SEI Pumps 36% in 24 Hours—Here’s What’s Driving the Altcoin’s Breakout

SEI's 36% surge in just 24 hours signals a potential for more gains as investor interest and network inflows soar, pushing the coin to new highs.

Layer-1 (L1) coin SEI is today’s top market gainer, rocketing by over 36% in the past 24 hours.

This double-digit surge comes amid a spike in network inflow volume, a signal of renewed investor interest and capital movement onto the network.

SEI Rally as Net Inflows Spike

Sei Network has recorded one of the largest net inflows across all chains over the past 24 hours. It ranked fourth in bridged net flows, outperforming major networks like Solana during that period.

Top Bridged Netflows. Source:

Artemis

Top Bridged Netflows. Source:

Artemis

According to Artemis, the Sei Network has seen $3 million in bridged netflows in the past 24 hours. In comparison, top network Solana has seen net outflows amounting to $5 million during the timeframe.

The spike in inflows signals growing user activity and possibly rising investor confidence in the Sei ecosystem. Per the data provider, only Arbitrum, Base, and Ethereum saw higher net inflows.

With capital flowing onto the network, the SEI coin has seen a surge in demand, reflected by its climbing Chaikin Money Flow (CMF). As of this writing, this momentum indicator is at 0.22.

SEI CMF. Source:

TradingView

SEI CMF. Source:

TradingView

The CMF indicator measures how money flows into and out of an asset. Positive readings indicate that accumulation outweighs selling activity among coin holders. On the other hand, when an asset’s CMF is below zero, selling pressure dominates the market.

For SEI, its CMF setup reinforces the narrative that the current rally is backed by strong demand and liquidity.

SEI Defies the Market Slump

The altcoin trades at a four-month high of $0.28 at press time. In fact, amid the broader market’s lackluster performance over the past week, SEI’s price has soared by over 65%.

With inflows climbing and momentum indicators flashing green, SEI could continue to outperform in the near term. If demand remains high, the coin could climb toward $0.36.

SEI Price Analysis. Source:

TradingView

SEI Price Analysis. Source:

TradingView

However, if demand craters and profit-taking commences, SEI coin price could break below the support floor at $0.27 and fall to $0.23.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

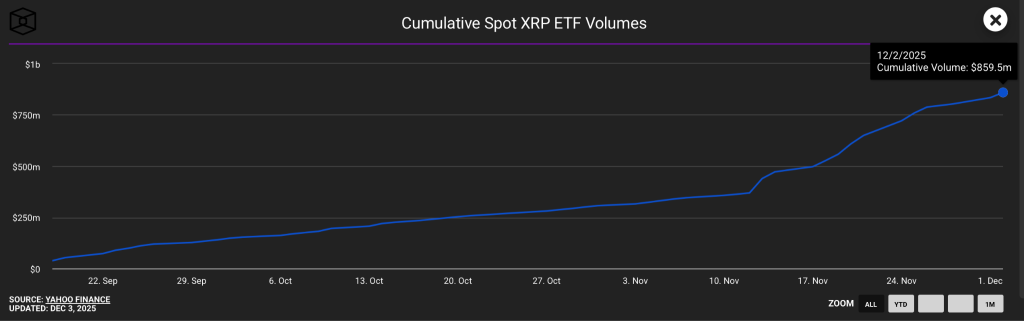

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts