Billions in corporate buys can’t budge Bitcoin—5 reasons the BTC price won’t move

2025/06/28 04:25

2025/06/28 04:25From Michael Saylor to David Bailey, Anthony Pompliano to Jack Mallers, and everyone in between, there’s a rising tide of executives buying bitcoin for their corporate treasuries. Large companies and Wall Street are vacuuming up billions of dollars’ worth of BTC every week, yet its price remains relatively untouched. One Bitcoiner took to Twitter to ask why and received more than 1.3K replies. Here’s the best:

“Can anyone explain to me why companies are buying billions of dollars of bitcoin every week and the price is virtually unchanged over the last 6 months?”

Bitcoin Cam’s question clearly reflects the broader sentiment of Crypto Twitter, receiving over 800,000 views in a few hours and more than 1,300 replies. Even Bitcoin skeptic Peter Schiff chimed in with his 2 cents:

“The whales who already own a bunch of Bitcoin are selling to these buyers to cash out their huge gains.”

But the best reply came from SightBringer, who provides signal-bearing intelligence across macro, crypto, and capital. He said:

“They’re buying billions and the price isn’t moving because this isn’t a market anymore – it’s a controlled ignition chamber.”

Then he broke it down point by point:

1. ETF flows are real. Sovereigns and institutions are accumulating cold bitcoin.

Basically, large investors like BlackRock and Fidelity are buying real bitcoin through special funds called ETFs. This isn’t just pretend money; these are actual coins being tucked away for the long term.

In 2025, public companies bought a record number of bitcoins, and these ETFs are seeing billions in new money come in. The coins are being taken off exchanges, so fewer are left for everyone else to buy or sell.

2. Exchange liquidity is fake. Most trading happens on fractional reserves of “paper bitcoin” – IOUs, not actual coins.

Here, SightBringer explains that most trading on big crypto exchanges doesn’t actually move real coins. Instead, it’s just “paper bitcoin” (IOUs or promises to deliver bitcoin later).

This means there’s a lot of trading, but not much real bitcoin changing hands. If everyone tried to take their coins out at once, things could get messy (think Silicon Valley Bank (SVB) in 2023). This makes the market seem bigger than it really is.

3. Whales are rotating old supply out silently. Early miners and OTC wallets are feeding demand without triggering price – precisely to keep it low during transition.

Echoing Schiff’s reply, in point 3, SightBringer means that large holders, known as whales, aren’t selling their old coins on the open market. Instead, they’re selling quietly to new buyers or moving coins to private wallets.

This keeps the price from jumping around. In April alone, Glassnode revealed that whales had absorbed more than 300% of the newly mined bitcoin supply, drastically reducing the coins available to everyone else.

4. Volatility is being suppressed. BlackRock, Fidelity, and macro funds need price stability to finalize compliance, settlement rails, and balance sheet integration.

Big companies and funds don’t like wild price swings. They need stable prices to make sure everything works smoothly. BlackRock and others are even saying bitcoin is less volatile than before, which is good for them, as the asset becomes more credible to investors.

5. The real breakout is being delayed by design. Because once this thing moves, it won’t come back. It becomes untouchable.

SightBringer maintains that the market is being manipulated, with the BTC price being held back on purpose. When it finally breaks out, it could go exponentially higher, and it might not come back down. That’s why the big players are getting ready now, so they’re in the best position when the real move happens.

“The real question isn’t “why isn’t it moving?” It’s: Who’s making sure it doesn’t and why?”

The post Billions in corporate buys can’t budge Bitcoin—5 reasons the BTC price won’t move appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

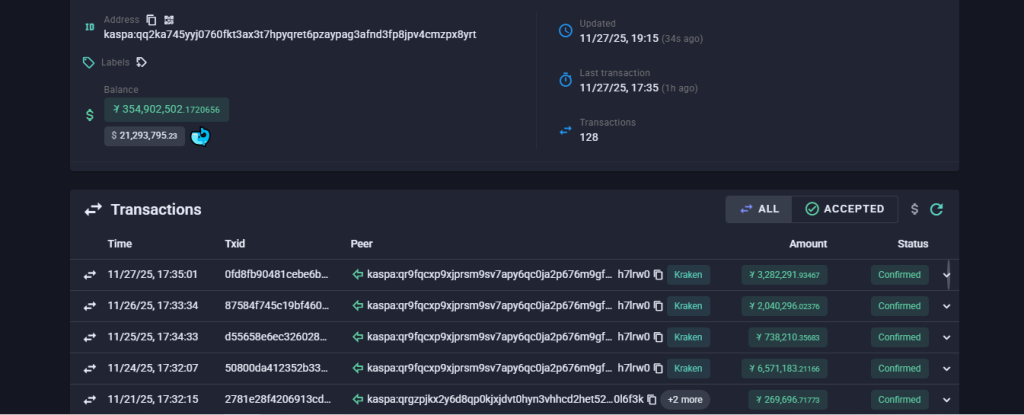

KAS Price Jumps 66%: Can Momentum Push Kaspa Toward December’s Bigger Targets?

VIRTUAL Price Jumps 17% as Falling Wedge Breakout Signals December Upside

Pi Network News: Can the CiDi Games Partnership Push Pi Beyond $1?

Charles Hoskinson Reveals When Altcoins Like ADA, XRP and ETH Will Hit New All-Time Highs