-

The Altcoin Season Index reveals a decisive shift as Bitcoin reasserts dominance over the broader crypto market, signaling a Bitcoin Season phase.

-

With an index reading of 21, less than a quarter of top altcoins have outperformed Bitcoin in the past 90 days, highlighting investor preference for BTC amid market consolidation.

-

According to COINOTAG, “The current Altcoin Season Index score underscores Bitcoin’s role as the primary store of value during periods of macroeconomic uncertainty and institutional inflows.”

Altcoin Season Index at 21 confirms Bitcoin Season dominance, guiding investors on portfolio strategies amid shifting crypto market dynamics.

Understanding the Altcoin Season Index and Its Market Implications

The Altcoin Season Index serves as a critical barometer for crypto investors, measuring how many of the top 100 altcoins outperform Bitcoin over a 90-day period. Excluding stablecoins and wrapped tokens, this index provides a clear snapshot of market sentiment and asset rotation trends. Currently, the index reading of 21 firmly places the market in a Bitcoin Season, indicating that Bitcoin’s performance is outpacing the majority of altcoins. This metric is invaluable for investors seeking to align their strategies with prevailing market cycles, as it highlights when capital is consolidating around Bitcoin rather than dispersing across altcoins.

Bitcoin Season Defined: Market Characteristics and Investor Behavior

Bitcoin Season is characterized by a market environment where fewer than 25% of the top altcoins outperform Bitcoin. This phase typically sees Bitcoin maintaining or increasing its market dominance, often driven by factors such as institutional adoption, macroeconomic uncertainty, and post-halving consolidation. Investors tend to gravitate towards Bitcoin during these periods due to its perceived stability and established track record. Consequently, altcoins may experience heightened volatility and underperformance, especially smaller-cap projects lacking strong fundamentals. Understanding these dynamics helps investors manage expectations and adjust portfolio allocations accordingly.

Key Drivers Behind the Current Bitcoin Season

Several fundamental factors contribute to the ongoing Bitcoin Season:

- Post-Halving Market Dynamics: Historically, Bitcoin undergoes a consolidation phase following halving events, as the market digests supply changes and recalibrates expectations.

