Ethereum Spot ETFs Saw $219 Million Net Inflows Last Week, Marking Eight Consecutive Weeks of Net Inflows

According to a report by Jinse Finance, SoSoValue data shows that during last week's trading days (Eastern Time, June 30 to July 3), spot Ethereum ETFs recorded a net inflow of $219 million, with none of the nine ETFs experiencing net outflows. The spot Ethereum ETF with the highest weekly net inflow was BlackRock's ETFETHA, which saw a weekly net inflow of $99.4 million, bringing its historical total net inflow to $5.62 billion. The second highest was Fidelity's FETH ETF, with a weekly net inflow of $92.03 million and a historical total net inflow of $1.74 billion. As of press time, the total net asset value of spot Ethereum ETFs stands at $10.83 billion, with the ETF net asset ratio (market value as a percentage of Ethereum's total market cap) reaching 3.45%, and cumulative historical net inflows totaling $4.40 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

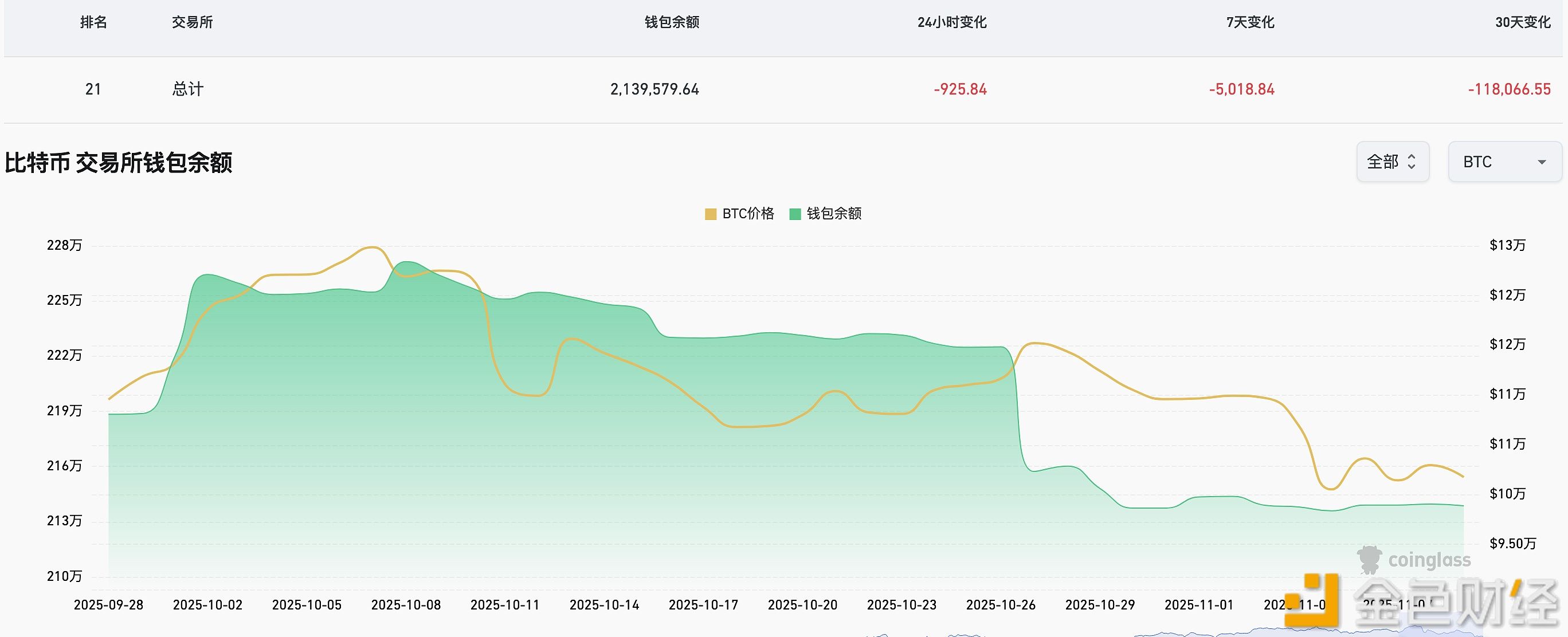

In the past week, 5,018.84 BTC have flowed out of CEX platforms.

RootData: VANA to unlock tokens worth approximately $4.57 million in one week

Analysis: Altseason Signals Hidden in Weeks of Bitcoin Dominance Weakness

Trump Media & Technology Group lost $54.8 million in Q3 and currently holds over 11,500 bitcoins