500 has become a strong accumulation zone.

Over 3.45 million ETH had a cost basis near this level, providing significant support for the altcoin. As Ethereum recently bounced off $2,533, this level has become an important launchpad for its current rally.

This $2,500 support level is crucial if Ethereum faces a price decline due to profit-taking. Should ETH’s price retrace, the strong accumulation around $2,500 will likely act as a cushion, preventing a deeper pullback and supporting a potential rebound.

Ethereum Cost Basis Distribution. Source:

Glassnode

Ethereum Cost Basis Distribution. Source:

Glassnode

ETH Price Needs To Find Support

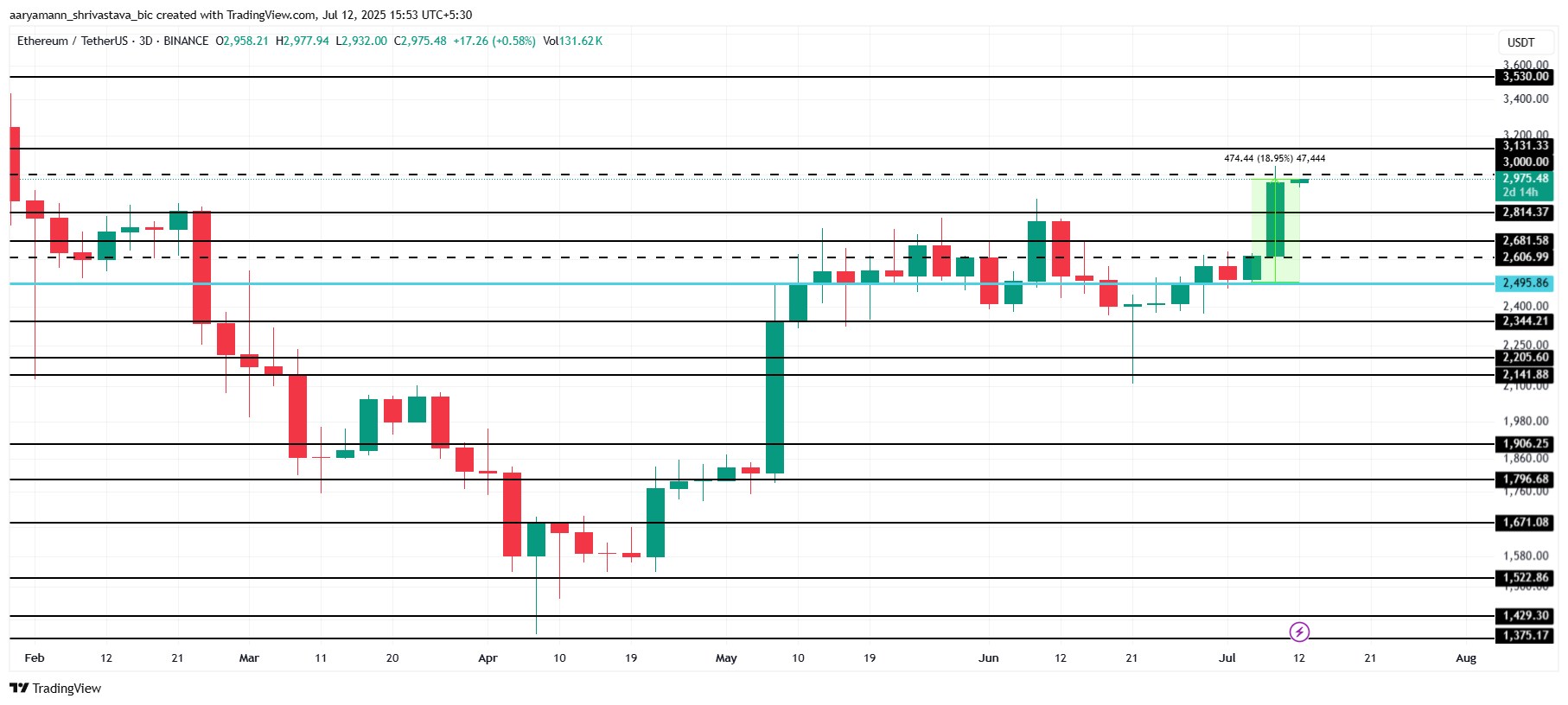

Ethereum is currently trading at $2,975, just below the crucial $3,000 resistance. After waiting five months to breach this level, Ethereum has finally crossed it.

However, the challenge remains in securing $3,000 as support. If ETH fails to hold this level, the rise could face significant resistance, limiting further gains.

Profit-taking could continue to weigh on Ethereum’s price in the short term. Yet, if Bitcoin’s uptrend continues and broader market conditions remain bullish, flipping $3,000 into support will likely push Ethereum towards the next resistance at $3,530. This move would indicate that the current bullish momentum is still intact.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Should profit-taking surge, Ethereum’s price could fall back below $3,000. The 19% gain seen this week could be undone, but ETH is expected to hold above $2,495, thanks to the strong support established at the $2,500 level.

However, this would extend the wait for seeing Ethereum above $3,000 further into Q3.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.