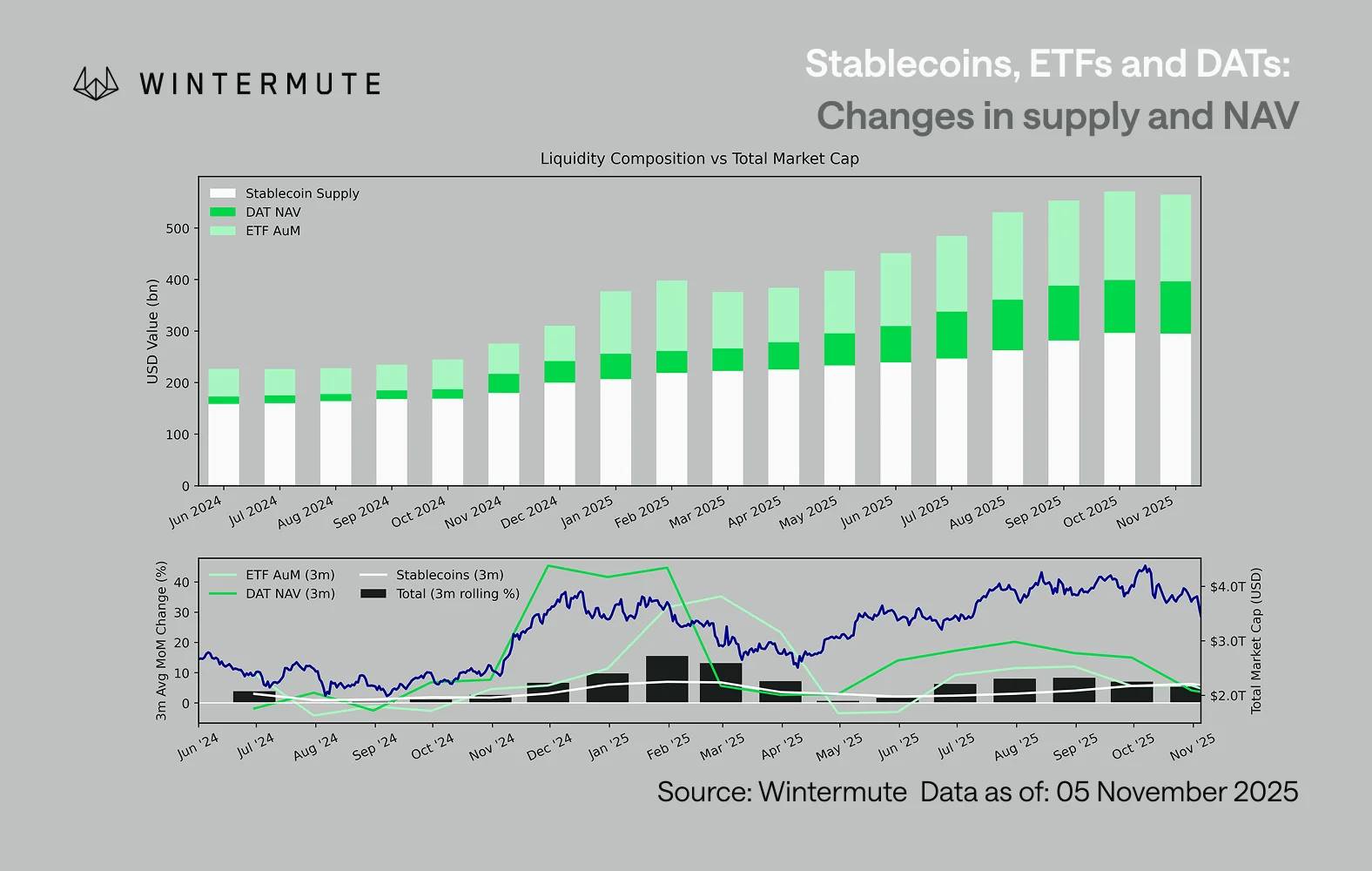

- Institutional Capital Inflows: The rise of Bitcoin ETFs and increased institutional participation have funneled significant capital into Bitcoin, reinforcing its market dominance.

- Macroeconomic Uncertainty: Global economic challenges prompt investors to seek relatively safer assets, positioning Bitcoin as a digital store of value amid broader market volatility.

- Market Consolidation: After earlier altcoin rallies, capital rotation back into Bitcoin reflects a strategic pause, allowing investors to reassess risk and opportunity.

Strategic Portfolio Management During Bitcoin Season

Investors navigating Bitcoin Season should consider the following strategies to optimize risk and potential returns:

- Risk Management: Evaluate altcoin exposure carefully, implement stop-loss mechanisms, and avoid excessive leverage to mitigate downside risks.

- Portfolio Rebalancing: Increasing allocations to Bitcoin or stablecoins can preserve capital, while selective accumulation of fundamentally strong altcoins may offer long-term upside.

- Focus on Fundamentals: Prioritize projects with robust technology, adoption, and tokenomics to identify altcoins with resilience during market downturns.

- Stay Informed: Monitor the Altcoin Season Index, Bitcoin price trends, and regulatory developments to anticipate market shifts and adjust strategies proactively.

Indicators Signaling a Potential Return to Altcoin Season

While Bitcoin Season currently prevails, the crypto market’s cyclical nature means altcoin dominance may resurface. Key signals to watch include:

- An upward trajectory of the Altcoin Season Index surpassing 25, indicating growing altcoin outperformance.

- Sustained rallies across diverse altcoins supported by increased trading volumes and broad market participation.

- Capital rotation from Bitcoin into altcoins as BTC’s momentum stabilizes or matures.

- Emergence of sector-specific strength, such as in DeFi, NFTs, or AI-related tokens, sparking renewed investor interest.

Conclusion

The Altcoin Season Index’s current reading of 21 confirms the crypto market is entrenched in Bitcoin Season, emphasizing Bitcoin’s dominance and altcoin underperformance. For investors, this phase demands disciplined risk management, strategic portfolio adjustments, and a focus on high-quality projects. While altcoin opportunities exist, they require careful selection and patience. Staying informed and responsive to market indicators will be crucial for capitalizing on future shifts when altcoin momentum returns.